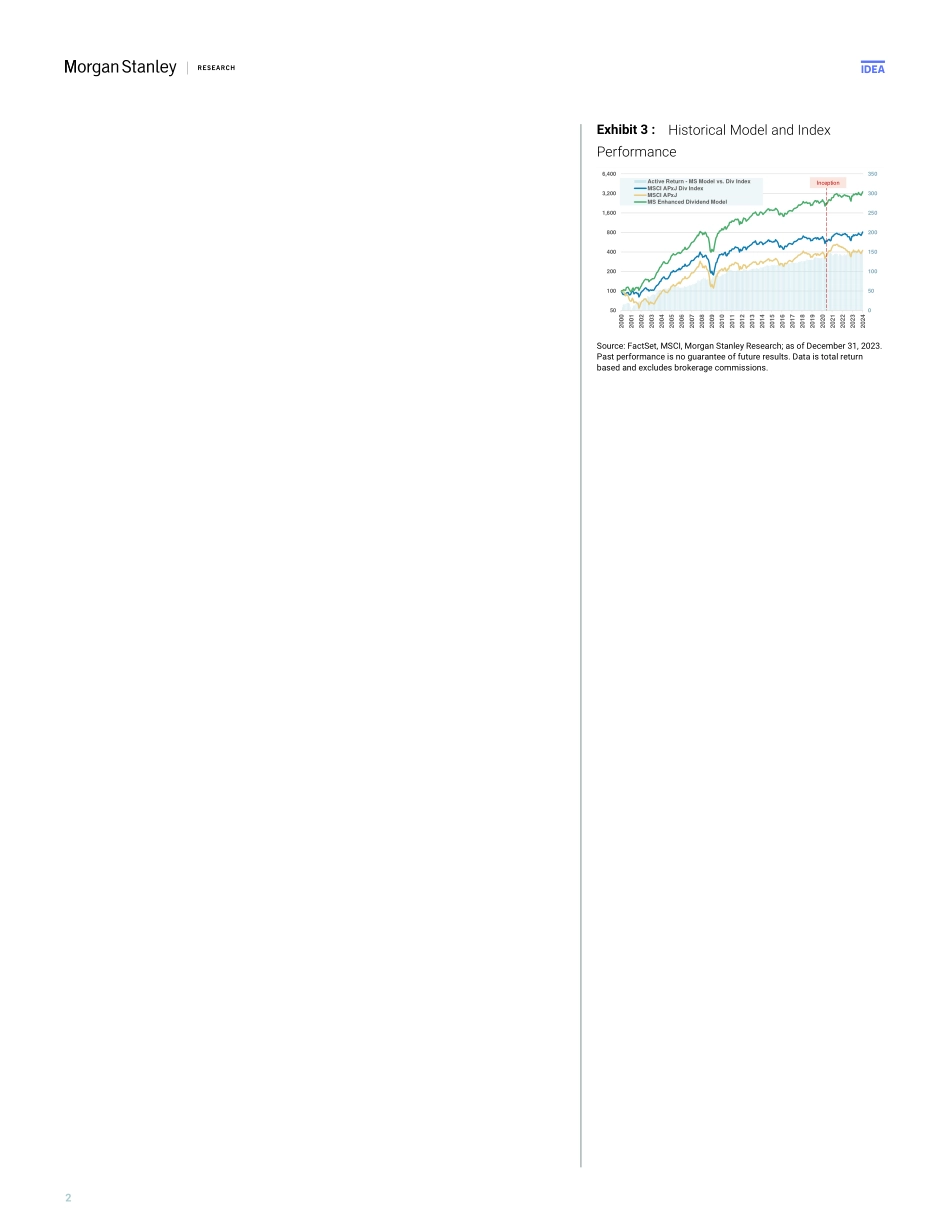

M IdeaAsia Quantitative Strategy | Asia PacificDividend Stock Ideas – 1Q24Morgan Stanley Asia Limited+Gilbert Wong, CFAQuantitative Strategist Gilbert.Wong@morganstanley.com +852 2848-7102 Jason Ng, CFAQuantitative Strategist Jason.Dl.Ng@morganstanley.com +852 2848-8845 Morgan Stanley Asia (Singapore) Pte.+Jonathan F GarnerEquity Strategist Jonathan.Garner@morganstanley.com +65 6834-8172 Daniel K BlakeEquity Strategist Daniel.Blake@morganstanley.com +65 6834-6597 Morgan Stanley appreciates your support in the 2024 Institutional Investor All-Asia Research Team Survey. Voting will open early January 2024. Exhibit 2 : Performance of MS Enhanced Dividend Model vs. MSCI IndicesFrom 9/30/2023 to 12/31/2023ReturnMS Enhanced Dividend Model - Top 20th9.82%MS Enhanced Dividend Model - Bottom 20th7.60%MSCI AC Asia Pacific ex JP High Dividend Yield9.65%MSCI AC Asia Pacific ex JP7.89%Since Model Launch (from 5/31/2020 onward)ReturnCumulative Long Only Return (Top 20th)56.3%Cumulative Long-Short Alpha (Top vs. Bottom 20th)35.8%Benchmark #1: MSCI APxJ High Div Index42.3%Benchmark #2: MSCI APxJ Index22.7% Source: MSCI, Morgan Stanley Research; as of December 31, 2023. Past performance is no guarantee of future results. Data is total return based and excludes brokerage commissions. This quarterly report updates our proprietary "Enhanced Dividend Screen" and "Dividend At Risk Screen," reflecting the most- and least-preferred dividend stocks in APxJ per both Morgan Stanley quant and industry analysts' opinions. M 4Q23 dividend strategy recap: MSCI APxJ High Dividend Index outperformed MSCI APxJ by 1.76% in 4Q23. Our Enhanced Dividend Model realized market-neutral L/S alpha of +2.22% during the quarter ( Exhibit 2 ). We note that the defensive sentiment among Asia/EM investors continued to favor Quality Dividend stocks to outperform despite the Fed sending a signal of a potential pivot and the global financial conditions having started to turn easing from November onward.Our key message to dividend investors in 1Q24 – Fed pivot does not mean the end of outperformance among Quality Dividend stocks: Although market has been pricing toward more rate cuts in 2024 since last November, overall financial conditions are still tight in absolute terms; UST 10Y yield at around 4% might keep inducing fund flows to go to money market funds and other income-related investing strategies. Meanwhile, recent Fed rate cut expectations might have gone too far – bond futures market is expecting six cuts in 2024 vs. Fed dotpot guiding to just three; If these price actions are going to reverse a bit, we believe Dividend stocks could continue to outperform in 1Q24. On the China front, the current deflation backdrop has also laid the ground for its Value/Dividend stocks to outperform. Top Quantamental ideas for 1Q24: Our selection process includes two steps: 1) We leverage our quantitative model to ident...