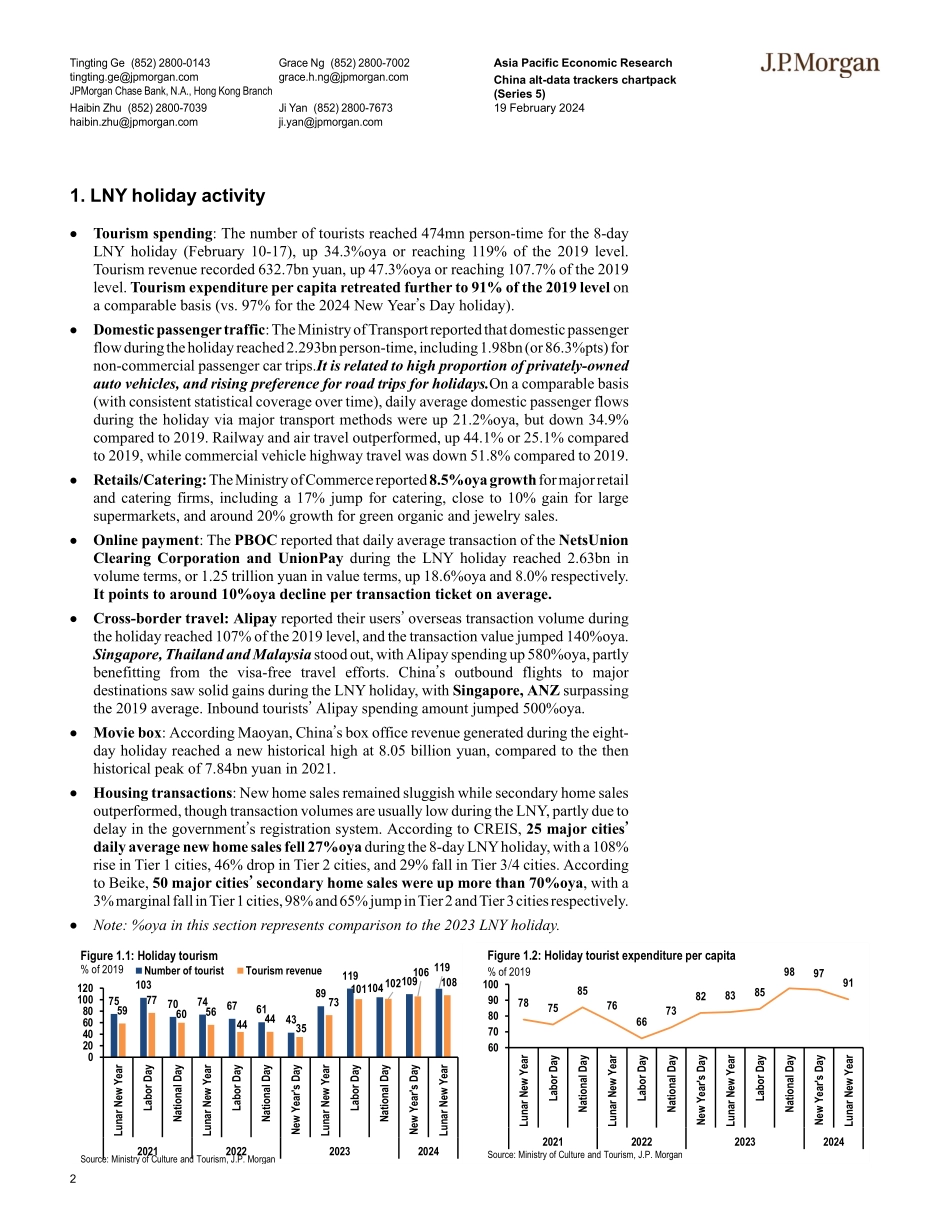

Asia Pacific Economic Research19 February 2024J P M O R G A Nwww.jpmorganmarkets.comEmerging Markets Asia, Economic and Policy ResearchTingting Ge(852) 2800-0143tingting.ge@jpmorgan.comHaibin Zhu(852) 2800-7039haibin.zhu@jpmorgan.comGrace Ng(852) 2800-7002grace.h.ng@jpmorgan.comJi Yan(852) 2800-7673ji.yan@jpmorgan.comJPMorgan Chase Bank, N.A., Hong Kong BranchAfter the eight-day Lunar New Year holiday (February 10-17), all eyes are on China�s holiday activity data. We summarize our key takeaways below, along with update for our alt-data trackers since our last update on Feb 8.•The number of tourists were up 34.3%oya or 119% of the 2019 level and tourism revenue was up 47.3%oya or 107.7% of the 2019 level. Tourism expenditure per capita retreated to 91% of the 2019 level.•Daily average domestic passenger flows were up 21.2%oya, but down 34.9% compared to 2019. Railway and air travel outperformed, up 44.1% or 25.1%.•Domestic passenger flows via non-commercial passenger car trips accounted for 86.3%pts, related to high proportion of privately-owned auto vehicles, and rising preference for road trips for holidays.•The Ministry of Commerce reported 8.5%oya growth for major retail and catering firms, including 17% jump for catering, close to 10% gain for large supermarkets, etc.•The PBOC reported that daily average UnionPay transaction during the LNY holiday rose 18.6%oya in volume and 8.0% in value terms, pointing to around 10%oya decline per transaction ticket.•Alipay reported their users� overseas transaction volume during the holiday reached 107% of the 2019 level, and the transaction value jumped 140%oya. Singapore, Thailand and Malaysia stood out, with Alipay spending up 580%oya, partly benefitting from the visa-free travel efforts.•Malaysia, Singapore, Philippines, Macau, Italy, and Spain led China�s outbound flights recovery in the two weeks running into the LNY holiday, while flights to ANZ, Singapore, Philippines, Macau and Malaysia retreated immediately last week, likely followed by further decline into the end of February as LNY demand booming effect fades.•CREIS� 25 major cities� LNY daily average new home sales fell 27%oya, with a 108% rise in Tier 1 cities, 46% and 29% fall in Tier 2 and 3/4 cities. Beike�s 50 major cities� secondary home sales were up ~70%oya, with a 3% marginal fall in Tier 1 cities, 98% and 65% jump in Tier 2 and Tier 3 cities. •LNY holiday box office revenue reached a new historical high at 8.05bn yuan.78758576667382838598979160708090100Lunar New YearLabor DayNational DayLunar New YearLabor DayNational DayNew Year's DayLunar New YearLabor DayNational DayNew Year's DayLunar New Year2021202220232024Source: Ministry of Culture and Tourism, J.P. MorganHoliday tourist expenditure per capita% of 201918.68.07.0*140.00306090120150Transaction volumeTransaction valueUnionPayAlipay (overseas)LNY holiday domestic and overseas transactionSour...