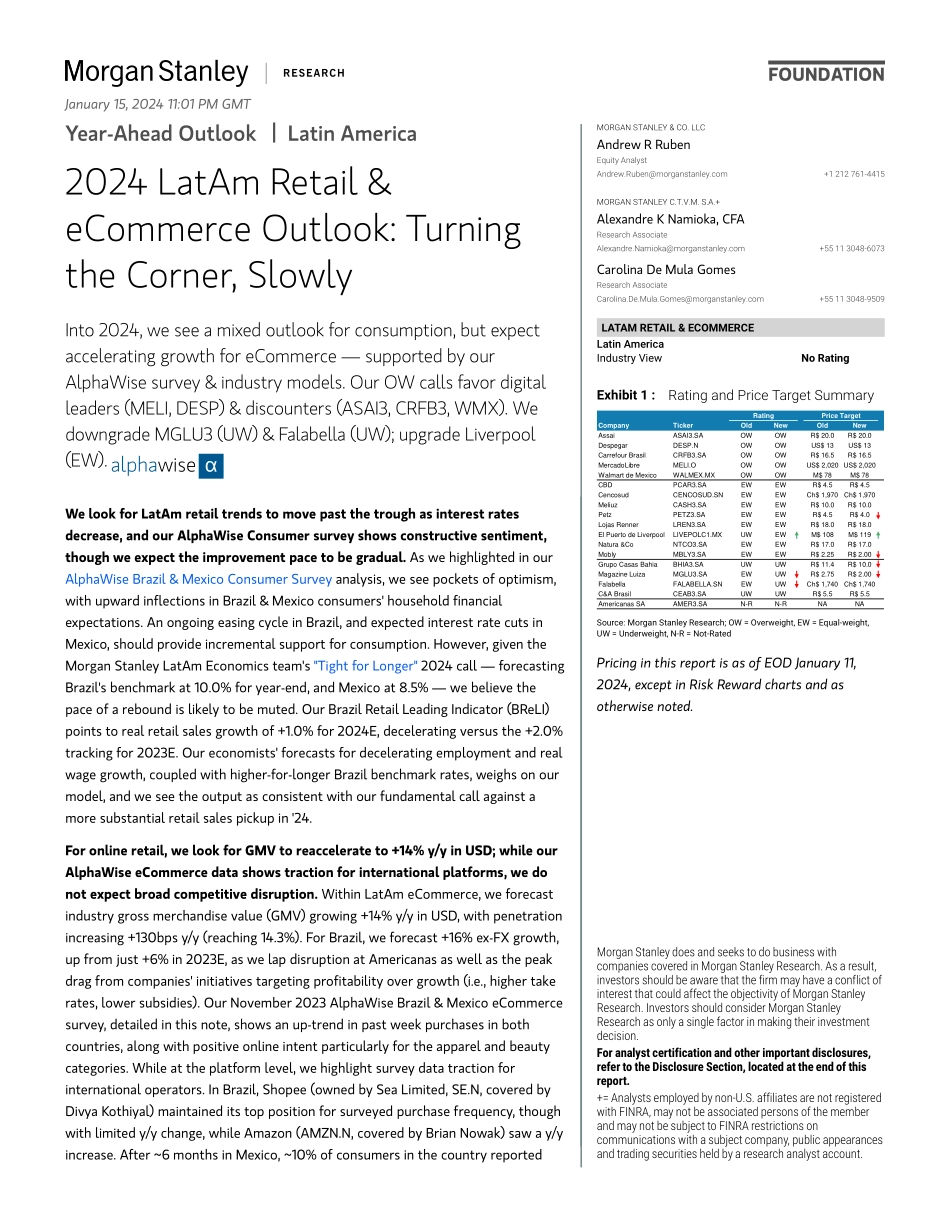

M FoundationYear-Ahead Outlook | Latin America2024 LatAm Retail & eCommerce Outlook: Turning the Corner, SlowlyMorgan Stanley & Co. LLCAndrew R RubenEquity Analyst Andrew.Ruben@morganstanley.com +1 212 761-4415 Morgan Stanley C.T.V.M. S.A.+Alexandre K Namioka, CFAResearch Associate Alexandre.Namioka@morganstanley.com +55 11 3048-6073 Carolina De Mula GomesResearch Associate Carolina.De.Mula.Gomes@morganstanley.com +55 11 3048-9509 LatAm Retail & eCommerceLatin AmericaIndustry ViewNo Rating Exhibit 1 : Rating and Price Target Summary RatingPrice TargetCompanyTickerOldNewOldNewAssaiASAI3.SAOWOWR$ 20.0R$ 20.0DespegarDESP.NOWOWUS$ 13US$ 13Carrefour BrasilCRFB3.SAOWOWR$ 16.5R$ 16.5MercadoLibreMELI.OOWOWUS$ 2,020 US$ 2,020Walmart de MexicoWALMEX.MXOWOWM$ 78M$ 78CBDPCAR3.SAEWEWR$ 4.5R$ 4.5CencosudCENCOSUD.SNEWEWCh$ 1,970Ch$ 1,970MeliuzCASH3.SAEWEWR$ 10.0R$ 10.0PetzPETZ3.SAEWEWR$ 4.5R$ 4.0Lojas RennerLREN3.SAEWEWR$ 18.0R$ 18.0El Puerto de LiverpoolLIVEPOLC1.MXUWEWM$ 108M$ 119Natura &CoNTCO3.SAEWEWR$ 17.0R$ 17.0MoblyMBLY3.SAEWEWR$ 2.25R$ 2.00Grupo Casas Bahia BHIA3.SAUWUWR$ 11.4R$ 10.0Magazine LuizaMGLU3.SAEWUWR$ 2.75R$ 2.00FalabellaFALABELLA.SNEWUWCh$ 1,740Ch$ 1,740C&A BrasilCEAB3.SAUWUWR$ 5.5R$ 5.5Americanas SAAMER3.SAN-RN-RNANA Source: Morgan Stanley Research; OW = Overweight, EW = Equal-weight, UW = Underweight, N-R = Not-Rated Pricing in this report is as of EOD January 11, 2024, except in Risk Reward charts and as otherwise noted. Into 2024, we see a mixed outlook for consumption, but expect accelerating growth for eCommerce — supported by our AlphaWise survey & industry models. Our OW calls favor digital leaders (MELI, DESP) & discounters (ASAI3, CRFB3, WMX). We downgrade MGLU3 (UW) & Falabella (UW); upgrade Liverpool (EW). M We look for LatAm retail trends to move past the trough as interest rates decrease, and our AlphaWise Consumer survey shows constructive sentiment, though we expect the improvement pace to be gradual. As we highlighted in our AlphaWise Brazil & Mexico Consumer Survey analysis, we see pockets of optimism, with upward inflections in Brazil & Mexico consumers' household financial expectations. An ongoing easing cycle in Brazil, and expected interest rate cuts in Mexico, should provide incremental support for consumption. However, given the Morgan Stanley LatAm Economics team's "Tight for Longer" 2024 call — forecasting Brazil's benchmark at 10.0% for year-end, and Mexico at 8.5% — we believe the pace of a rebound is likely to be muted. Our Brazil Retail Leading Indicator (BReLI) points to real retail sales growth of +1.0% for 2024E, decelerating versus the +2.0% tracking for 2023E. Our economists' forecasts for decelerating employment and real wage growth, coupled with higher-for-longer Brazil benchmark rates, weighs on our model, and we see the output as consistent with our fundamental call against a more substantial retail sales pickup in '24.For online retail, we look for ...