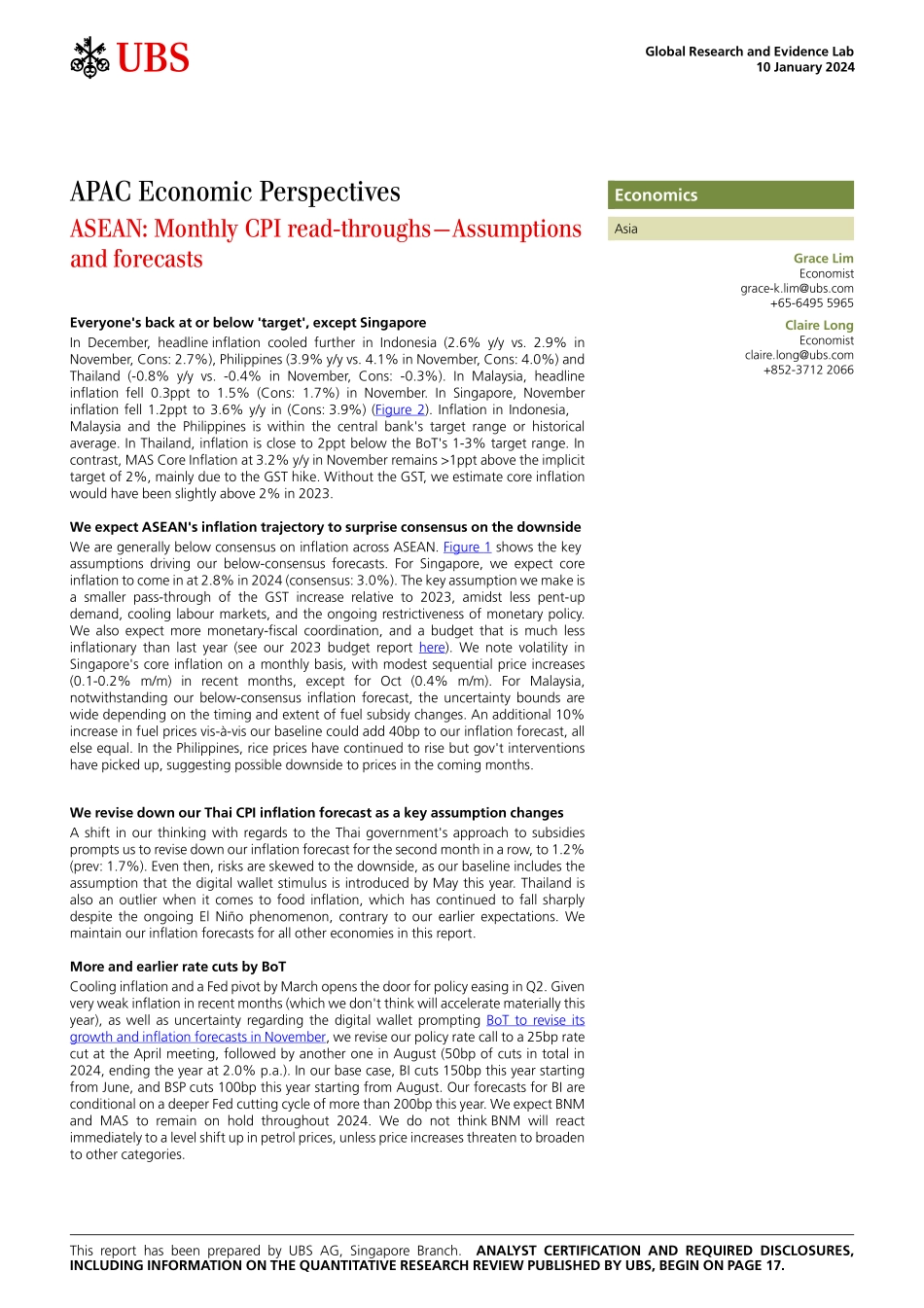

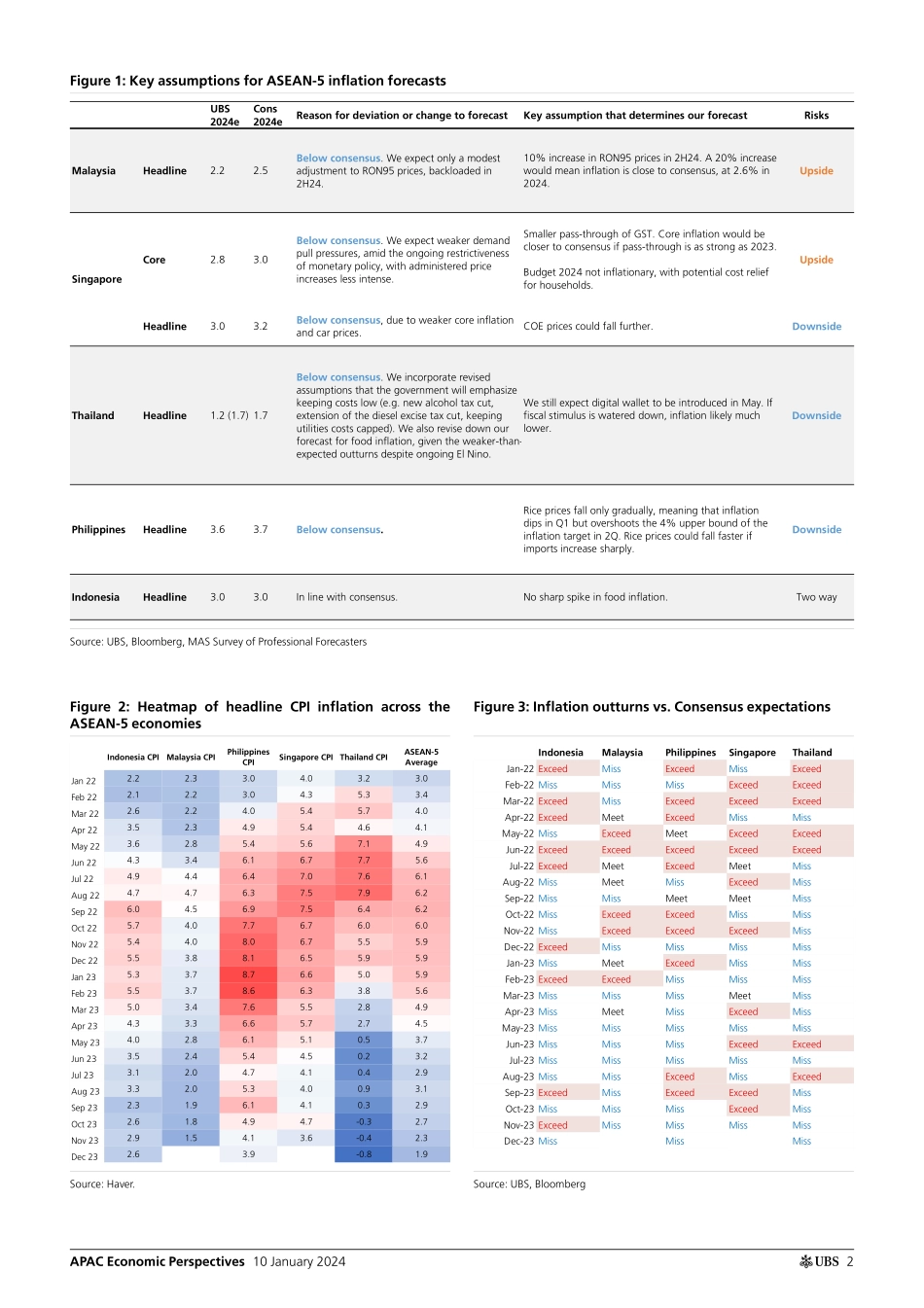

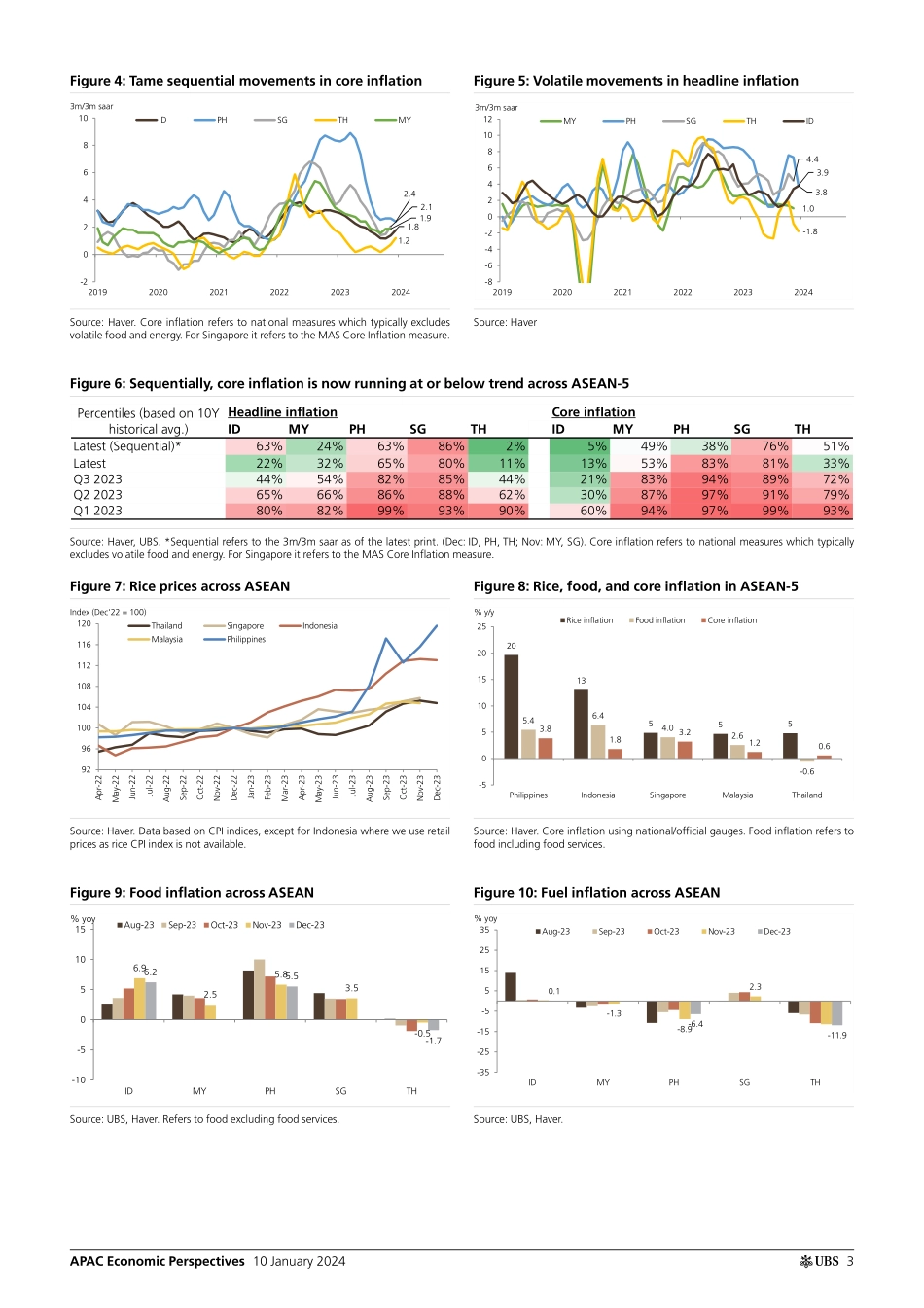

ab10 January 2024Global Research and Evidence LabAPAC Economic PerspectivesASEAN: Monthly CPI read-throughs—Assumptions and forecastsEveryone's back at or below 'target', except Singapore In December, headline inflation cooled further in Indonesia (2.6% y/y vs. 2.9% in November, Cons: 2.7%), Philippines (3.9% y/y vs. 4.1% in November, Cons: 4.0%) and Thailand (-0.8% y/y vs. -0.4% in November, Cons: -0.3%). In Malaysia, headline inflation fell 0.3ppt to 1.5% (Cons: 1.7%) in November. In Singapore, November inflation fell 1.2ppt to 3.6% y/y in (Cons: 3.9%) (Figure 2Heatmap of headline CPI inflation acros the ASEAN-5 economies). Inflation in Indonesia, Malaysia and the Philippines is within the central bank's target range or historical average. In Thailand, inflation is close to 2ppt below the BoT's 1-3% target range. In contrast, MAS Core Inflation at 3.2% y/y in