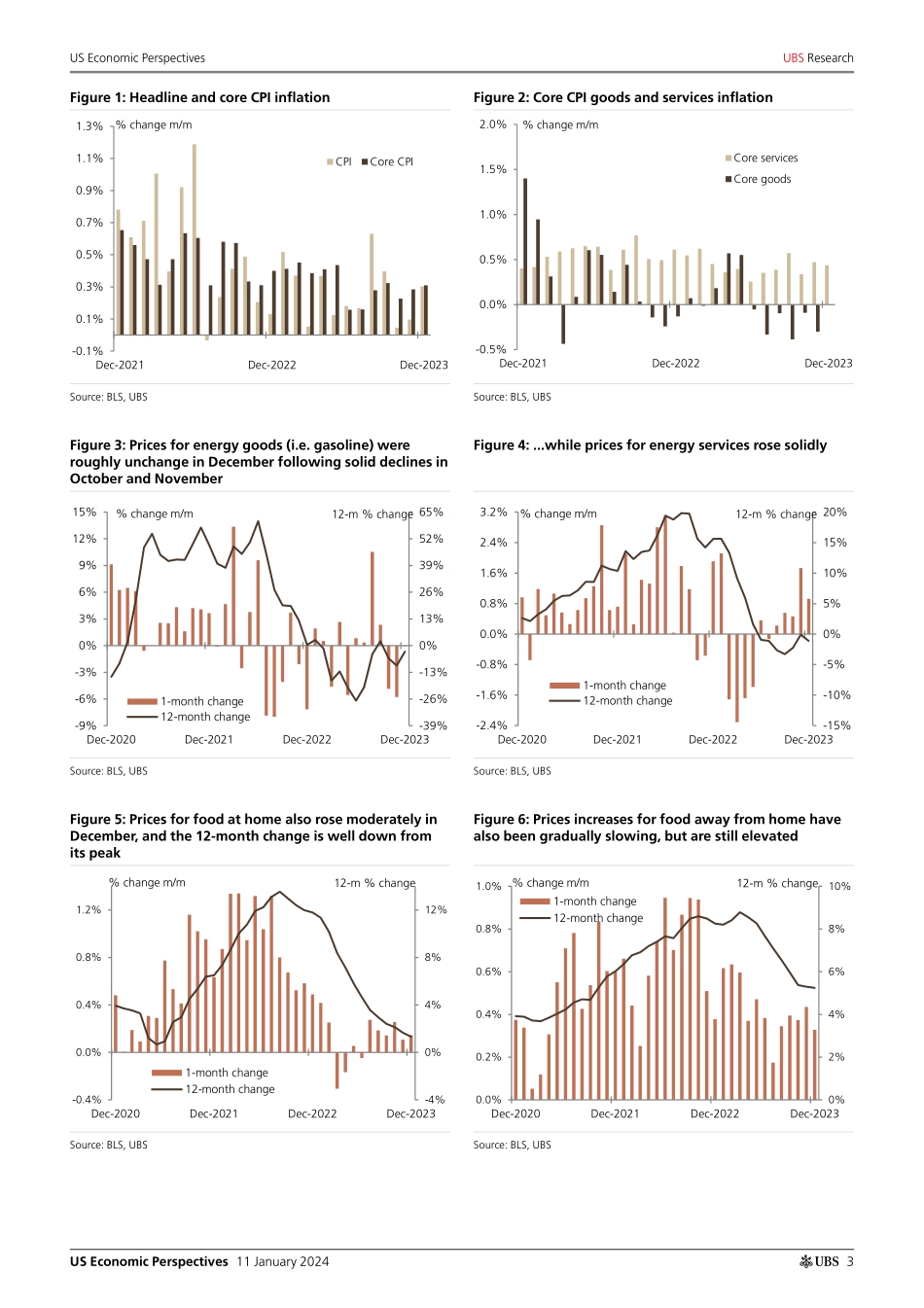

ab11 January 2024Global Research and Evidence LabUS Economic PerspectivesDecember CPI recap: Strong but not worrisomeHeadline CPI +0.30%: Close to core as energy does not push down DecemberThe December CPI showed the headline CPI rising faster (+30bp) than the muted increases in both October (+4bp) and November (+10bp). We take little signal from the momentum in the headline CPI this month as the main source for the pick up was gasoline prices that declined only slightly in December (on a seasonally adjusted basis) following large declines in October and November. Among the other main aggregates, food prices showed little sign for concern as prices for food at home (groceries) and food away from home (restaurants) continue to see easing in their 12-month changes. The core CPI increased 31bp — a quicker pace than the past couple of readings, but the components suggest less cause for concern. Compared to expectations, the 30bp headline CPI increase in December was roughly in line with our expectations and above those of consensus (UBS Econ projection 0.28%, UBS Nowcast -0.01%, Bloomberg consensus average 0.21%).Core CPI +0.31%: Solid rents and strong non-transportation core goodsCore CPI prices rose 31bp in December and the 12-month core CPI change slipped to 3.9%. The December increase was only the 2nd above-30bp core CPI increase in the past 7 months. Up to May core CPI increases had been above 30bp for 20 months in a row. Today's print was just a shade below our expectations, and somewhat above consensus expectations (UBS Econ projection 0.34%, UBS Nowcast 0.16%, consensus average 0.25%).We do not think that the pick up in the monthly core CPI pace is a sign of concern: the stronger core CPI increase compared to November can entirely be accounted for by stronger prices for core non-transportation goods, which in November saw an outsized decline that was tied with April 2020 as the largest decline in core non-transportation goods prices in decades (and did not align with the moderate movements in core consumer import prices). Among the other components, owners' equivalent rent (OER, the largest and one of the most stable CPI components) continued to rise solidly (up 47bp in December). As we noted in December's US Inflation Monthly we think we will have to wait until March, or perhaps into Q2, before OER increases below 40bp become regular (the pre-pandemic average pace was about 27bp). While the timing of that slowing is uncertain, new tenants' rents that have been running near their pre-pandemic pace for more than a year suggest that additional slowing in OER is coming. Prices for core non-rent services showed another solid increase in December (+40bp estimated), about the same as in November. The detailed release data including comparisons to our expectations are in the attached tables.Preliminary December core PCE...