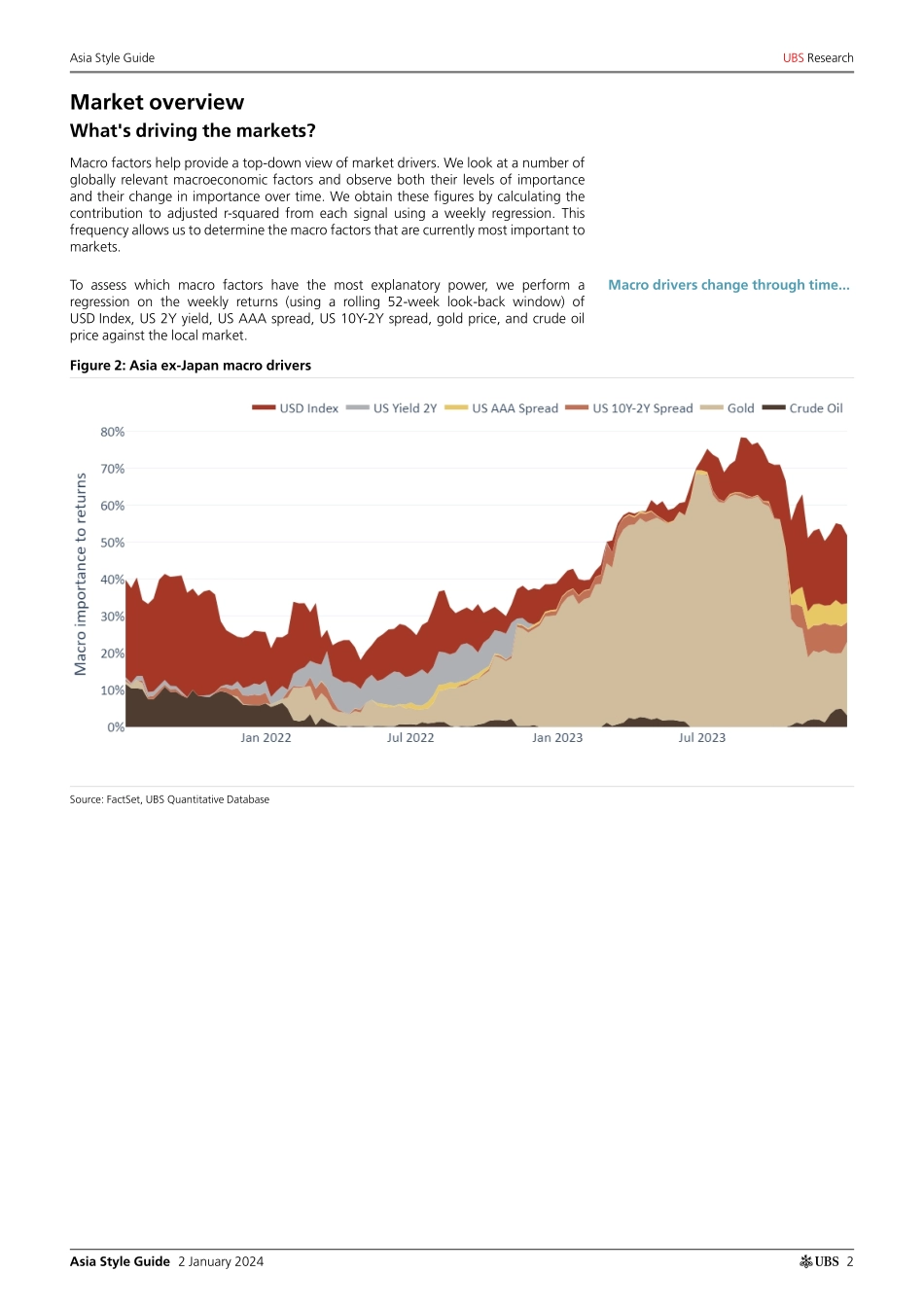

ab2 January 2024Global Research and Evidence LabAsia Style GuideLow Volatility performed best in 2023Low Risk in the black; Growth and Quality in the red Both definitions of Low Risk were the biggest winners in December, with Low Volatility up 6.4% MoM and Low Price Beta up 2.9% MoM. Delta Quality on the other hand was the worst performer of the month, declining 2.7%. Growth factors also suffered from losses in December, with Fundamental Growth and EPS Growth down 1.7% and 0.8%, respectively. 2023 ended with Low Volatility being the best-performing factor, up 25.5% YoY. Trailing behind were Delta Quality and High Quality, yielding 15.2% and 14.6%, respectively. In contrast, Momentum factors were the only factors finishing the year in the red, with 12-month Momentum, Momentum Composite and Earnings Momentum down 9%, 7.2% and 5.8% YoY, respectively.Gold continued to dominate the macroeconomic environmentThe macroeconomic environment's explanatory power remained relatively flat over December, currently at 51% of the market variance. Gold continued to be the main macro driver, accounting for 20% of the variance. The explanatory power of the next main macro factor, the USD Index, inched up from 17% to 18% in December. Pairwise correlations were up for Korea, flat for Taiwan and Asia ex-Japan, and down for ASEAN, CN+HK and India in December. Cross-sectional volatilities were up for Taiwan and ASEAN, flat for CN+HK, and down for Asia ex-Japan, Korea and India. Market valued close to the median of its historical PE range The Asia ex-Japan market's valuation increased again in December, from a 12-month forward PE of 11.8x in November to 12.2x in December. It is still trading close to its historical median. ASEAN's valuation increased as well, from 12.3x to 12.7x of 12-month forward PE. India remains the most expensive market in Asia and is currently priced at 21.7x forward PE, up from 20.3x a month ago. At the sector level, Health Care and Consumer Staples are still the two most expensive, with each valued at 22.5x and 21.3x forward PE, respectively. From a style perspective, 12-month Momentum and Momentum Composite saw the biggest increases in valuation in December, and are now trading close to their upper quartile of historical valuations.Figure 1: Style-factor performance in December 2023Source: FactSet, UBS Quantitative DatabaseThis report has been prepared by UBS Securities Asia Limited. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES, including information on the Quantitative Research Review published by UBS, begin on page 11. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment de...