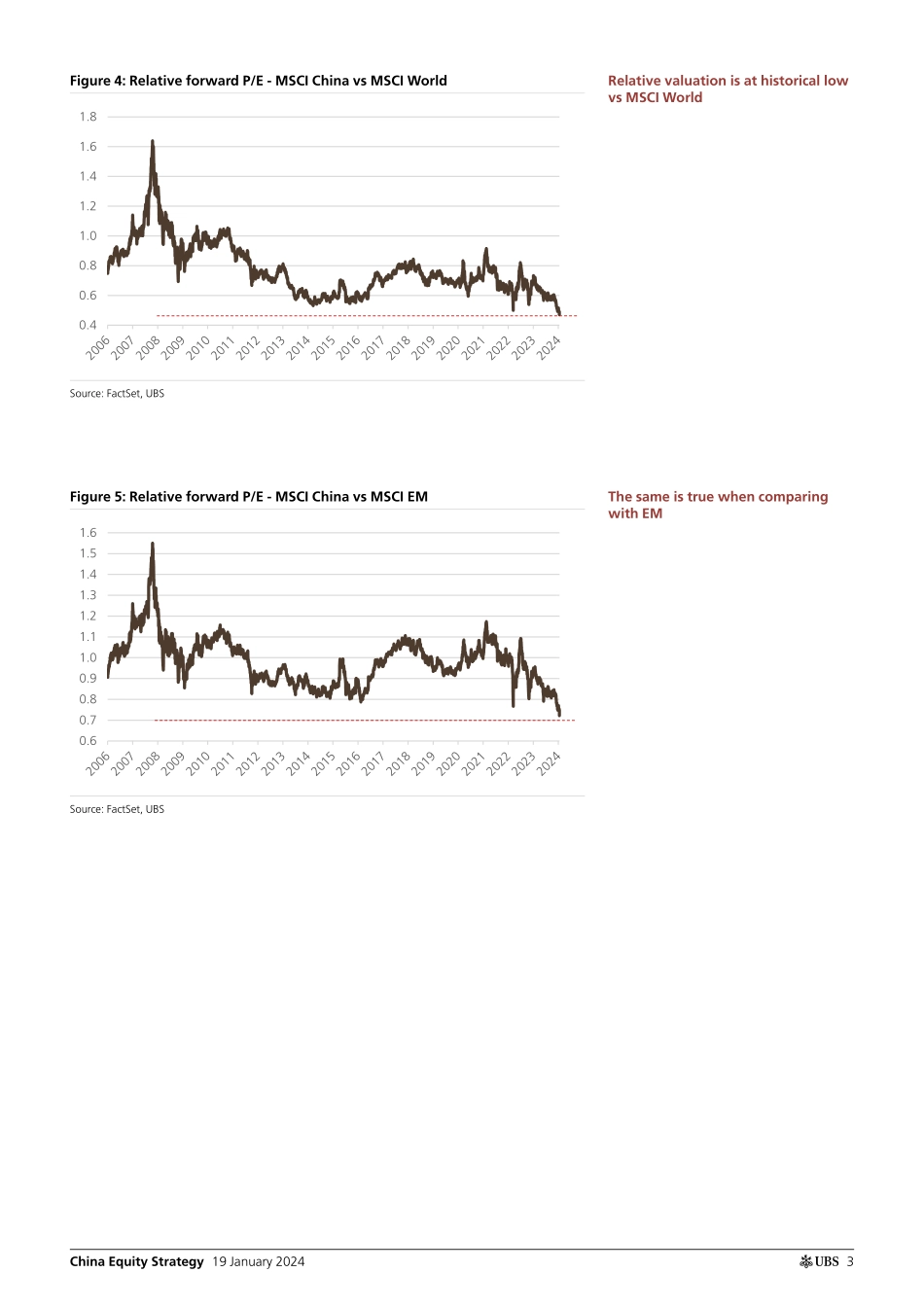

ab19 January 2024Global Research and Evidence LabChina Equity StrategyHow much is cheap enough? MSCI China at record low valuation MSCI China has declined 10% YTD, underperforming global markets by 8%, and is currently trading at 8.2x forward P/E - on par with previous troughs reached since 2014. Historically if investors bought into the MSCI China index at this valuation multiple, they would have generated an average return of 12% in one week. As global equities have benefitted from lower interest rate expectations, MSCI China is now also trading at record discount vs MSCI World and EM. While recent economic indicators have not shown a material improvement, they have certainly not shown the level of deterioration that has been exhibited by the equity market. Looking at the FX, commodity and fixed income markets, it would seem that equity investors are pricing in a more pessimistic outlook on the domestic economy than investors in other markets (see figure 9-13). With trough valuation multiples, light investor position and potential support from the 'national team' (see note), we believe risk reward is attractive at this level. History repeating itself?In some ways, the YTD sell-off seemed similar to the early 2016 experience in A-shares with technical trading factors (e.g. forced sell-off and redemptions) not economic factors, causing the market to drop lower. That said the CSI300 is now trading at 9.8x forward P/E which is below the trough in 2016 at 10.4x and close to the trough in 2018 during the trade war. Meanwhile H-shares which are trading on 7.0x 12mth fwd PE, are also lower vs the 2016 trough and at a similar level during the two recent sell-offs in March and Oct 2022 driven by ADR delisting concerns and COVID resurgences respectively. Short selling volume in H-shares reached 21% of total over the past few days, close to historical high. While some investors would like to compare the current economic experience in China vs Japan in the 1990s, the Japanese equity market has de-rated 57% from a peak of 70x to a low of 30x in the 1990s while MSCI China has also derated by 57% from its 2021 peak. On a stock level, c.50% of the top 100 stocks in A- & H-share market are trading below their 2015-16 troughs. Other markets suggest equity investors are pricing in more pessimism Looking at other markets, it would seem that equity investors are pricing in a more pessimistic scenario. These include: 1) FX - the CNYUSD exchange rate has already bottomed out in Nov 2023; 2) The 10 year government bond yields have hovered around the 2.5-2.6% mark recently while the equity market continued to dip lower, 3) iron ore prices, which historically have been closely linked to China's construction activities have gone up by 20% in 2023 (and only down 5-6% YTD), 4) LGFV bond yields have fallen significantly in recent...