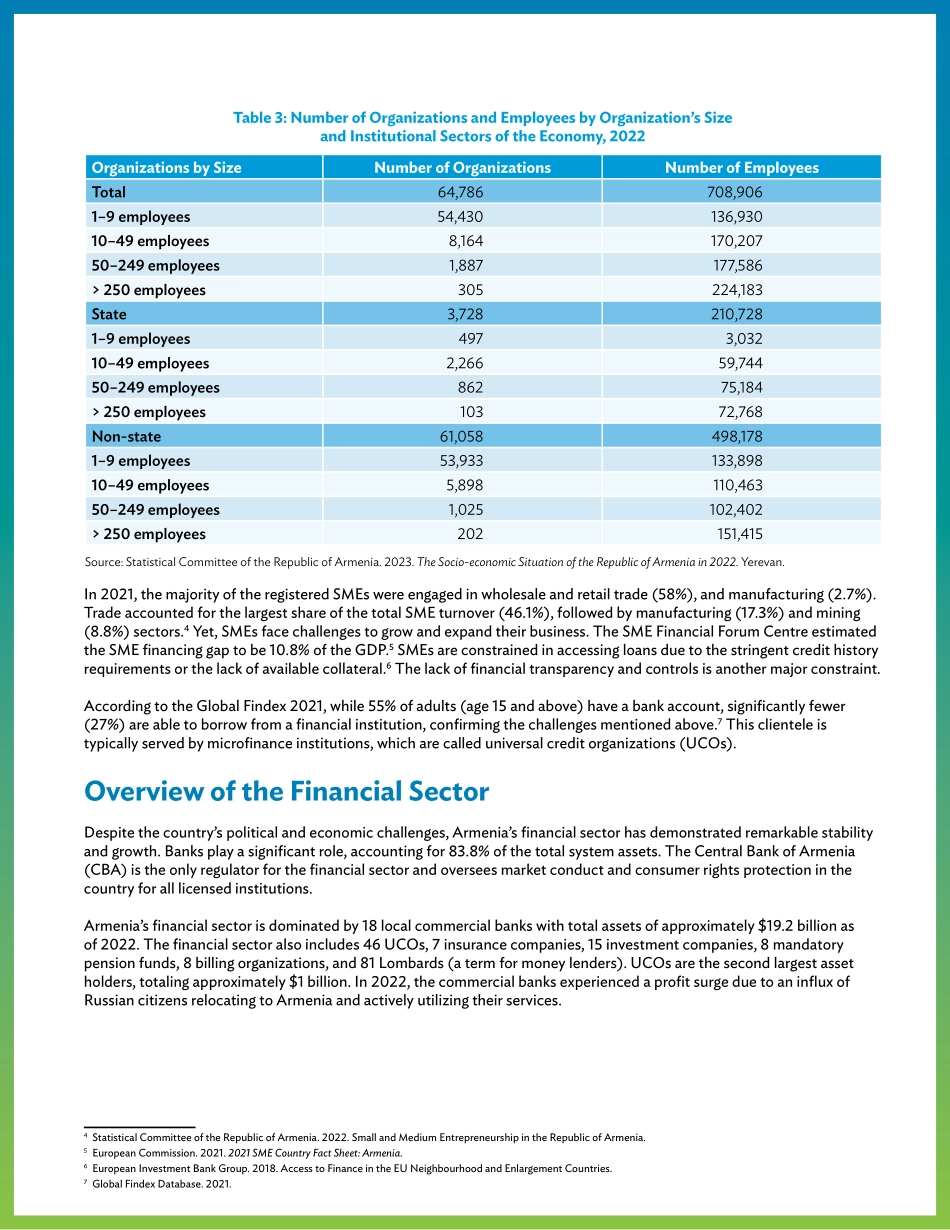

ARMENIA’S MICROFINANCE SECTOR AT A GLANCE Economy Overview. The policies adopted by the Government of Armenia in the last few decades have improved the country’s tax administration, reduced the size of the shadow economy, and decreased the level of public debt. The country’s economy owes its resilience to the recent shocks to careful macroeconomic management, including a stable financial sector, a flexible currency rate, and an active inflation-targeting system.In 2022, the Armenian economy grew by a remarkable 12.6%, despite a difficult external environment. The share of services in gross domestic product (GDP) reached 64.7%. Tourism, finance, and information technology experienced the most substantial growth, while industry accounted for 23.9% and agriculture at 11.4%. The double-digit growth and the Armenian dram’s appreciation of more than 20% against the United States (US) dollar boosted Armenia’s GDP per capita to $6,572. The unemployment rate has been fluctuating largely during the last few years, reaching 12.6% in 2022, which was 0.2 percentage point less compared to the previous year. In the same year, supply-side shocks and rising prices for imported commodities, including oil, drove inflation up to 8.6%. The inflation targeting framework is set at 4% ±1.5 percentage points. However, inflation in Armenia is expected to slow down by the end of 2023 as global inflation stabilizes and domestic and external demand weaken.( ) = negative, AMD = Armenian dram, GDP = gross domestic product, YoY = year-over-year.a Represents the percentage point.b Currency rate: $1 = AMD391.2.Sources: Statistical Committee of the Republic of Armenia, the World Bank, and the Central Bank of Armenia.Indicators Actual (2022) Dynamics (YoY)Population, million 2.98- GDP, current, $ billion19.49 40.6% GDP growth rate, % 12.6 6.9aGDP per capita, current, $ 6,75240.3%Average annual inflation, % 8.61.4aUnemployment rate, % 13(1.5a)Average gross salary,b $ 540.515.4%Public debt, % of GDP 49.3 (14.2a) Banking sector assets, % of GDP 98.7 (2.7a) Table 1: Main Indicators, 2022Credit ratings. Influenced by Armenia’s improving external and fiscal metrics and the reduction in public debt, Fitch Ratings upgraded Armenia’s long-term foreign currency issuer default rating to ‘BB-’ from ‘B+’ in 2023, with a stable outlook.1 Similarly, S&P Global Ratings raised its long-term foreign and local currency sovereign credit ratings on Armenia to ‘BB-’ from ‘B+’ and affirmed its short-term foreign and local currency sovereign credit ratings at ‘B’. The outlook is stable.2 Moody’s has affirmed the ‘Ba3’ local and foreign currency long-term issuer and foreign currency senior unsecured ratings of the Government of Armenia and revised the outlook from negative to stable.COVID-19 response. The coronavirus disease (COVID-19) pandemic had minimal impact on Armenia’s economy as the...