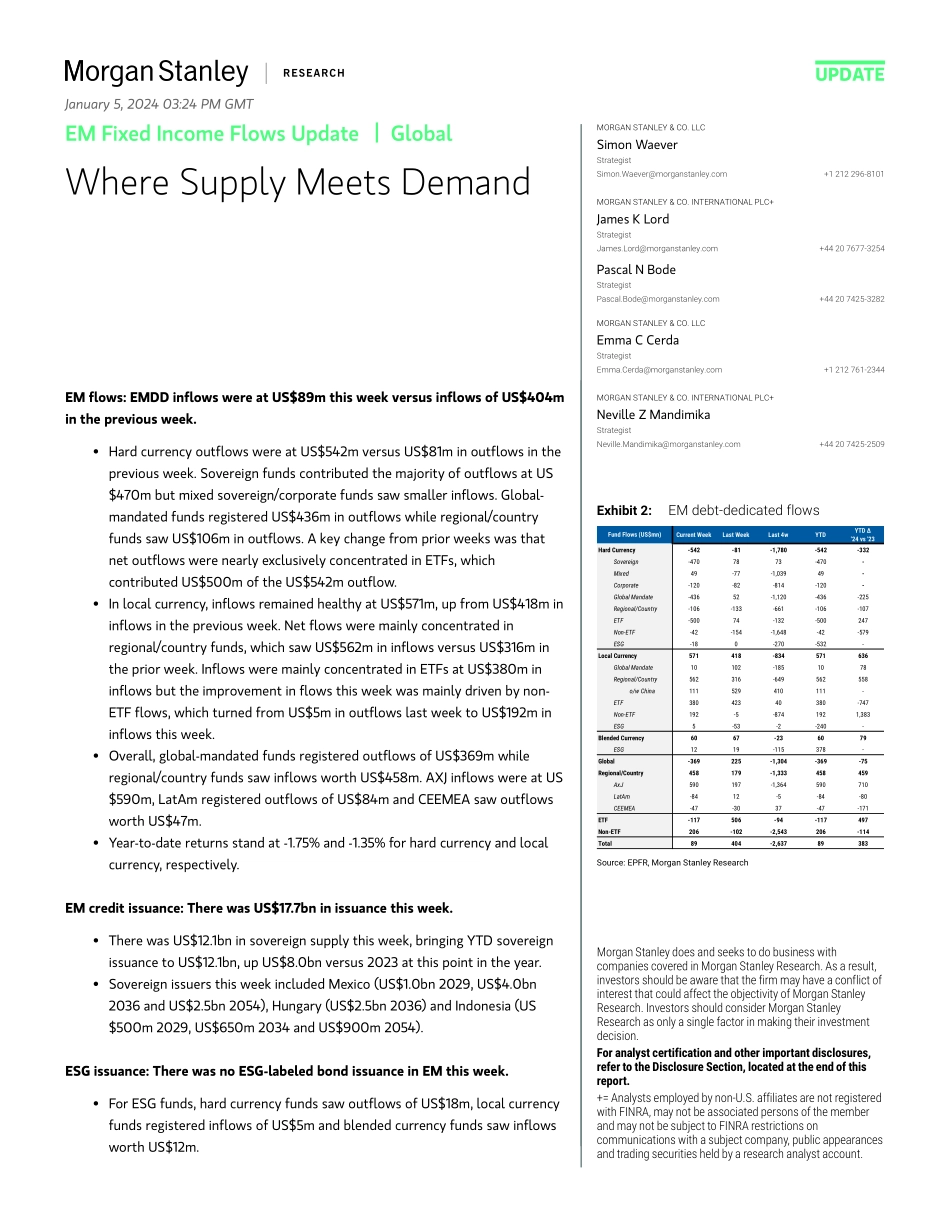

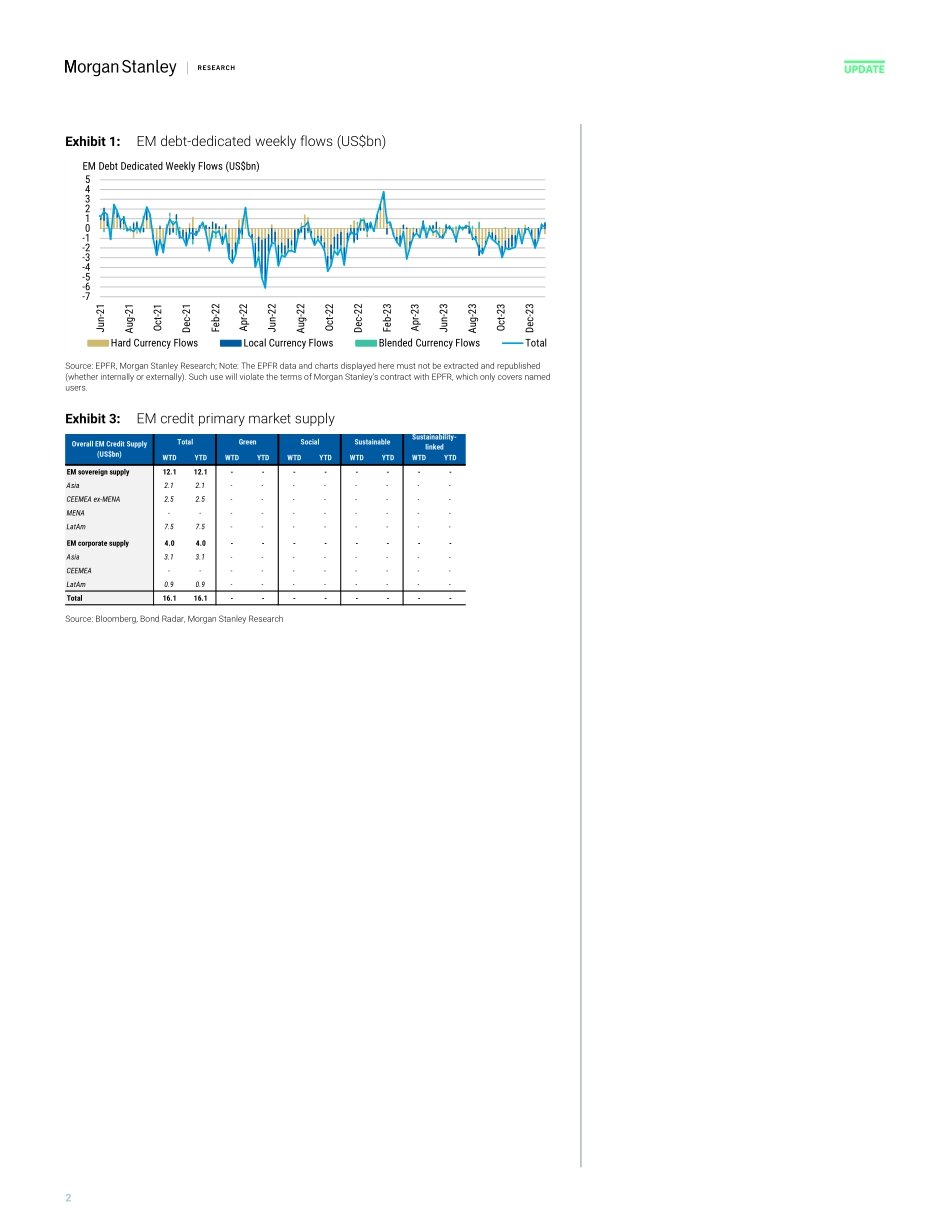

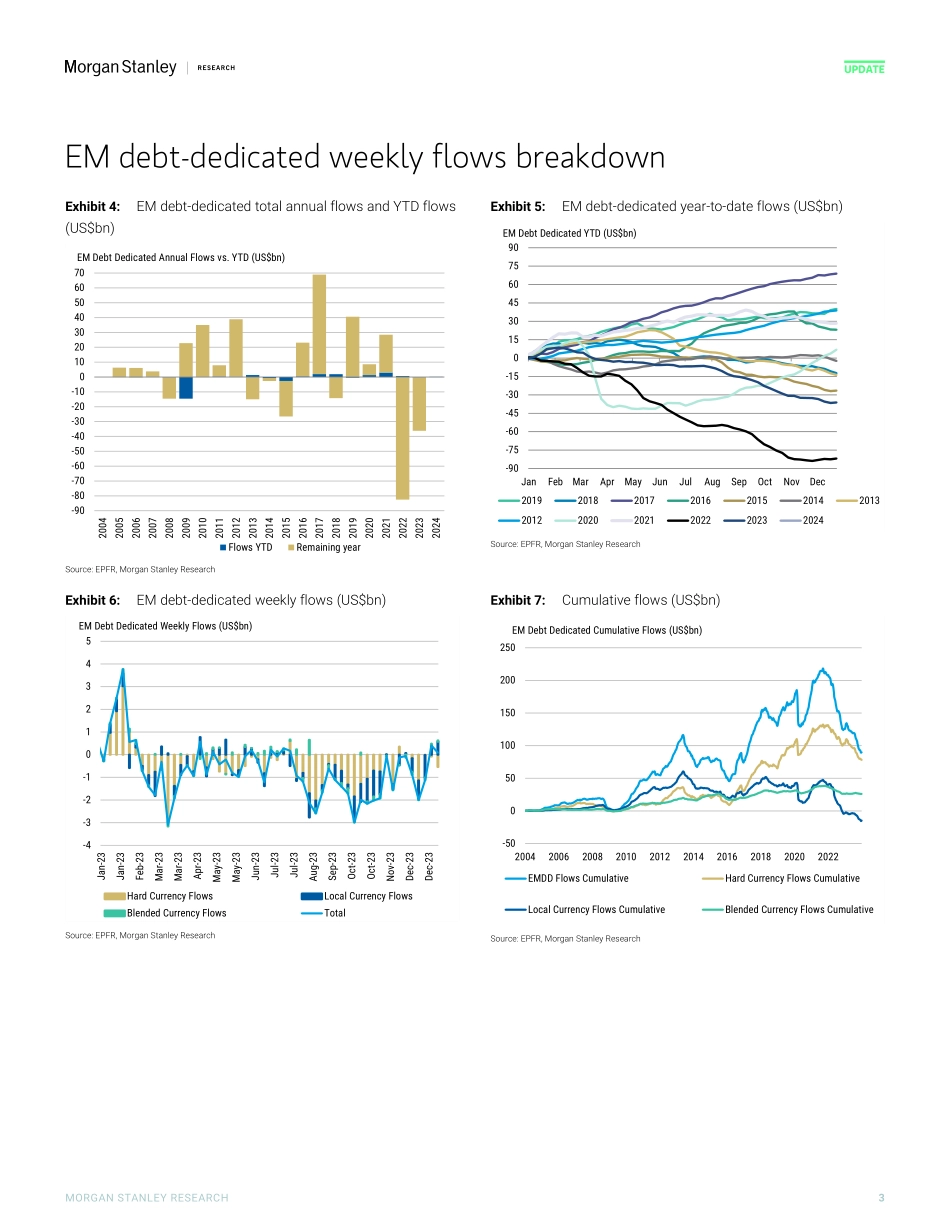

M UpdateEM Fixed Income Flows Update | Global Where Supply Meets DemandMorgan Stanley & Co. LLCSimon WaeverStrategist Simon.Waever@morganstanley.com +1 212 296-8101 Morgan Stanley & Co. International plc+James K LordStrategist James.Lord@morganstanley.com +44 20 7677-3254 Pascal N BodeStrategist Pascal.Bode@morganstanley.com +44 20 7425-3282 Morgan Stanley & Co. LLCEmma C CerdaStrategist Emma.Cerda@morganstanley.com +1 212 761-2344 Morgan Stanley & Co. International plc+Neville Z MandimikaStrategist Neville.Mandimika@morganstanley.com +44 20 7425-2509 Exhibit 2: EM debt-dedicated flowsCurrent WeekLast WeekLast 4wYTDYTD ∆'24 vs '23Hard Currency-542-81-1,780-542-332Sovereign-4707873-470-Mixed49-77-1,03949-Corporate-120-82-814-120-Global Mandate-43652-1,120-436-225Regional/Country-106-133-661-106-107ETF-50074-132-500247Non-ETF-42-154-1,648-42-579ESG-180-270-532-Local Currency571418-834571636Global