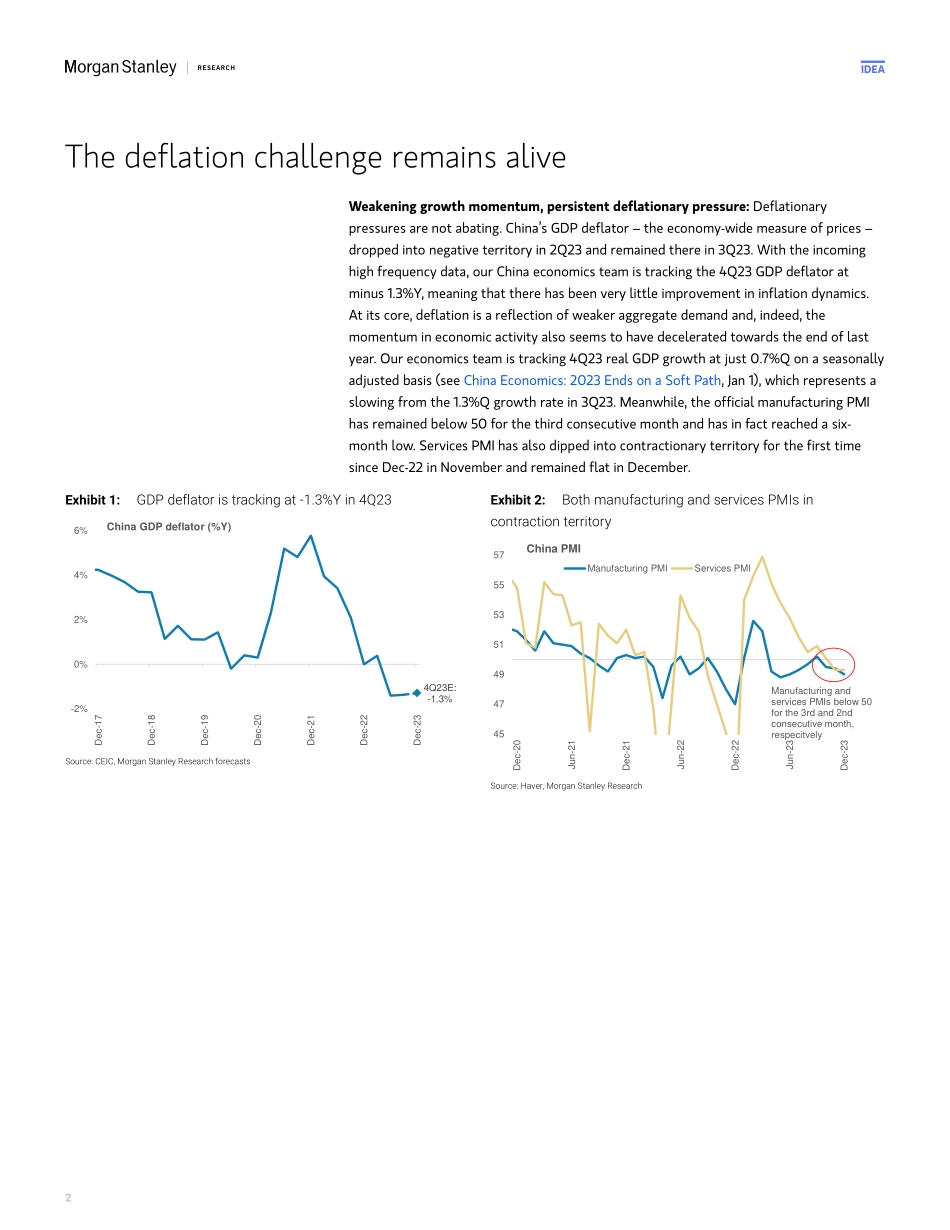

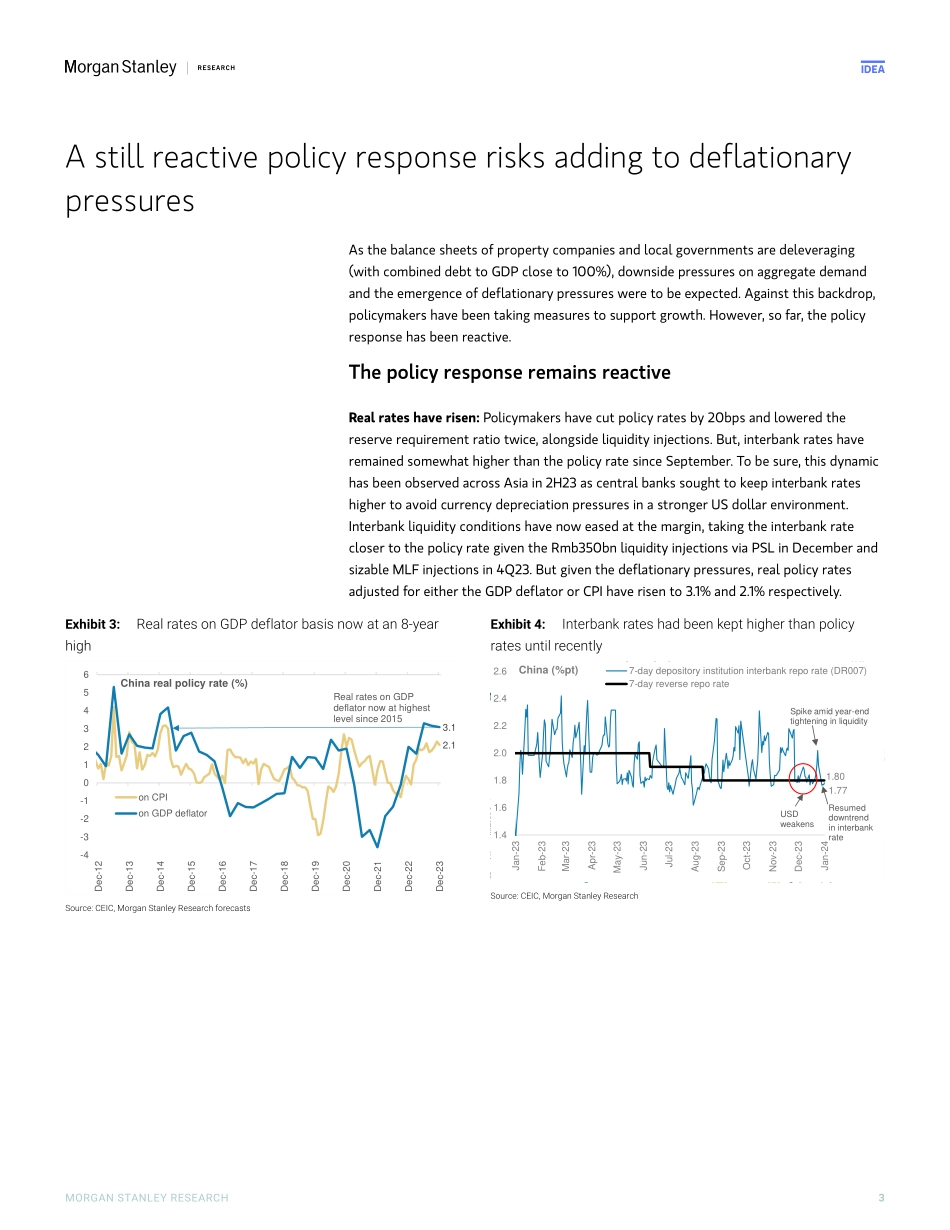

M IdeaAsia Economics | Asia PacificThe Viewpoint: China – Deflationary Pressures Still PersistentDeflationary pressures appear to be persisting in China, while the policy response remains reactive. Against this backdrop, there are risks that the corporate sector slows wage growth, broadening the deleveraging trend to households and increasing deflationary pressures. Morgan Stanley Asia LimitedChetan AhyaChief Asia Economist Chetan.Ahya@morganstanley.com +852 2239-7812 Derrick Y KamAsia Economist Derrick.Kam@morganstanley.com +65 6834-8272 Qiusha PengEconomist Qiusha.Peng@morganstanley.com +852 3963-0376 Jonathan CheungEconomist Jonathan.Cheung@morganstanley.com +852 2848-5652 Morgan Stanley appreciates your support in the 2024 Institutional Investor All-Asia Research Team Survey. Request your ballot here. For important disclosures, refer to the Disclosure Section, located at the end of this report.Key TakeawaysAggregate demand is weak. Our China economics team estimates the GDP deflator at -1.3%Y in 4Q23, the third consecutive quarter with over a 1% decline in prices. Nominal GDP growth will likely be 3.5%Y in 4Q23, marking the second consecutive quarter of below 4% growth. Corporate revenue growth is slowing. This may prompt the corporate sector to slow investment and cut wage growth. If this materialises, it could risk the start of household deleveraging, weakening aggregate demand and adding