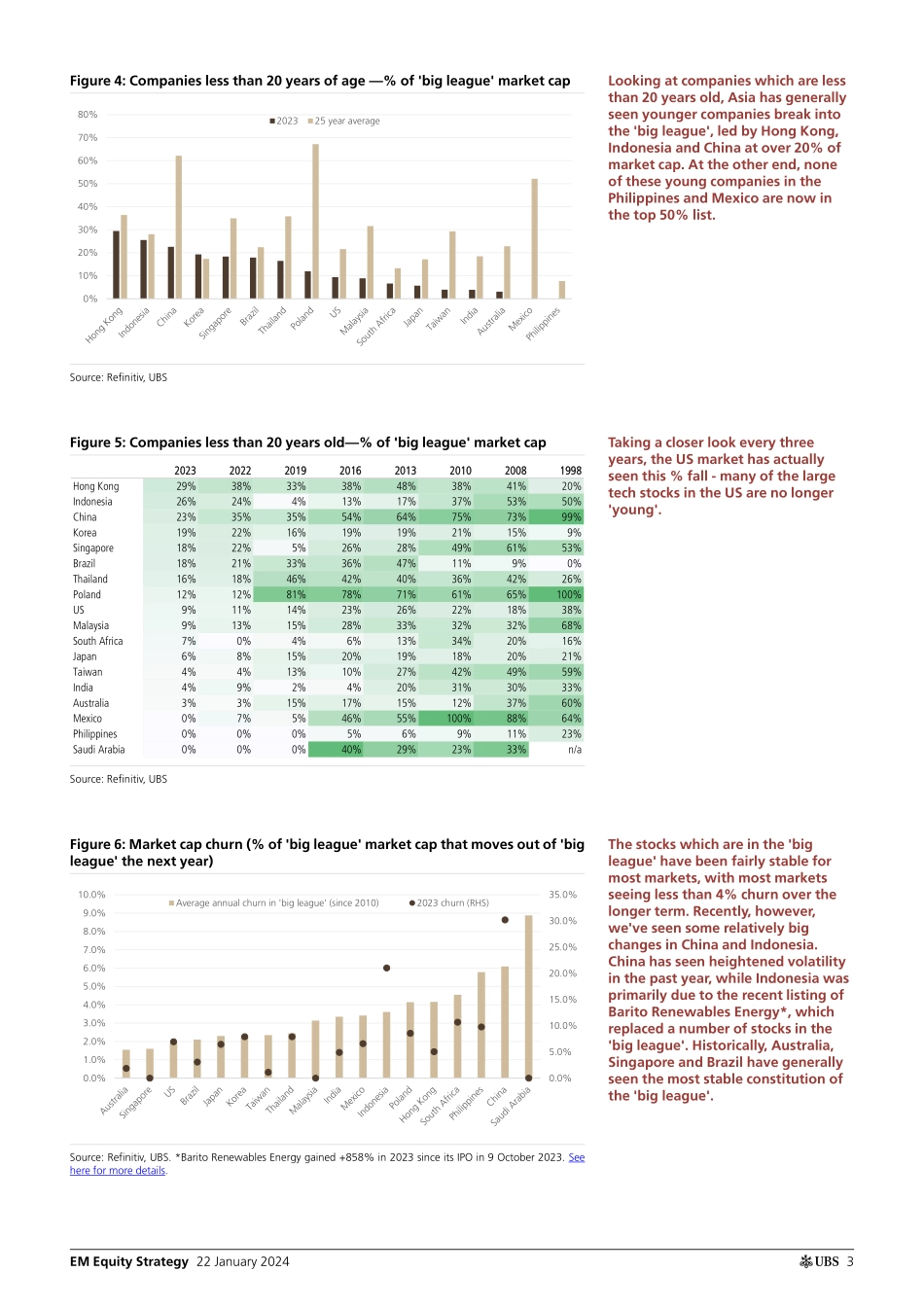

ab22 January 2024Global Research and Evidence LabEM Equity Strategy'Coming of age': Where do young firms grow big quickly?Getting into the 'big league'Which markets enable young, innovative firms to gain big market cap? Not all markets are equally efficient in allowing younger firms to make it big in equity markets. The factors that determine this could include the structure of the economy, regulatory regimes (protecting old businesses vs encouraging new enterprises; open markets vs keeping out foreign giants), the availability of early-stage capital as well as the ease of going public. In this report, we refer to companies that account for the top 50% of market cap in each market as 'big league' stocks. This is a fairly small, exclusive group: typically less than 5% of all listed stocks in each market account for the top-50% market cap. Our analysis could help guide investors on which markets tend to enable new, innovative companies to gain market cap quickly (providing exposure to new sectors) vs markets that have legacy firms staying big and relevant (historically making them less vulnerable to disruption).China's companies are young but getting older; Korea's old but getting youngerNot surprisingly, China has the youngest 'big league' stocks at an average age of 25 years old (market cap wtd avg), as seen in Figure 1. Taiwan is slightly younger than Korea, while Australia and Japan have the oldest companies in APAC. Within ASEAN, Indonesia and Singapore have relatively younger companies, while Philippines has among the oldest. Over the last 25 years, Figure 2 shows that Korea, Thailand and Brazil (along with the US) have defied ageing and enabled newer companies to climb up the market cap ranks significantly - and thus seen a drop in their average age. Korea and Brazil stocks are old but getting younger, while China and Poland stocks are young but getting older. Overall, the markets that have seen the biggest churn at the top include Saudi Arabia, Mexico, China, Hong Kong and Philippines, while the most stable have been Australia, Singapore, Brazil and Japan (Figure 6). A higher churn may not necessarily mean younger stocks are replacing older ones - it could be other older firms are growing large, too.Which stocks have stood the test of time and stayed relevant? We screen for stocks that have consistently been in the top-50% 'big league' in their respective markets (Figure 10). These companies have remained large over time, which to us suggests that they have either been able to remain competitive in largely relevant businesses, and/or have been able to reinvent themselves amidst the new economy sectors (or possibly benefiting from some form of protection). Over the past 25 years, we find 79 stocks that have been in the 'big league' within their markets - with Japan having a lion's share of 31 stocks. Taiwan...