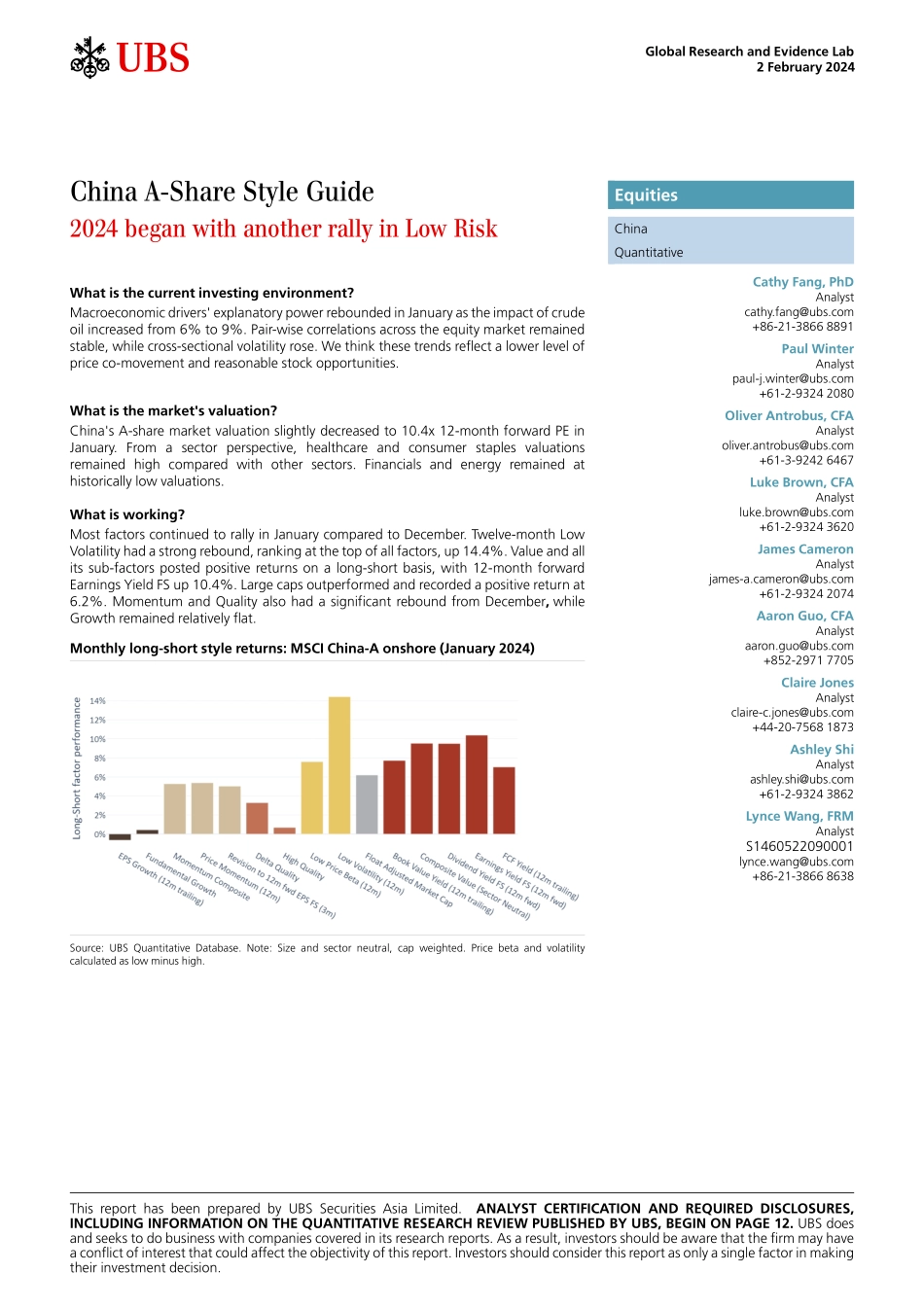

ab2 February 2024Global Research and Evidence LabChina A-Share Style Guide2024 began with another rally in Low RiskWhat is the current investing environment?Macroeconomic drivers' explanatory power rebounded in January as the impact of crude oil increased from 6% to 9%. Pair-wise correlations across the equity market remained stable, while cross-sectional volatility rose. We think these trends reflect a lower level of price co-movement and reasonable stock opportunities.What is the market's valuation?China's A-share market valuation slightly decreased to 10.4x 12-month forward PE in January. From a sector perspective, healthcare and consumer staples valuations remained high compared with other sectors. Financials and energy remained at historically low valuations.What is working?Most factors continued to rally in January compared to December. Twelve-month Low Volatility had a strong rebound, ranking at the top of all factors, up 14.4%. Value and all its sub-factors posted positive returns on a long-short basis, with 12-month forward Earnings Yield FS up 10.4%. Large caps outperformed and recorded a positive return at 6.2%. Momentum and Quality also had a significant rebound from December, while Growth remained relatively flat. Monthly long-short style returns: MSCI China-A onshore (January 2024)Source: UBS Quantitative Database. Note: Size and sector neutral, cap weighted. Price beta and volatility calculated as low minus high.This report has been prepared by UBS Securities Asia Limited. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES, including information on the Quantitative Research Review published by UBS, begin on page 12. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.EquitiesChinaQuantitativeCathy Fang, PhDAnalyst cathy.fang@ubs.com +86-21-3866 8891Paul WinterAnalyst paul-j.winter@ubs.com +61-2-9324 2080Oliver Antrobus, CFAAnalyst oliver.antrobus@ubs.com +61-3-9242 6467Luke Brown, CFAAnalyst luke.brown@ubs.com +61-2-9324 3620James CameronAnalyst james-a.cameron@ubs.com +61-2-9324 2074Aaron Guo, CFAAnalyst aaron.guo@ubs.com +852-2971 7705Claire JonesAnalyst claire-c.jones@ubs.com +44-20-7568 1873Ashley ShiAnalyst ashley.shi@ubs.com +61-2-9324 3862Lynce Wang, FRMAnalystS1460522090001 lynce.wang@ubs.com +86-21-3866 8638 China A-Share Style Guide 2 February 2024ab 2China A-Share Style GuideUBS ResearchMarket overviewWhat is driving the markets?Macroeconomic factors help provide a top-down view of market drivers. We look at a number of globally relevant macroeconomic factors and observe their levels and change in importance over time. We obtain these figures by calculating the contribution to adjusted R-squared from each signal...