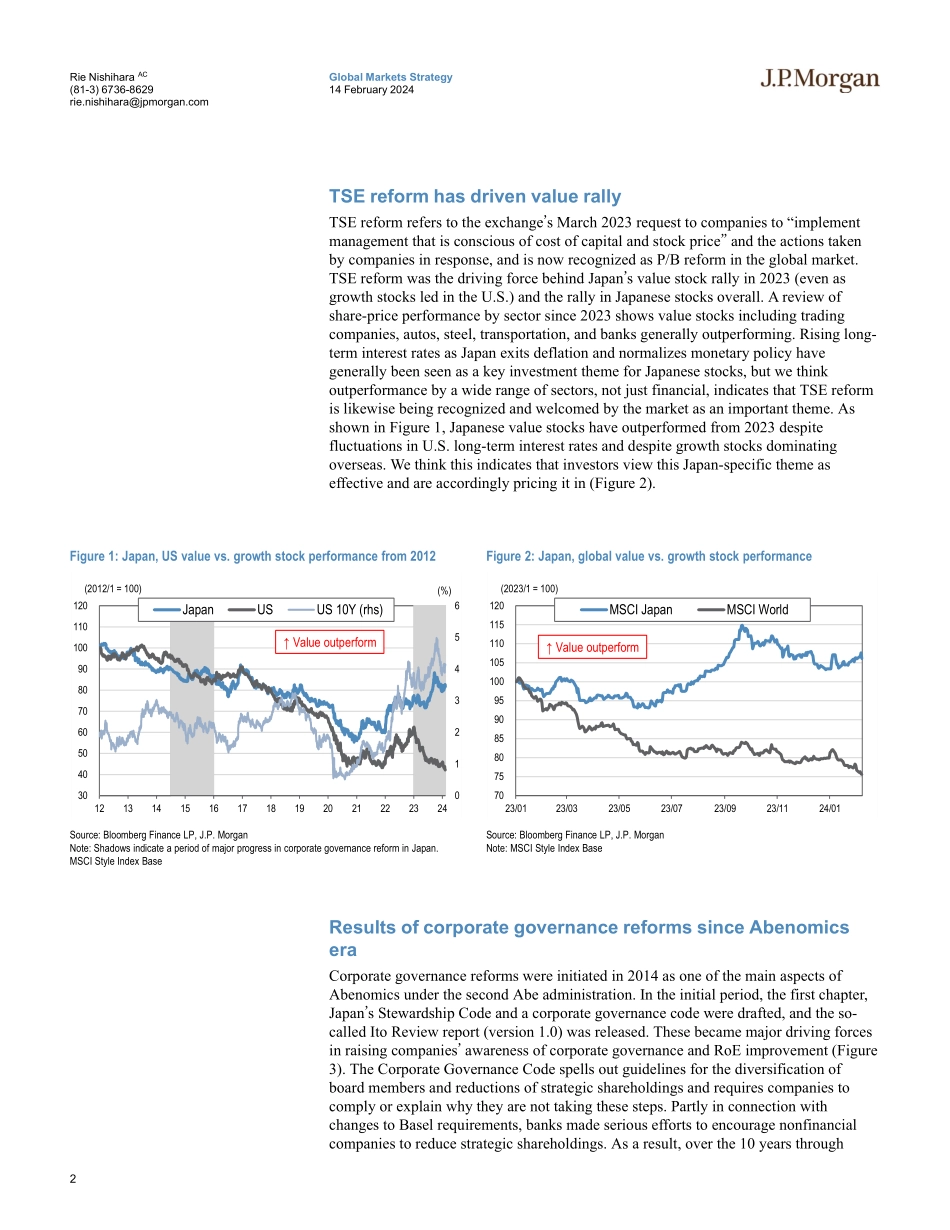

Global Markets Strategy14 February 2024J P M O R G A Nwww.jpmorganmarkets.comEquity StrategyRie Nishihara AC(81-3) 6736-8629rie.nishihara@jpmorgan.comBloomberg JPMA NISHIHARA JPMorgan Securities Japan Co., Ltd.Yong Guo, CFA(81-3) 6736-8623yong.guo@jpmorgan.comJPMorgan Securities Japan Co., Ltd.Mansi Das(91) 2261 573343mansi.das@jpmchase.comJ.P. Morgan India Private LimitedMislav Matejka, CFA(44-20) 7134-9741mislav.matejka@jpmorgan.comJ.P. Morgan Securities plcDubravko Lakos-Bujas(1-212) 622-3601dubravko.lakos-bujas@jpmorgan.comJ.P. Morgan Securities LLCMarko Kolanovic, PhD(1-212) 622-3677marko.kolanovic@jpmorgan.comJ.P. Morgan Securities LLCJapan, US value vs. growth stock performance01234563040506070809010011012012131415161718192021222324(%)(2012/1 = 100)JapanUSUS 10Y (rhs)↑ Value outperformSource: Bloomberg Finance LP, J.P. MorganNote: Shadows indicate a period of major progress in corporate governance reform in Japan. MSCI Style Index BaseTSE-led corporate governance reform efforts continue to gain momentum. On Feb 1, the TSE released best practices to date in corporate disclosures regarding management with awareness of the cost of capital and stock price. This follows the release of a list of companies disclosing actions in response to TSE initiatives and should lead to further corporate moves and a market pickup by encouraging companies to enhance dialogue and engagement with market participants. TSE-led reform represents the second chapter of corporate governance reform that began as part of Abenomics and has been a driver of the rally in Japanese stocks in general and value stocks in particular since 2023. This note provides an overview of TSE reforms and their history, a review of corporate governance reforms to date, and investment ideas based on these reforms. Near-term, we expect a focus on companies which have yet to disclose initiatives around TSE reform and are therefore likely to do so, but think high capital efficiency will impact longer-term performance.•The TSE published a list of companies with best practices on Feb 1, allowing investors and companies to engage in dialogue more effectively than before. It plans to update the list every six months, and we hope this will improve the quality of companies� initiatives.•TSE reform drove Japan�s value stock rally in 2023 (even as growth stocks led in the U.S.) and thus the rally in Japanese stocks overall. It is not a stand-alone initiative, but part of a series of corporate governance reforms underway since Abenomics. Following an initial phase including the introduction of the Corporate Governance Code in 2015, corporate reforms can be seen as being in a second chapter, with TSE reforms symbolizing this phase. •Corporate governance reforms were the most successful area of reforms launched during Abenomics, and over the past decade, there has been significant progress. The amount of share buybacks announce...