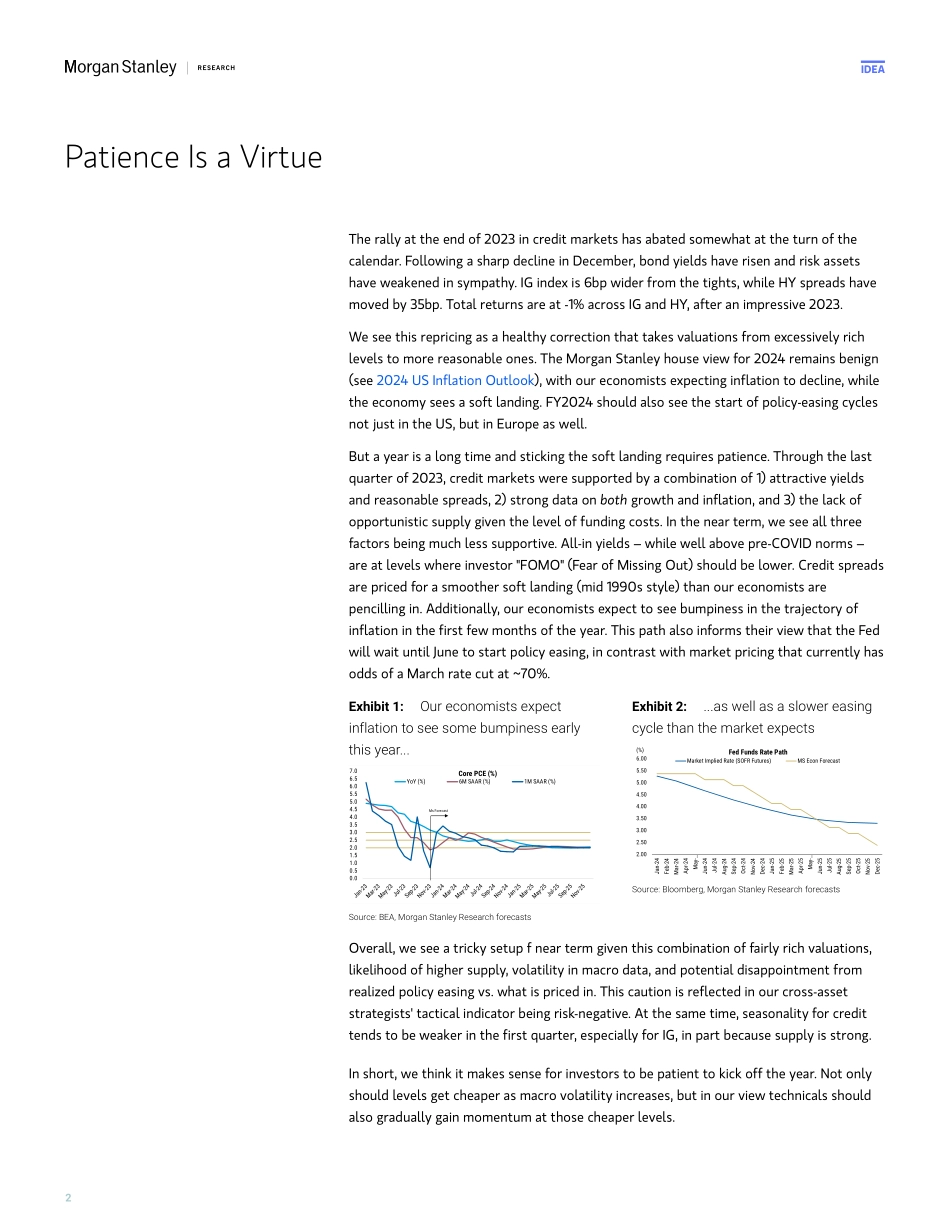

M IdeaUS Credit Strategy | North AmericaPicking Our SpotsThe rally in December limits directional upside from here. In leveraged credit, we see room to catch up in CCCs and Loans. In IG, the long end looks unattractive, while the front end should see inflows from cash. Morgan Stanley & Co. LLCVishwas PatkarStrategist Vishwas.Patkar@morganstanley.com +1 212 761-8041 Joyce JiangStrategist Joyce.Jiang@morganstanley.com +1 212 761-0165 Karen ChenStrategist Karen.Chen@morganstanley.com +1 212 761-1199 Ian RobinsonStrategist Ian.Robinson@morganstanley.com +1 212 761-3117 Morgan Stanley does and seeks to do business with companies covered in Morgan Stanley Research. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of Morgan Stanley Research. Investors should consider Morgan Stanley Research as only a single factor in making their investment decision.For analyst certification and other important disclosures, refer to the Disclosure Section, located at the end of this report.Key TakeawaysOur soft landing view for 2024 remains intact. But rich valuations, bumpy macro data, and delayed policy easing make for a tougher short-term set-up.Valuations favor IG over HY, but we think quality compression WITHIN both assets is likely short term.In leveraged credit, we see a window for CCCs to outperform. Our preference for Loans overs Bonds is more strategic.In IG, we stick to the front end where carry and income remain reasonable. Long-end technicals should weaken on both the demand and supply fronts.In synthetics, we take off the CDX decompression trade and prefer alternatives with less exposure to CCCs (short HY 15-100% vs. Long CDX IG). January 9, 2024 09:00 PM GMTM Idea2Patience Is a VirtueThe rally at the end of 2023 in credit markets has abated somewhat at the turn of the calendar. Following a sharp decline in December, bond yields have risen and risk assets have weakened in sympathy. IG index is 6bp wider from the tights, while HY spreads have moved by 35bp. Total returns are at -1% across IG and HY, after an impressive 2023. We see this repricing as a healthy correction that takes valuations from excessively rich levels to more reasonable ones. The Morgan Stanley house view for 2024 remains benign (see 2024 US Inflation Outlook), with our economists expecting inflation to decline, while the economy sees a soft landing. FY2024 should also see the start of policy-easing cycles not just in the US, but in Europe as well. But a year is a long time and sticking the soft landing requires patience. Through the last quarter of 2023, credit markets were supported by a combination of 1) attractive yields and reasonable spreads, 2) strong data on both growth and inflation, and 3) the lack of opportunistic supply given the level of funding costs. In the near term, we see all thr...