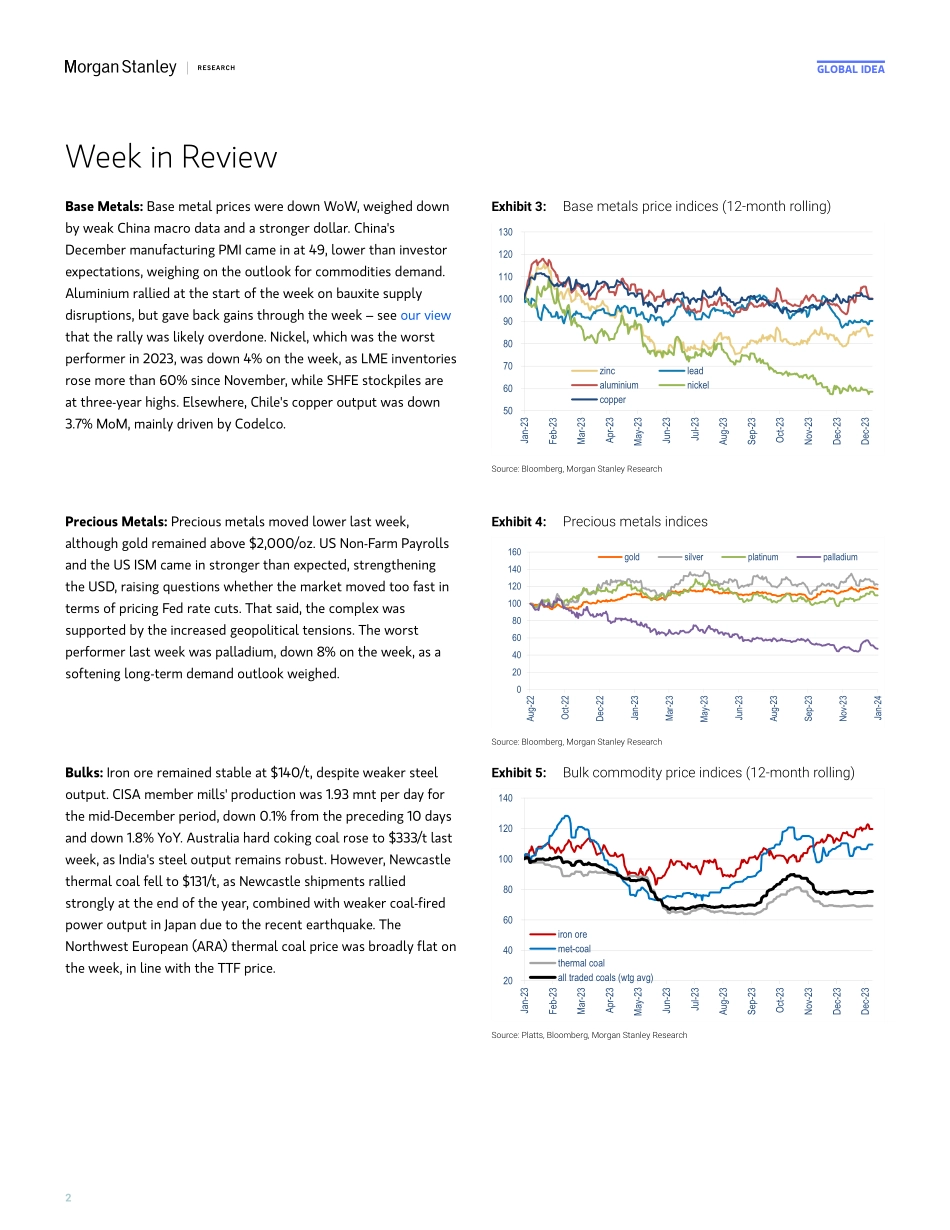

M Global Ideametal&ROCKGold: A New Trendline Gold's relationship with real yields evolved rather than broke down in 2023, ending the year with a weaker sensitivity to yields but a growing safe haven premium. We see gold fairly priced for now, but prices could move higher as rate cuts approach. Morgan Stanley & Co. International plc+Amy Gower (Amy Sergeant), CFACommodities Strategist Amy.Sergeant@morganstanley.com +44 20 7677-6937 Walid HasanzadehResearch Associate Walid.Hasanzadeh@morganstanley.com +44 20 7425-1191 Martijn Rats, CFAEquity Analyst and Commodities Strategist Martijn.Rats@morganstanley.com +44 20 7425-6618 Exhibit 1 : Looking at real yields versus real gold prices, the relationship appears to have broken down in 2023, with an R2 of just 6%... y = -318.35x + 1773R² = 0.9196y = -129.93x + 1963R² = 0.6269y = -38.178x + 2023.9R² = 0.06391300180023002800-1.50-1.00-0.500.000.501.001.502.002.503.00Real Gold Price ($/oz) vs US 10y TIPS (%)2018-202120222023Current10y TIPSReal Gold ($/oz)2018-202120222023 Source: Bloomberg, Morgan Stanley Research Exhibit 2 : … But breaking 2023 into sections shows better correlations, suggesting the factors driving gold have been evolving R² = 0.6862R² = 0.6714R² = 0.81771300180023002800-1.50-1.00-0.500.000.501.001.502.002.503.00Real Gold Price ($/oz) vs US 10y TIPS (%)2018-20212022Mid Oct 2023+CurrentMar - mid Oct 2023Jan-Mar 202310y TIPSReal Gold ($/oz)2018-20212022Mar - Mid Oct 2023Mid Oct 2023 +Q1 2023 Source: Bloomberg, Morgan Stanley Research Relationships breaking down? At first glance, gold's relationship with real yields appears to have broken down in 2023 ( Exhibit 1 ), with an R2 of just 6%, suggesting real yields were becoming less helpful in analysing gold. This was widely attributed to rising physical demand, particularly from central banks, offsetting the headwinds from rising rates. Or changing? If we split 2023 into three periods, the R2 between real yields and gold improves significantly ( Exhibit 2 ). January to mid-March saw a steep trendline, with gold reacting to changing real yields as market expectations were that Fed hikes would soon be ending. From mid-March, concerns around the health of the US banking system and global economic growth escalated (see 2011 Parallels?), and central bank purchases accelerated. The trend line shifted higher but also flattened as gold held up well against rising real yields. Finally, from mid-October onwards, as geopolitical tensions escalated in the Middle East, the trendline has shifted up further to incorporate more safe haven premium. However, the slope remains shallow – 10 year real yields fell almost 100 bp between the 25th Oct peak to the late Dec trough, but gold rallied just 5%, well below the +16% and +29% moves that the 1Q24 and 2018-2021 regressions would have implied. Where next? In our Price Deck , we argued gold is fairly valued around...