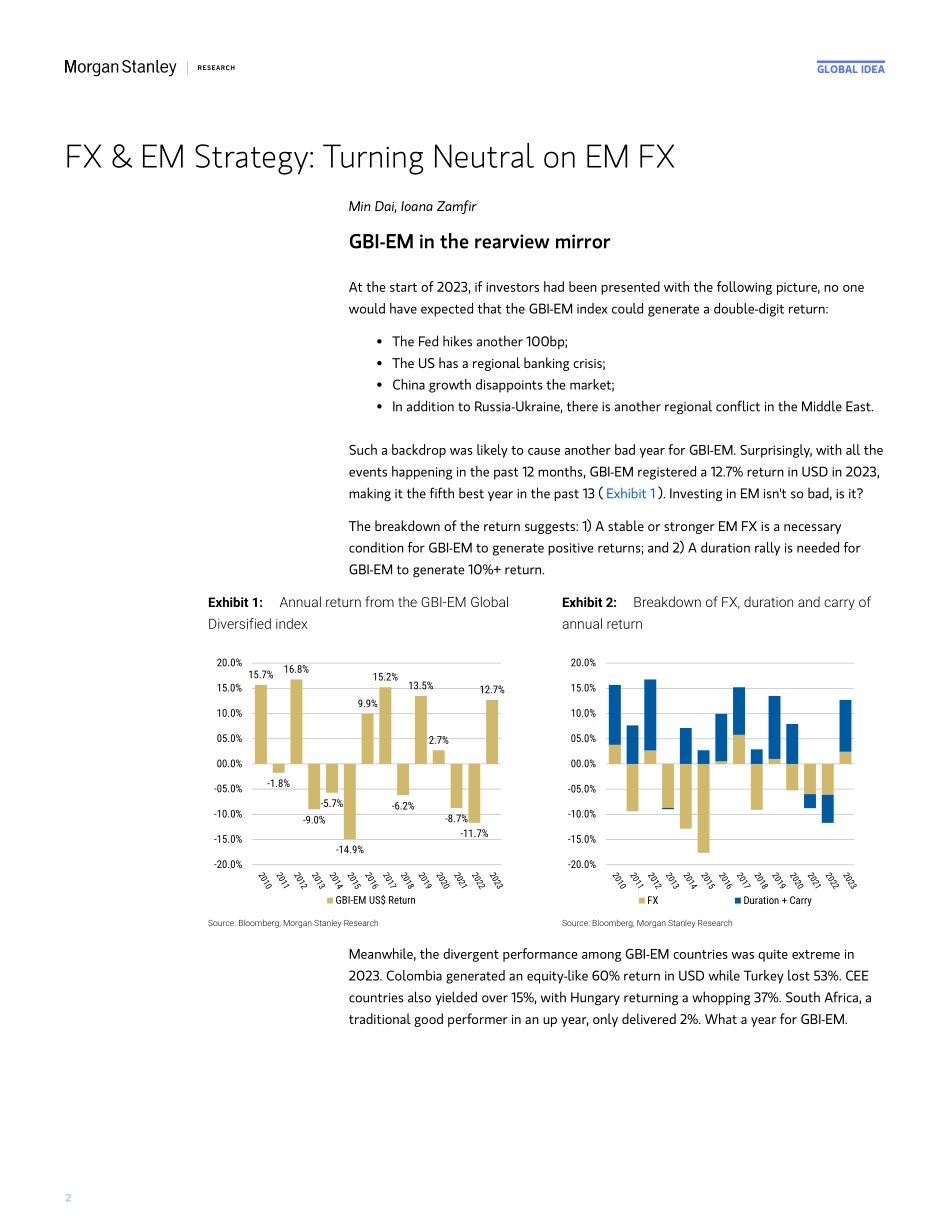

M Global IdeaGlobal EM StrategistTurning Neutral on EM FXMorgan Stanley & Co. International plc+James K LordStrategist James.Lord@morganstanley.com +44 20 7677-3254 Neville Z MandimikaStrategist Neville.Mandimika@morganstanley.com +44 20 7425-2509 Pascal N BodeStrategist Pascal.Bode@morganstanley.com +44 20 7425-3282 Morgan Stanley & Co. LLCSimon WaeverStrategist Simon.Waever@morganstanley.com +1 212 296-8101 Ioana ZamfirStrategist Ioana.Zamfir@morganstanley.com +1 212 761-4012 Emma C CerdaStrategist Emma.Cerda@morganstanley.com +1 212 761-2344 Eli P CarterStrategist Eli.Carter@morganstanley.com +1 212 761-4703 Morgan Stanley Asia Limited+Min DaiStrategist Min.Dai@morganstanley.com +852 2239-7983 Gek Teng KhooStrategist Gek.Teng.Khoo@morganstanley.com +852 3963-0303 We turn neutral on EM FX thanks to downside surprises in US data, still decent EM FX carry and reasonable valuations. But we hold a USD-bullish bias given the recent USD weakness overshoot and aggressive rate cut expectation. FX & EM Strategy: The GBI-EM index yielded 12.7% in 2023 despite all the challenges from a hawkish Fed, China slowdown, US regional banking crisis and increasing geopolitical tensions. The dispersion of the country return is the highest in history, allowing investors to generate decent alpha.We turn neutral on EM FX from bearish as: 1) The market will likely bounce between the hawkish/dovish Fed and easing/tightening financial conditions; 2) US data surprising on the downside more versus EM; 3) EM FX still offers decent carry; and 4) EM FX valuations seem fair. But we hold a bullish bias on USD given the USD weakness overshoot seen late last year. Sovereign Credit Strategy: November and December front-loaded half of the 14% 2024 full-year expected return from our outlook, leaving it mostly down to carry from here, given that we don't see reasons to adjust our spread forecast tighter. If anything, we see spreads wider in 1Q24 due to stretched valuations, increased supply, downside risks to oil prices and some pushback on near-term easing priced from global central banks. Given this view, we suggest reducing beta in portfolios, even after an already weak first week. In BBBs, we replace our Hungary like stance with Uruguay. In BBs, we replace our Colombia and South Africa like stances with Brazil and Morocco, moving Colombia directly to a dislike stance. Top longs among the lower-rated credits are Angola, Egypt, Ghana, El Salvador and Venezuela. With Pemex 2030 hitting our target, we also close our trade and will reassess when and where to re-enter. LatAm Macro Strategy: We explore three patterns that tend to occur in January in LatAm markets, related to FX performance and inflation patterns. We keep our structural 5-year TIIE receiver, but add a tactical 1-year TIIE payer. We also add a 5-year COPxIBR receiver and long BRL/MXN.Asia Macro Strategy: We revisit the three t...