to deflationary pressures. A decisive shift towards active fiscal easing and rebalancing towards consumption is needed to address the deflation challenge, in our view. January 8, 2024 05:25 PM GMTM Idea2The deflation challenge remains aliveWeakening growth momentum, persistent deflationary pressure: Deflationary pressures are not abating. China’s GDP deflator – the economy-wide measure of prices – dropped into negative territory in 2Q23 and remained there in 3Q23. With the incoming high frequency data, our China economics team is tracking the 4Q23 GDP deflator at minus 1.3%Y, meaning that there has been very little improvement in inflation dynamics. At its core, deflation is a reflection of weaker aggregate demand and, indeed, the momentum in economic activity also seems to have decelerated towards the end of last year. Our economics team is tracking 4Q23 real GDP growth at just 0.7%Q on a seasonally adjusted basis (see China Economics: 2023 Ends on a Soft Path, Jan 1), which represents a slowing from the 1.3%Q growth rate in 3Q23. Meanwhile, the official manufacturing PMI has remained below 50 for the third consecutive month and has in fact reached a six-month low. Services PMI has also dipped into contractionary territory for the first time since Dec-22 in November and remained flat in December. Exhibit 1:GDP deflator is tracking at -1.3%Y in 4Q234Q23E: -1.3%-2%0%2%4%6%Dec-17Dec-18Dec-19Dec-20Dec-21Dec-22Dec-23China GDP deflator (%Y)Source: CEIC, Morgan Stanley Research...