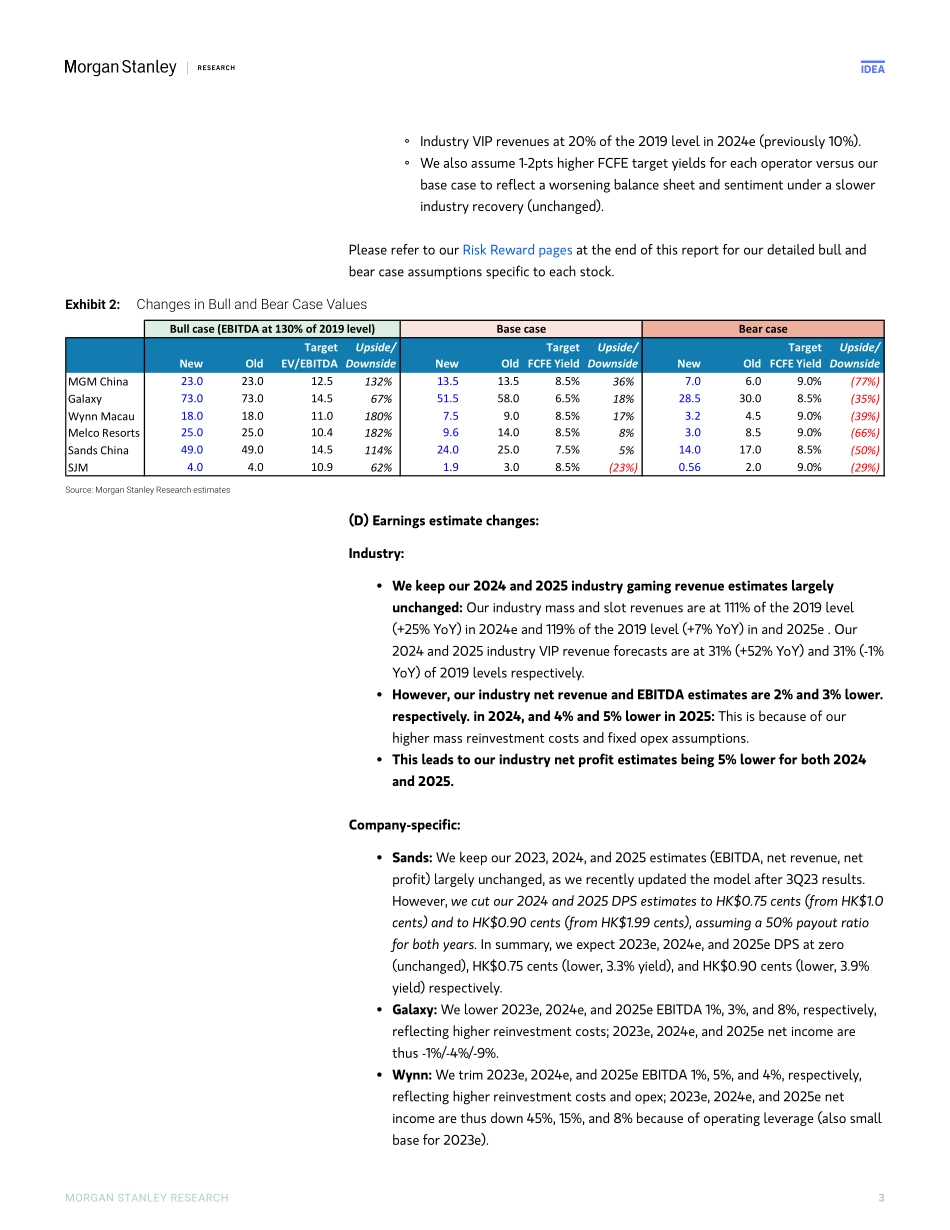

M IdeaMacau Gaming | Asia Pacific2024 Outlook: Estimate and Rating ChangesMorgan Stanley Asia Limited+Praveen K ChoudharyEquity Analyst Praveen.Choudhary@morganstanley.com +852 2848-5068 Gareth Leung, CFAEquity Analyst Gareth.Leung@morganstanley.com +852 2848-7339 Morgan Stanley & Co. LLCStephen W GramblingEquity Analyst Stephen.Grambling@morganstanley.com +1 212 761-1010 Morgan Stanley appreciates your support in the 2024 Institutional Investor All-Asia Research Team Survey. Voting will open early January 2024. Hong Kong/Macau GamingAsia PacificIndustry ViewAttractive What’s Changed Galaxy Entertainment (0027.HK)FromToPrice TargetHK$58.00HK$51.50Sands China Ltd. (1928.HK)FromToPrice TargetHK$25.00HK$24.00Melco Resorts & Entertainment Ltd (MLCO.O)FromToRatingOverweightEqual-weightPrice TargetUS$14.00US$9.60Wynn Macau, Limited (1128.HK)FromToPrice TargetHK$9.00HK$7.50SJM Holdings (0880.HK)FromToPrice TargetHK$3.00HK$1.902023 was a year of reopening and rapid revenue growth (GGR +330% YoY). Despite the full recovery, we expect 2024 GGR, Mass GGR, and EBITDA to grow 29%, 25%, and 33% respectively. Industry-wide de-rating means we use a 50bp higher target yield. We downgrade MLCO to EW.Two key changes: Even though we have kept our industry gaming revenue estimates largely unchanged –mass GGR at 111% of the 2019 level (+25% YoY) in 2024e and 119% of 2019 level (+7% YoY) in 2025e – we have increased opex and reinvestment costs for companies. We also increase target FCFE yield for companies 50bps to reflect the higher interest rate environment. This leads to lower price targets for most companies.We remain constructive on the industry: Near-term catalysts include (a) strong December data to push up the market's 2024 estimates, (b) potential stock supports in January ahead of CNY holiday (February 10-17), (c) 4Q23e EBITDA, which could grow 11% QoQ, (d) our expectation of market share gains by MGM China, Wynn Macau, and Galaxy in 4Q23. Risks include (a) 20% higher non-gaming opex and capex (b) earnings estimate revisions tapering off. Rating changes: We downgrade MLCO to EW from OW. In summary, we now have OW ratings for MGM China, Galaxy, and Wynn; EW for MLCO and Sands; and UW for SJM.Price target changes: Our valuation methodology remains unchanged. Exhibit 1 summarizes the changes and implied upside for each company's stock.Estimate changes: Our industry EBITDA estimates are 3% lower in 2024, at US$8.5bn (92% of 2019), and 3% lower in 2025, at US$9.2bn (100% of 2019). This is because of our higher estimates for mass reinvestment costs and fixed opex (wage increases in 2024). In terms of 2024e mass market share expectation, we increase our projections for MGM China (from 13.1% to 13.8%, 3Q23A was 14.4%), and Wynn (from 11.9% to 12.7%, 3Q23A was 12.5%), but reduce for Sands (from 28.2% to 27.3%, 3Q23A was 27.0%) and SJM excluding satellite (from 8.8% to 8.0%, 3Q23A...