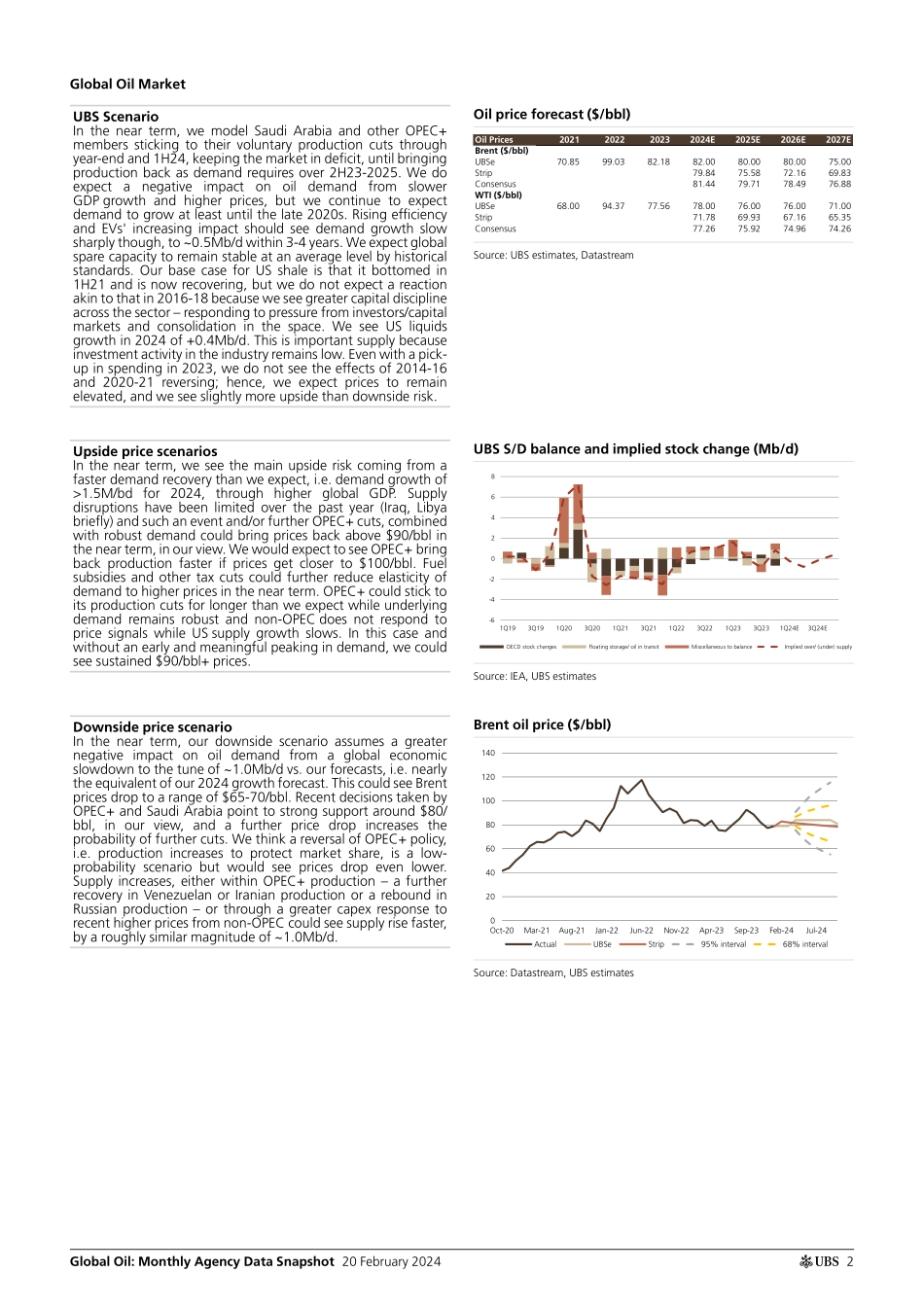

ab20 February 2024Global Research and Evidence LabPowered byUBS Evidence LabYESGlobal Oil: Monthly Agency Data SnapshotA wide range for supply growth tooMixed revisions to balancesThe IEA and OPEC again made bearish changes for 2024, incorporating higher non-OPEC supply. The IEA now sees a larger surplus of 0.8Mb/d in 2024, vs. 0.5Mb/d previously, assuming OPEC returns 1Mb/d in 2Q and a further 0.4Mb/d in 3Q. While OPEC similarly cut the implied call on OPEC by 0.1Mb/d to 28.4Mb/d, its forecast suggests 0.5Mb/d of incremental call on OPEC crude in 2Q that is in contrast to the IEA's forecasts calling for flat OPEC output. The EIA's market balance was largely unchanged at -0.1Mb/d for the year, as it forecasts OPEC returning only 0.7Mb/d in 2Q. Our own forecasts indicate a marginally tighter market balance for 2024, largely driven by US supply disruptions in 1Q. We continue to expect a similar market balance over 2Q-3Q of a 0.5Mb/d deficit on average, which supports our $84/bbl Brent forecast for 2Q-3Q.Demand forecasts for 2024 largely unchanged Agencies' demand growth forecasts for 2024 were little changed this month. The IEA and OPEC left forecasts virtually unchanged at 1.2Mb/d and 2.2Mb/d while the EIA marginally raised its forecast to 1.4Mb/d. We revised up our own forecast by 0.1Mb/d to 1.3Mb/d, on higher global GDP growth (+2.8% from +2.6%). For 2025, the EIA raised demand growth by 80kb/d to 1.3Mb/d (US +0.1Mb/d to 0.1Mb/d), while OPEC left it unchanged at 1.9Mb/d. Our demand forecast next year is more bearish at +1.1Mb/d, as we see lower non-OECD growth (OPEC 1.7Mb/d; EIA 1.3Mb/d vs, UBSe 1.1Mb/d).A wider range for non-OPEC supply, driven by the USRevisions to non-OPEC supply were mixed: upgrades from the IEA and OPEC and a downgrade from the EIA. As with demand growth, expectations for 2024 supply growth are now in a wide range: EIA +0.8Mb/d, OPEC +1.3Mb/d and the IEA +1.4Mb/d. Diverging views on US supply are the key driver: the EIA is the most bearish on +0.2Mb/d, while the IEA has +0.8Mb/d and OPEC +0.6Mb/d. The EIA's DPR shows that January US crude output fell by 0.6Mb/d m/m, with both wells drilled and wells completed down m/m. We expect non-OPEC supply growth of 0.9Mb/d (unchanged), including US liquids growth of 0.5Mb/d (+0.3Mb/d exit-to-exit).OPEC+ compliance issues in January: output down only 0.2Mb/d m/mUnsurprisingly, compliance with the new OPEC+ cuts was uneven in January: the UAE, Iraq and Kazakhstan produced a combined 0.7Mb/d more than their commitments made in early December. The combined output from OPEC-9 and partners was down only 0.2Mb/d m/m in January to 34.9Mb/d, 0.5Mb/d above the targeted level but in line with the drop we expect in 1Q24. We still expect the cut to be extended beyond the end of March, till at least the end of June 2024.Figure 1: Agency oil forecast dashboard a...