Mandate10102-1851078Regional/Country562316-649562558o/w China111529410111-ETF38042340380-747Non-ETF192-5-8741921,383ESG5-53-2-240-Blended Currency6067-236079ESG1219-115378-Global-369225-1,304-369-75Regional/Country458179-1,333458459AxJ590197-1,364590710LatAm-8412-5-84-80CEEMEA-47-3037-47-171ETF-117506-94-117497Non-ETF206-102-2,543206-114Total89404-2,63789383Fund Flows (US$mn) Source: EPFR, Morgan Stanley ResearchEM flows: EMDD inflows were at US$89m this week versus inflows of US$404m in the previous week.• Hard currency outflows were at US$542m versus US$81m in outflows in the previous week. Sovereign funds contributed the majority of outflows at US$470m but mixed sovereign/corporate funds saw smaller inflows. Global-mandated funds registered US$436m in outflows while regional/country funds saw US$106m in outflows. A key change from prior weeks was that net outflows were nearly exclusively concentrated in ETFs, which contributed US$500m of the US$542m outflow.• In local currency, inflows remained healthy at US$571m, up from US$418m in inflows in the previous week. Net flows were mainly concentrated in regional/country funds, which saw US$562m in inflows versus US$316m in the prior week. Inflows were mainly concentrated in ETFs at US$380m in inflows but the improvement in flows this week was mainly driven by non-ETF flows, which turned from US$5m in outflows last week to US$192m in inflows this week.• Overall, global-mandated funds registered outflows of US$369m while regional/country funds saw inflows worth US$458m. AXJ inflows were at US$590m, LatAm registered outflows of US$84m and CEEMEA saw outflows worth US$47m.• Year-to-date returns stand at -1.75% and -1.35% for hard currency and local currency, respectively.EM credit issuance: There was US$17.7bn in issuance this week. • There was US$12.1bn in sovereign supply this week, bringing YTD sovereign issuance to US$12.1bn, up US$8.0bn versus 2023 at this point in the year. • Sovereign issuers this week included Mexico (US$1.0bn 2029, US$4.0bn 2036 and US$2.5bn 2054), Hungary (US$2.5bn 2036)...