November remains >1ppt above the implicit target of 2%, mainly due to the GST hike. Without the GST, we estimate core inflation would have been slightly above 2% in 2023. We expect ASEAN's inflation trajectory to surprise consensus on the downsideWe are generally below consensus on inflation across ASEAN. Figure 1Key asumptions for ASEAN-5 inflation forecasts shows the key assumptions driving our below-consensus forecasts. For Singapore, we expect core inflation to come in at 2.8% in 2024 (consensus: 3.0%). The key assumption we make is a smaller pass-through of the GST increase relative to 2023, amidst less pent-up demand, cooling labour markets, and the ongoing restrictiveness of monetary policy. We also expect more monetary-fiscal coordination, and a budget that is much less inflationary than last year (see our 2023 budget report here). We note volatility in Singapore's core inflation on a monthly basis, with modest sequential price increases (0.1-0.2% m/m) in recent months, except for Oct (0.4% m/m). For Malaysia, notwithstanding our below-consensus inflation forecast, the uncertainty bounds are wide depending on the timing and extent of fuel subsidy changes. An additional 10% increase in fuel prices vis-à-vis our baseline could add 40bp to our inflation forecast, all else equal. In the Philippines, rice prices have continued to rise but gov't interventions have picked up, suggesting possible downside to prices in the coming months.We revise down our Thai CPI inflation forecast as a key assumption changesA shift in our thinking with regards to the Thai government's approach to subsidies prompts us to revise down our inflation forecast for the second month in a row, to 1.2% (prev: 1.7%). Even then, risks are skewed to the downside, as our baseline includes the assumption that the digital wallet stimulus is introduced by May this year. Thailand is also an outlier when it comes to food inflation, which has continued to fall sharply despite the ongoing El Niño phenomenon, c...