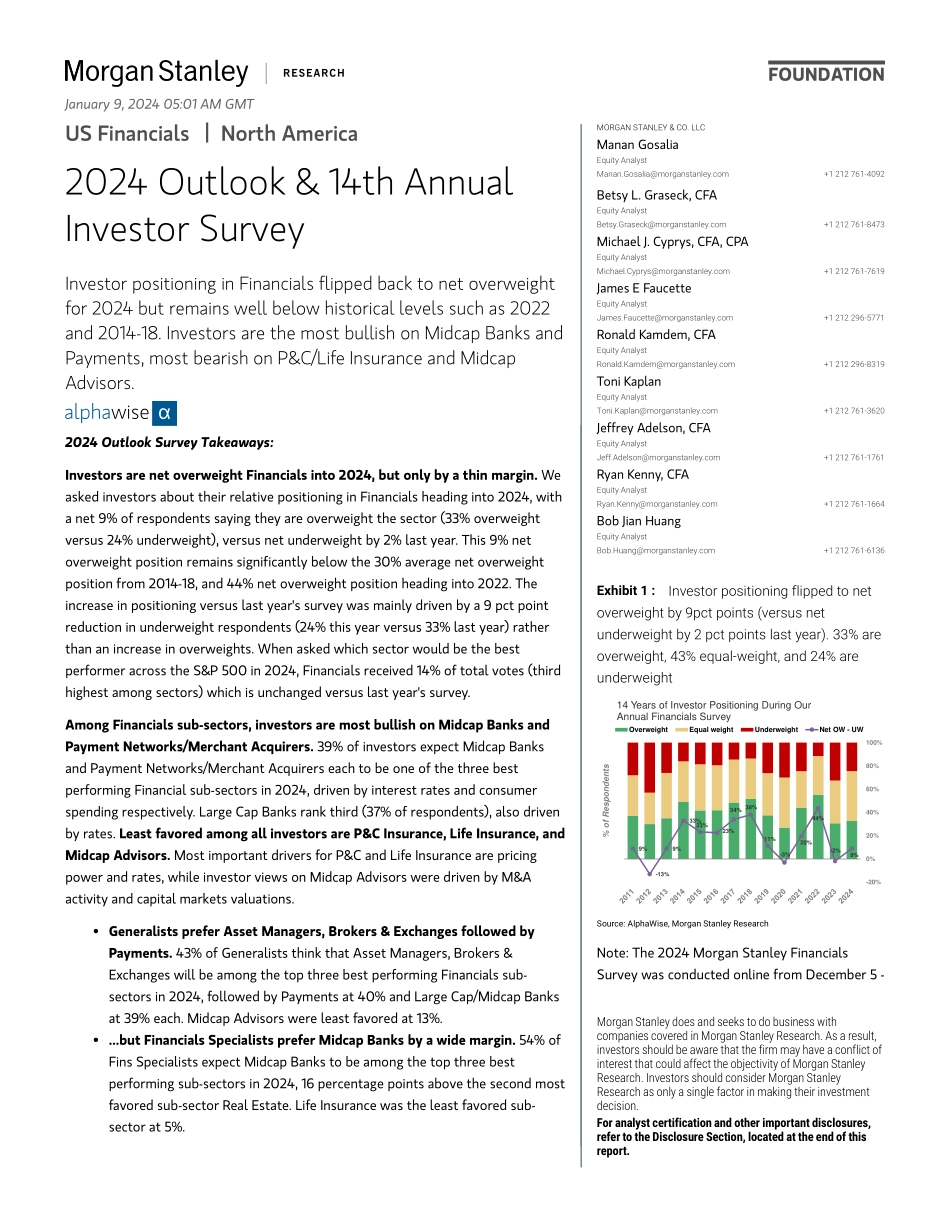

M FoundationUS Financials | North America2024 Outlook & 14th Annual Investor Survey Morgan Stanley & Co. LLCManan GosaliaEquity Analyst Manan.Gosalia@morganstanley.com +1 212 761-4092 Betsy L. Graseck, CFAEquity Analyst Betsy.Graseck@morganstanley.com +1 212 761-8473 Michael J. Cyprys, CFA, CPAEquity Analyst Michael.Cyprys@morganstanley.com +1 212 761-7619 James E FaucetteEquity Analyst James.Faucette@morganstanley.com +1 212 296-5771 Ronald Kamdem, CFAEquity Analyst Ronald.Kamdem@morganstanley.com +1 212 296-8319 Toni KaplanEquity Analyst Toni.Kaplan@morganstanley.com +1 212 761-3620 Jeffrey Adelson, CFAEquity Analyst Jeff.Adelson@morganstanley.com +1 212 761-1761 Ryan Kenny, CFAEquity Analyst Ryan.Kenny@morganstanley.com +1 212 761-1664 Bob Jian HuangEquity Analyst Bob.Huang@morganstanley.com +1 212 761-6136 Exhibit 1 : Investor positioning flipped to net overweight by 9pct points (versus net underweight by 2 pct points last year). 33% are overweight, 43% equal-weight, and 24% are underweight 9%-2%44%20%-3%11%38%34%23%23%33%9%-13%9%-20%0%20%40%60%80%100%14 Years of Investor Positioning During Our Annual Financials SurveyOverweightEqual weightUnderweightNet OW - UW% of Respondents Source: AlphaWise, Morgan Stanley Research Note: The 2024 Morgan Stanley Financials Survey was conducted online from December 5 - Investor positioning in Financials flipped back to net overweight for 2024 but remains well below historical levels such as 2022 and 2014-18. Investors are the most bullish on Midcap Banks and Payments, most bearish on P&C/Life Insurance and Midcap Advisors. M 2024 Outlook Survey Takeaways:Investors are net overweight Financials into 2024, but only by a thin margin. We asked investors about their relative positioning in Financials heading into 2024, with a net 9% of respondents saying they are overweight the sector (33% overweight versus 24% underweight), versus net underweight by 2% last year. This 9% net overweight position remains significantly below the 30% average net overweight position from 2014-18, and 44% net overweight position heading into 2022. The increase in positioning versus last year's survey was mainly driven by a 9 pct point reduction in underweight respondents (24% this year versus 33% last year) rather than an increase in overweights. When asked which sector would be the best performer across the S&P 500 in 2024, Financials received 14% of total votes (third highest among sectors) which is unchanged versus last year's survey. Among Financials sub-sectors, investors are most bullish on Midcap Banks and Payment Networks/Merchant Acquirers. 39% of investors expect Midcap Banks and Payment Networks/Merchant Acquirers each to be one of the three best performing Financial sub-sectors in 2024, driven by interest rates and consumer spending respectively. Large Cap Banks rank third (37% of respondents), also driven by rates. Least favored among all investors are...