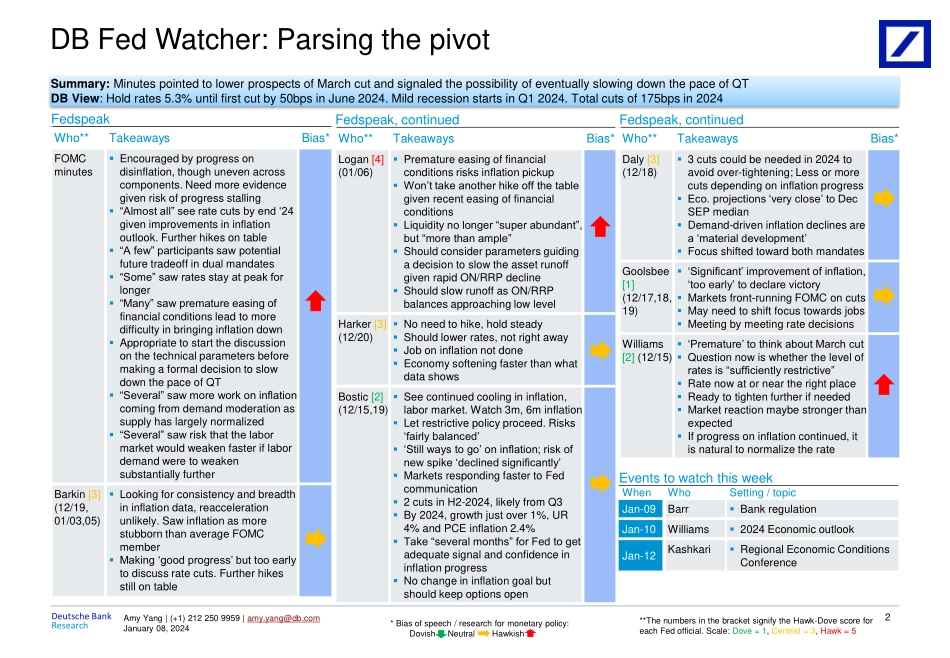

ResearchDeutsche BankAmy Yang | (+1) 212 250 9959 | amy.yang@db.comJanuary 08, 2024IMPORTANT RESEARCH DISCLOSURES AND ANALYST CERTIFICATIONS LOCATED IN APPENDIX 1. MCI (P) 041/10/2023. UNTIL 19th MARCH 2021 INCOMPLETEDISCLOSURE INFORMATION MAY HAVE BEEN DISPLAYED, PLEASE SEE APPENDIX 1 FOR FURTHER DETAILS.Fed Watcher: Parsing the pivotDeutsche BankResearchAmy YangEconomist(+1) 212 250 9959 | amy.yang@db.comMatthew LuzzettiChief US Economist(+1) 212 250 6161 | matthew.luzzetti@db.comBrett RyanSenior Economist(+1) 212 250 6294 | brett.ryan@db.comJustin WeidnerEconomist(+1) 212 469 1679 | justin-s.weidner@db.com Avik ChattopadhyayResearch Associateavik-a.chattopadhyay@db.comJanuary 08, 2024Distributed on: 08/01/2024 22:36:06 GMT7T2se3r0Ot6kwoPaResearchDeutsche BankAmy Yang | (+1) 212 250 9959 | amy.yang@db.comJanuary 08, 2024DB Fed Watcher: Parsing the pivot2FedspeakWho**TakeawaysBias*FOMC minutes▪ Encouraged by progress on disinflation, though uneven across components. Need more evidence given risk of progress stalling▪ “Almost all” see rate cuts by end ‘24 given improvements in inflation outlook. Further hikes on table▪ “A few” participants saw potential future tradeoff in dual mandates ▪ “Some” saw rates stay at peak for longer▪ “Many” saw premature easing of financial conditions lead to more difficulty in bringing inflation down▪ Appropriate to start the discussion on the technical parameters before making a formal decision to slow down the pace of QT▪ “Several” saw more work on inflation coming from demand moderation as supply has largely normalized▪ “Several” saw risk that the labor market would weaken faster if labor demand were to weaken substantially further Barkin [3](12/19, 01/03,05)▪ Looking for consistency and breadth in inflation data, reacceleration unlikely. Saw inflation as more stubborn than average FOMC member▪ Making ‘good progress’ but too early to discuss rate cuts. Further hikes still on table Fedspeak, continuedWho**TakeawaysBias*Logan [4](01/06)▪ Premature easing of financial conditions risks inflation pickup▪ Won’t take another hike off the table given recent easing of financial conditions ▪ Liquidity no longer “super abundant”, but “more than ample” ▪ Should consider parameters guiding a decision to slow the asset runoff given rapid ON/RRP decline▪ Should slow runoff as ON/RRP balances approaching low levelHarker [3](12/20)▪ No need to hike, hold steady▪ Should lower rates, not right away▪ Job on inflation not done ▪ Economy softening faster than what data showsBostic [2](12/15,19)▪ See continued cooling in inflation, labor market. Watch 3m, 6m inflation▪ Let restrictive policy proceed. Risks ‘fairly balanced’▪ ‘Still ways to go’ on inflation; risk of new spike ‘declined significantly’▪ Markets responding faster to Fed communication▪ 2 cuts in H2-2024, likely from Q3▪ By 2024, growth just over 1%, UR 4% and ...