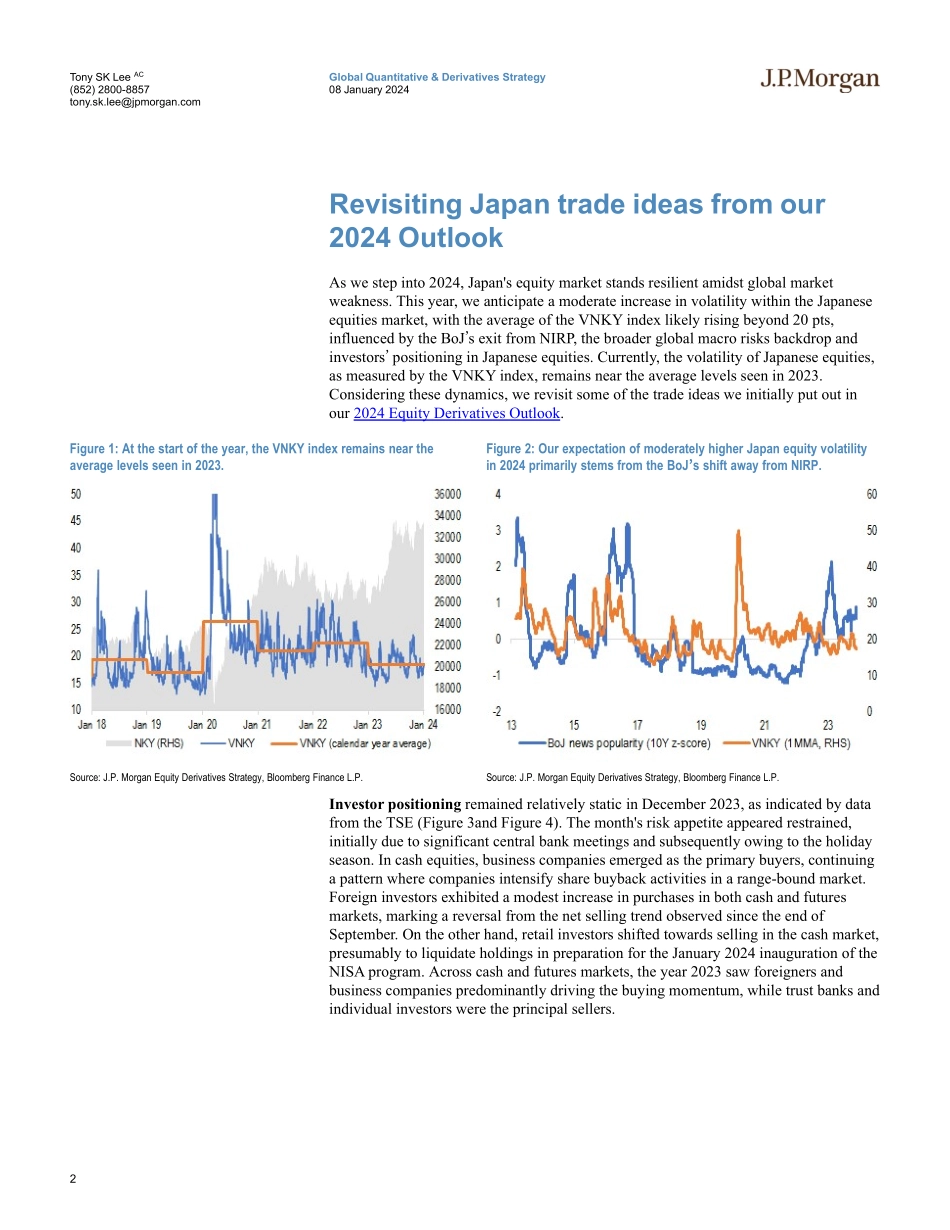

Global Quantitative & Derivatives Strategy08 January 2024J P M O R G A Nwww.jpmorganmarkets.comGlobal Quantitative and Derivatives StrategyTony SK Lee AC(852) 2800-8857tony.sk.lee@jpmorgan.comBloomberg JPMA TONYLEE J.P. Morgan Securities (Asia Pacific) Limited/ J.P. Morgan Broking (Hong Kong) LimitedHaoshun Liu AC(852) 2800-7736haoshun.liu@jpmorgan.comBloomberg JPMA HLIU J.P. Morgan Securities (Asia Pacific) Limited/ J.P. Morgan Broking (Hong Kong) LimitedTwinkle Mehta, CFA AC(852) 2800-7109twinkle.mehta@jpmorgan.comJ.P. Morgan Securities (Asia Pacific) Limited/ J.P. Morgan Broking (Hong Kong) LimitedXipu Han AC(852) 2800-1029xipu.han@jpmorgan.comJ.P. Morgan Securities (Asia Pacific) Limited/ J.P. Morgan Broking (Hong Kong) LimitedDavide Silvestrini(44-20) 7134-4082davide.silvestrini@jpmorgan.comJ.P. Morgan Securities plcBram Kaplan, CFA(1-212) 272-1215bram.kaplan@jpmorgan.comJ.P. Morgan Securities LLCMarko Kolanovic, PhD(1-212) 622-3677marko.kolanovic@jpmorgan.comJ.P. Morgan Securities LLCJ.P. Morgan Research does not provide research coverage of the JPJPBPBJ basket and investors should not expect continuous analysis or additional reports relating to it. •Entering 2024, Japan's equity market exhibits resilience despite global market weaknesses. Despite our expectations of a moderate increase in volatility, the VNKY index closely aligns with the average levels observed in 2023. Investor activity in December 2023 remained relatively static, with businesses companies actively buying in cash equities and foreign investors reversing their selling trend. Dealers hold a sizable short gamma position in the Nikkei, indicating that technical factors are likely contributing to heightened market volatility, particularly in the event of market corrections. Corporate governance reforms and the relaunch of the NISA program are key near-term catalysts. This backdrop underpins our preference of starting the year with bullish Japanese equities trades and TSE reform thematic trades.•Leveraging correlations for Japanese equity upside: For investors agreeing with our view, we recommend leveraging correlations to build long exposure in Japanese equities via the following structures: a) Buy TPX calls contingent on USDJPY lower at expiry; b) Buy TPX calls contingent on SPX capped at expiry or buy TPX calls funded by selling SPX call spreads and c) Buy dual digital on TPX outperforms SPX and JPY rates higher.•Buy Japan buyback basket with low P/B tilt: Following the emphasis on TSE reforms, the announced buyback amount in 2023 has matched the record high set in 2022. We anticipate that the buyback factor will continue to outperform with the new TSE reform measures coming up. Our systematic backtest also shows that Incorporating a low P/B ratio tilt into buyback strategy can enhance the excess return. Investors can consider our Japan buyback with low P/B tilt basket (JPJPBPBJ Index) to implement the id...