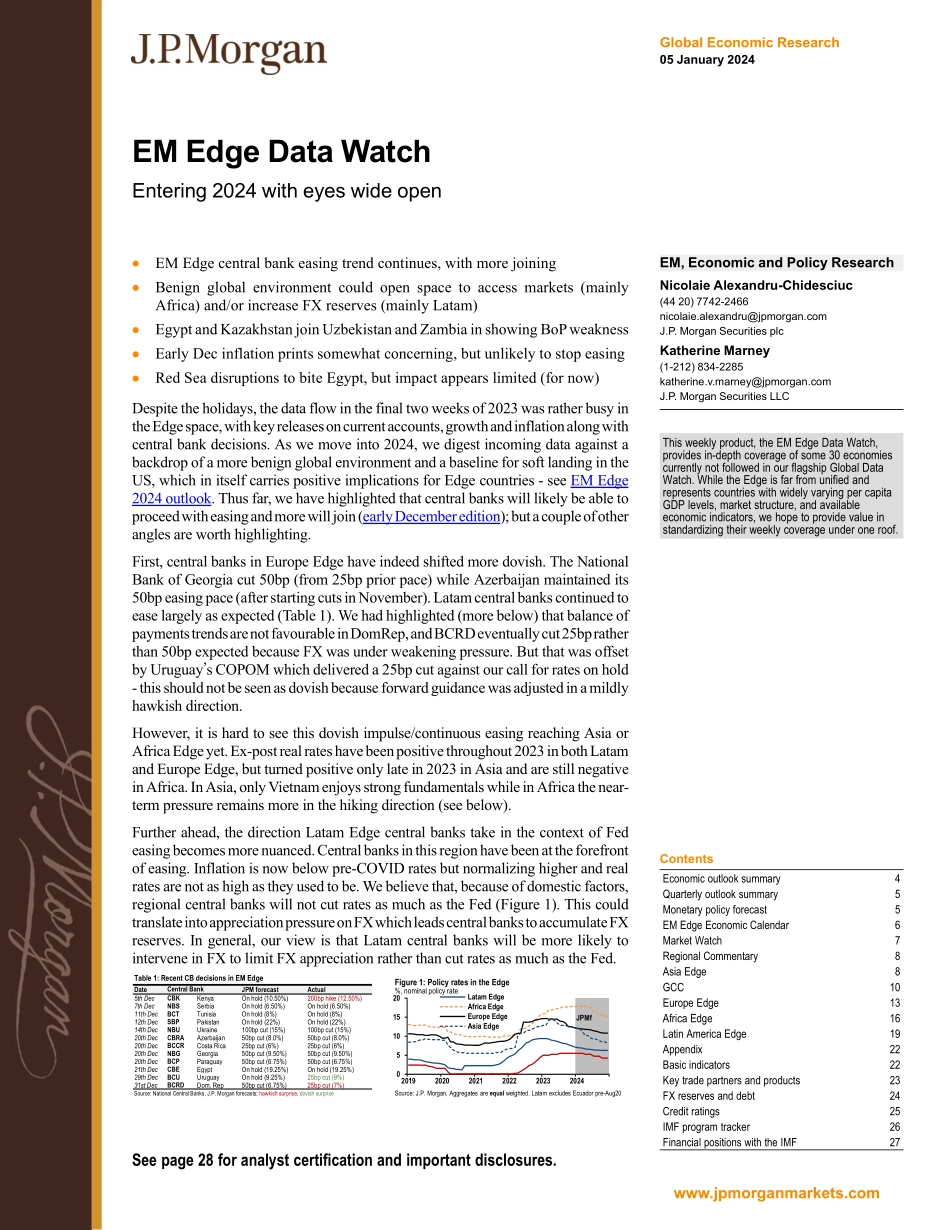

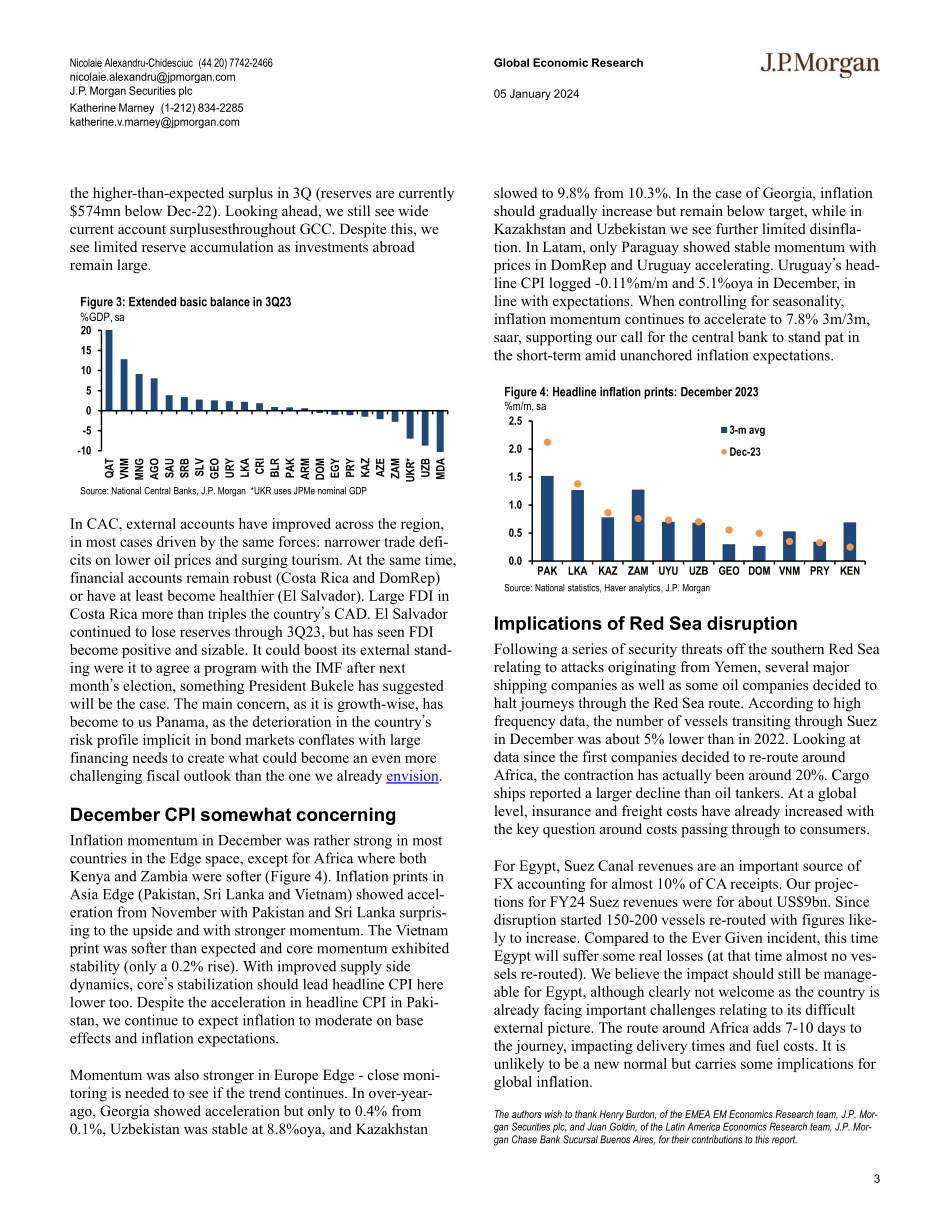

Global Economic Research05 January 2024J P M O R G A Nwww.jpmorganmarkets.comContentsEconomic outlook summary4Quarterly outlook summary5Monetary policy forecast5EM Edge Economic Calendar6Market Watch7Regional Commentary8Asia Edge8GCC10Europe Edge13Africa Edge16Latin America Edge19Appendix22Basic indicators22Key trade partners and products23FX reserves and debt24Credit ratings25IMF program tracker26Financial positions with the IMF27EM, Economic and Policy ResearchNicolaie Alexandru-Chidesciuc(44 20) 7742-2466nicolaie.alexandru@jpmorgan.comJ.P. Morgan Securities plcKatherine Marney(1-212) 834-2285katherine.v.marney@jpmorgan.comJ.P. Morgan Securities LLCThis weekly product, the EM Edge Data Watch, provides in-depth coverage of some 30 economies currently not followed in our flagship Global Data Watch. While the Edge is far from unified and represents countries with widely varying per capita GDP levels, market structure, and available economic indicators, we hope to provide value in standardizing their weekly coverage under one roof. •EM Edge central bank easing trend continues, with more joining •Benign global environment could open space to access markets (mainly Africa) and/or increase FX reserves (mainly Latam)•Egypt and Kazakhstan join Uzbekistan and Zambia in showing BoP weakness•Early Dec inflation prints somewhat concerning, but unlikely to stop easing•Red Sea disruptions to bite Egypt, but impact appears limited (for now)Despite the holidays, the data flow in the final two weeks of 2023 was rather busy in the Edge space, with key releases on current accounts, growth and inflation along with central bank decisions. As we move into 2024, we digest incoming data against a backdrop of a more benign global environment and a baseline for soft landing in the US, which in itself carries positive implications for Edge countries - see EM Edge 2024 outlook. Thus far, we have highlighted that central banks will likely be able to proceed with easing and more will join (early December edition); but a couple of other angles are worth highlighting. First, central banks in Europe Edge have indeed shifted more dovish. The National Bank of Georgia cut 50bp (from 25bp prior pace) while Azerbaijan maintained its 50bp easing pace (after starting cuts in November). Latam central banks continued to ease largely as expected (Table 1). We had highlighted (more below) that balance of payments trends are not favourable in DomRep, and BCRD eventually cut 25bp rather than 50bp expected because FX was under weakening pressure. But that was offset by Uruguay�s COPOM which delivered a 25bp cut against our call for rates on hold - this should not be seen as dovish because forward guidance was adjusted in a mildly hawkish direction. However, it is hard to see this dovish impulse/continuous easing reaching Asia or Africa Edge yet. Ex-post real rates have been positive throughout 2023 ...