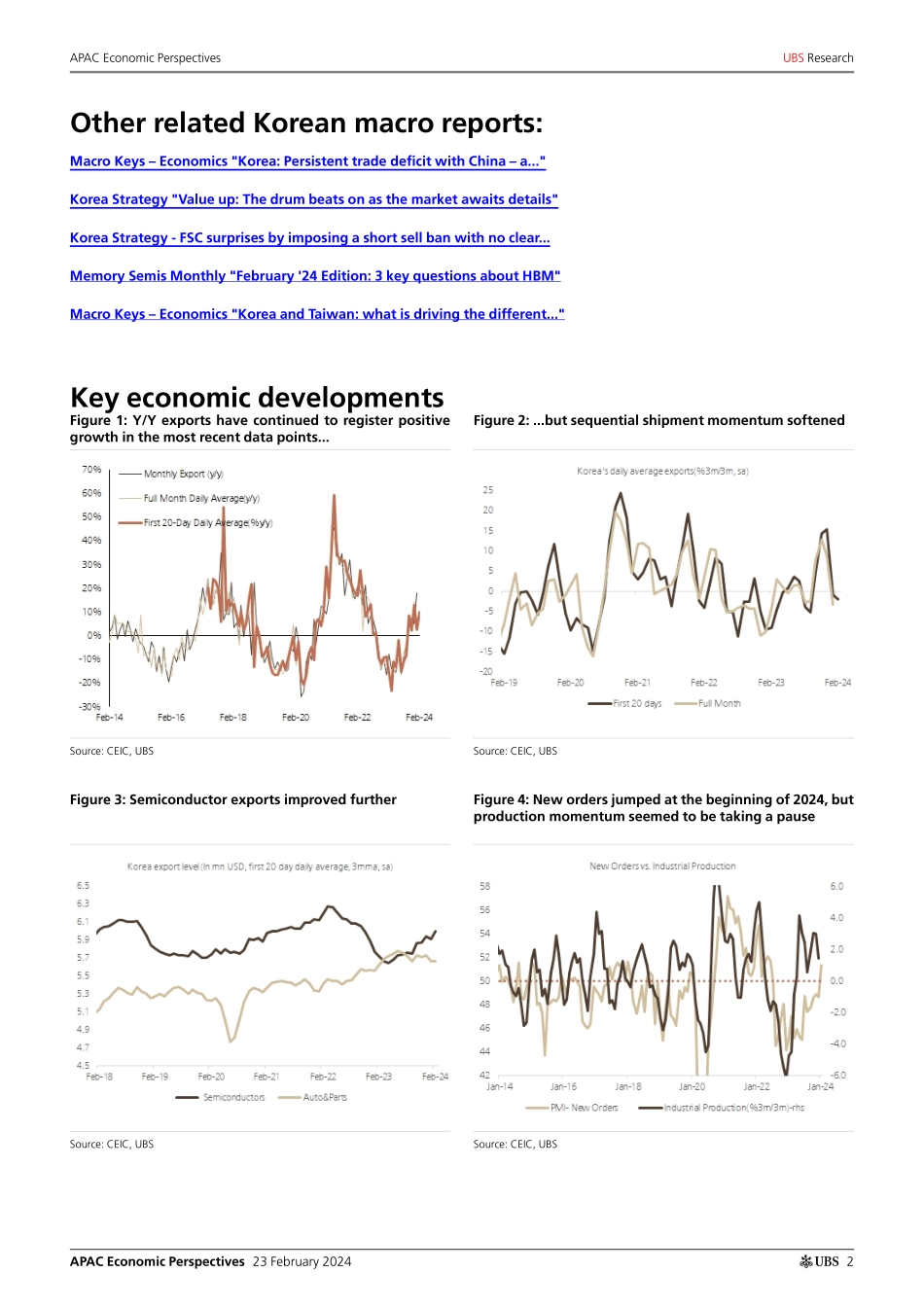

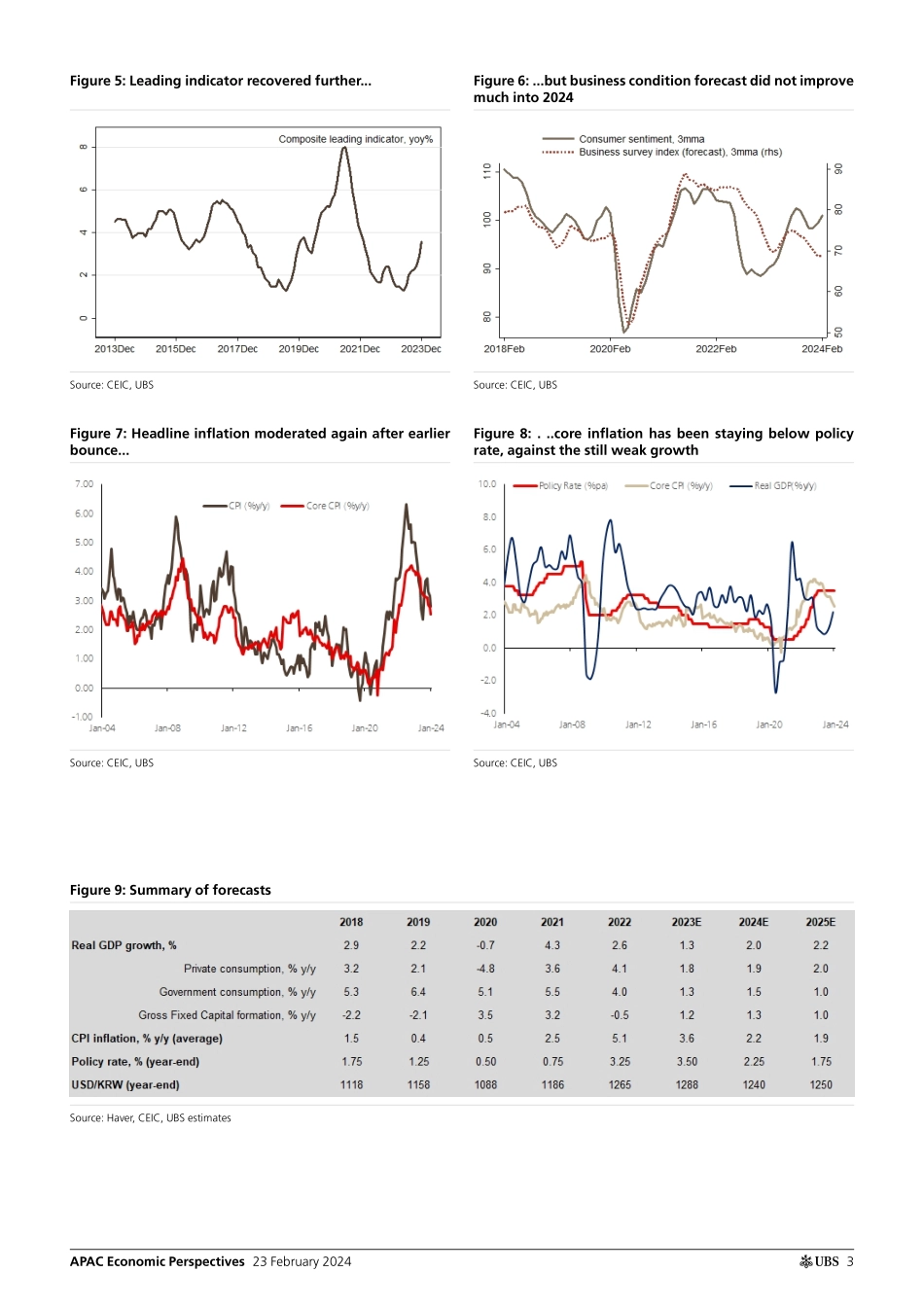

ab23 February 2024Global Research and Evidence LabAPAC Economic PerspectivesKorea by the Numbers: Continuing recovery, delayed policy rate cut Headline export growth continuedThe latest export data point from the first 20 days of February suggests that Korea’s export recovery has continued. On a working day daily average basis, export shipments grew by 9.8%y/y (vs. 2.4% in January). Up to 20th Feb 2024, total exports grew by 7.2%y/y vs. 4.7%y/y in 4Q23. On a working day daily average basis, exports managed to grow by 7.1% for the period into 2024, though softer than the 9.6% seen in 4Q. In net, high frequency data suggests that overall export growth has maintained a solid pace in the most recent weeks into 2024. Semiconductor shipment growth jumped to the fastest pace in recent history Continued improvement in semiconductor exports is a key factor supporting the solid overall export growth. Semiconductor exports grew by 66% on a working day average basis in the first 20 days of February, one of the strongest growth rates seen in recent years. Up to 20th Feb 2024, semiconductor shipments jumped by 46%y/y on daily average basis, a significant acceleration from 15% recorded in 4Q23. Semiconductor shipments contributed 6.2ppt to the overall 7.2% export growth rate in 2024 so far. Still mixed signal in some data points, worth some monitoring aheadThe sharp export growth increase coming from semiconductor shipments was offset by some signs of weakness in other areas. For example, auto and auto parts exports contracted by 4%y/y year-to-20th Feb, whereas a 15.3% growth was recorded in 4Q23. There are some mixed signals beyond export growth too. Korea’s manufacturing PMI carried on the recovery stream to stand above 50-benchmark in both new orders and output in January. On the other hand, industrial production momentum recovery seemed to be taking a pause by year-end 2023. In addition, while consumer sentiment seemed to have improved into the most recent months in 2024, the business condition forecast has not yet shown much sign of improvement. Moderating inflation trend has continued Headline CPI has resumed moderation after the temporary rebound at the start of 4Q23 due to energy prices, falling to 2.8% in January. Importantly, core inflation has continued to moderate, reaching 2.5% in January – the lowest since December 2021. An earlier rebound of headline CPI has not seemed to result in a large spillover to core inflation so far. The continuation of the moderating core inflation trend also brings the gap between the policy rate and core inflation to 96bps by January, the widest since October 2019. Delayed rate cut from the BoKThe BoK (Bank of Korea) kept the policy interest rate unchanged in the 22nd February meeting; the decision was made on unanimous basis. That said, one member of the monetary policy committee membe...