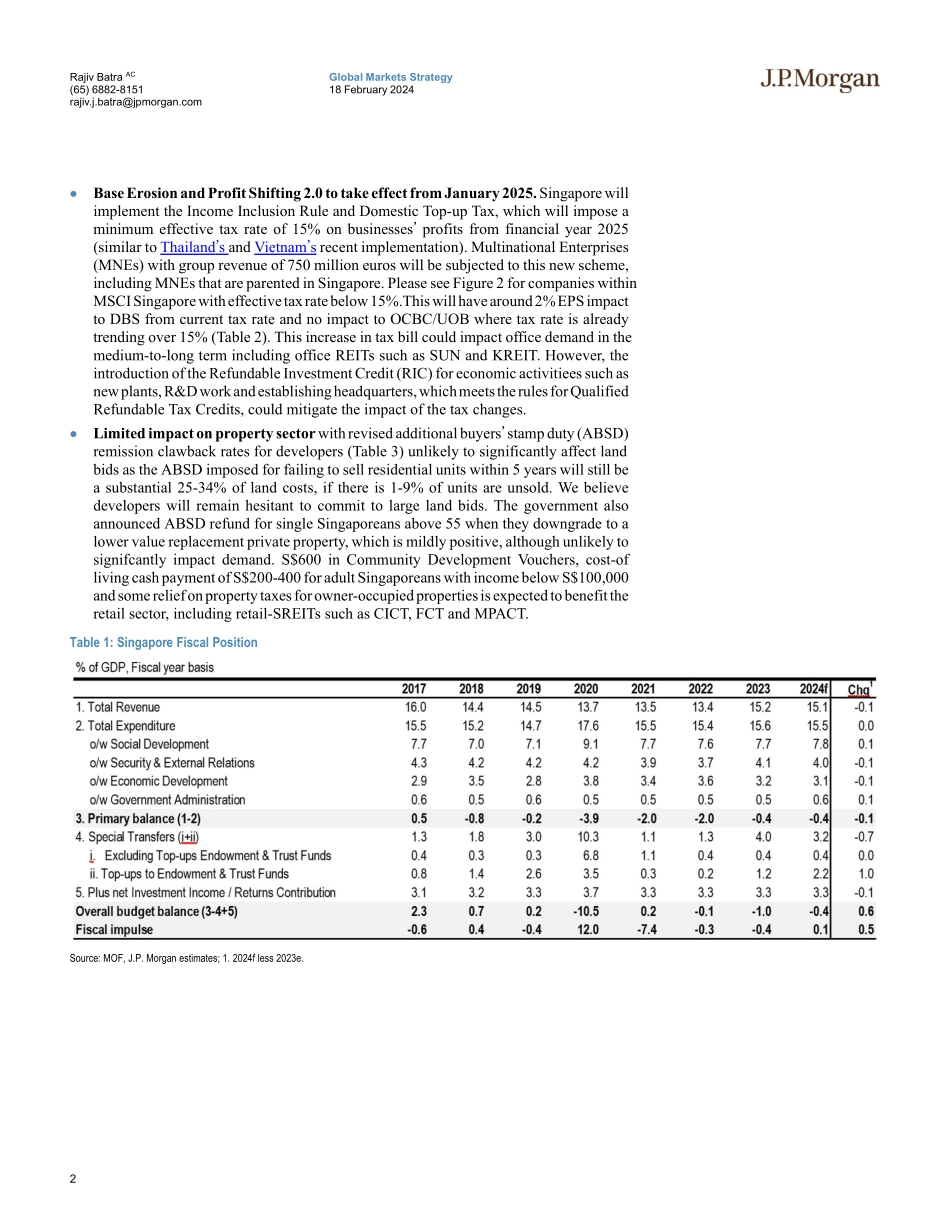

Global Markets Strategy18 February 2024J P M O R G A Nwww.jpmorganmarkets.comEquity Macro ResearchRajiv Batra AC(65) 6882-8151rajiv.j.batra@jpmorgan.comBloomberg JPMA BATRA J.P. Morgan Securities Singapore Private LimitedKhoi Vu, CFA AC(65) 6882-8170khoi.t.vu@jpmorgan.comJ.P. Morgan Securities Singapore Private LimitedSin Beng Ong AC(65) 6882-1623sinbeng.ong@jpmorgan.comJPMorgan Chase Bank, N.A., Singapore BranchMervin Song, CFA AC(65) 6882-7829mervin.song@jpmorgan.comBloomberg JPMA MSONG J.P. Morgan Securities Singapore Private Limited/ J.P. Morgan Securities (Asia Pacific) Limited/ J.P. Morgan Broking (Hong Kong) LimitedTerence M Khi AC(65) 6882-1518terence.ml.khi@jpmorgan.comBloomberg JPMA TKHI J.P. Morgan Securities Singapore Private Limited/ J.P. Morgan Securities (Asia Pacific) Limited/ J.P. Morgan Broking (Hong Kong) LimitedHarsh Wardhan Modi AC(65) 6882-2450harsh.w.modi@jpmorgan.comBloomberg JPMA MODI J.P. Morgan Securities Singapore Private Limited/ J.P. Morgan Securities (Asia Pacific) Limited/ J.P. Morgan Broking (Hong Kong) LimitedDaniel Andrew Tan, CFA AC(63-2) 8554-2413danielandrew.o.tan@jpmorgan.comBloomberg JPMA DTAN J.P. Morgan Securities Philippines, Inc.Ranjan Sharma, CFA AC(65) 6882-1303ranjan.x.sharma@jpmorgan.comBloomberg JPMA RSHARMA J.P. Morgan Securities Singapore Private LimitedThe Singapore government unveiled the 2024 budget on February 16, key highlights: (1) Government�s focus in the near term is mitigating the impact on households� cost of livings by cash transfers and grants, (2) Medium/Long-term investments revolve around upskilling, innovation and productivity growth, with the target to bring Singapore�s GDP growth to the 2-3% range in the next decade, (3) Changes to corporate taxes to take effect from 2025 as Singapore implements the Base Erosion and Profit Shifting 2.0 rules, (4) The changes to additional buyers� stamp duty (ABSD) might have limited impact on the property sector. The overall budget balance is 0.4% GDP deficit in 2024, indicating limited fiscal impulse (JPMe: 0.1% GDP). Near term, consumer, retail S-REITs, tech manufacturing and healthcare stocks will benefit, in our view. Overall FY2024 budget pencils in a budget deficit of 0.4% of GDP and an estimated fiscal impulse of 0.1% of GDP. However, we believe neutral fiscal impulse might not be sufficient to offset slower domestic demand amid an ongoing tech uplift and middling non-tech performance with some reversion to the mean following the outsized 4Q23 manufacturing gain. Consensus estimate MSCI Singapore EPS growth for 2024 at 1.3%. The moderation in index earnings growth is due to a sharp deceleration in earnings growth for the banking sector, which has a large weight in the STI. We reiterate underweight on Singapore equities. That said, we believe opportunities exist in shipbuilders (YZJSGD), industrials (STE), tech manufacturing (AEM) and selective REITs (MPACT,...