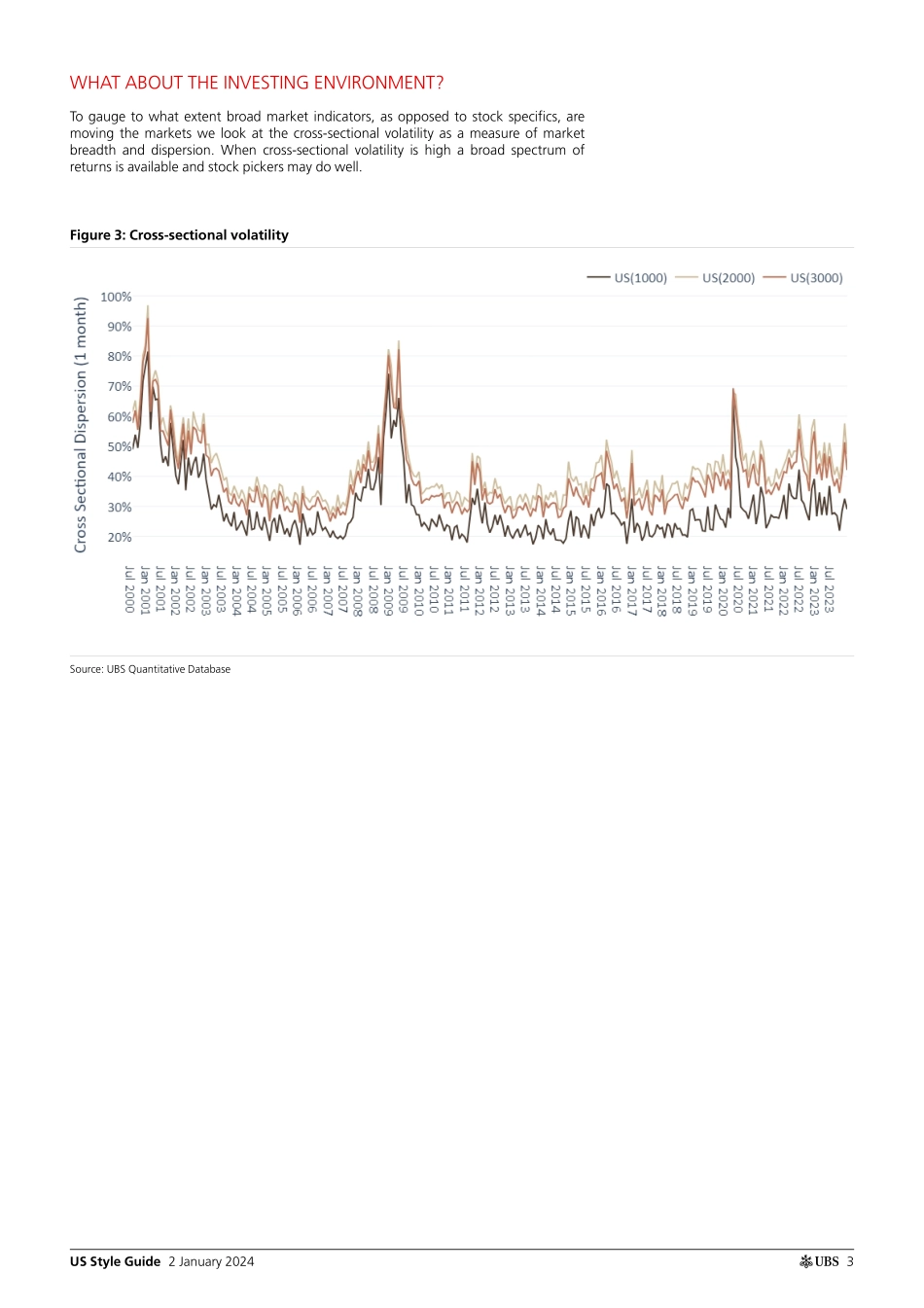

ab2 January 2024Global Research and Evidence LabUS Style Guide2023 Recap: Size and High Quality Outperform Market Performance2023 ended on a positive note as the Russell 1000 was up by 26.5% and the Russell 2000 by 16.9%. Markets extended the November rally into December with Russell 1000 up by +4.9% and Russell 2000 +12.2%. Inflation fears continued to subside as interest rates fell again (US 10-year dropped another 20bps to 4.23%, and the 2-year rate decreased to 3.9%). Factor OverviewFactor performance was mixed in December as Value outperformed and all other factor styles underperformed (Figure 1Style Factor Last Month Performance - Rusel 30). Though Size was largest underperforming factor in December (-10.8%) (Figure 11QualityFigure 7Long-Short), overall, it was the best performing factor in 2023 (+7.9%), followed by High Quality (+7.4%). All other factors struggled most of the year with Low Price Beta (-36.1%) and Low Volatility (-34.0%) seeing the worst performance of the year. Investing Environment OverviewThe USD Index and Gold were the key macro drivers for most of the year. However, during the last quarter of 2023, Gold largely fell off in importance, replaced by the US 10Y-2Y Spread (Figure 2)US macro drivers through time. Pairwise correlations (Figure 4Average pairwise corelation) have been falling for the majority of the year, though cross sectional volatility has been low, presenting headwinds for active investors.Key Research in 2023 In 2023 we have continued our series of sector-specific reports. Initially launched with Banks. we added Real Estate, Software, and Hardware & Semiconductors, with more to come in 2024. We leveraged the information in analysts' price targets to identify analyst high conviction ideas, and we also launched our China crowding scores. Sector specific data, analyst rankings and China crowding scores are all now available for download on our Quant Answers platform, email qa@ubs.com for access. Figure 1: Style Factor Last Month Performance - Russell 3000Source: FactSet, UBS Quantitative DatabaseThis report has been prepared by UBS Securities LLC. NA ANALYST CERTIFICATION AND REQUIRED DISCLOSURES, including information on the Quantitative Research Review published by UBS, begin on page 12. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.EquitiesAmericasQuantitativeNicolo MenezAnalyst nicolo.menez@ubs.com +1-212-713 3183Paul WinterAnalyst paul-j.winter@ubs.com +61-2-9324 2080Michael GrayAnalyst michael-f.gray@ubs.com +1-212-713 1313Jaiwish NolanAnalyst jaiwish.nolan@ubs.com +1-212-713 1489Tongda CheAnalyst tongda.che@ubs.com +1-212-713 3919Claire JonesAnalyst clai...