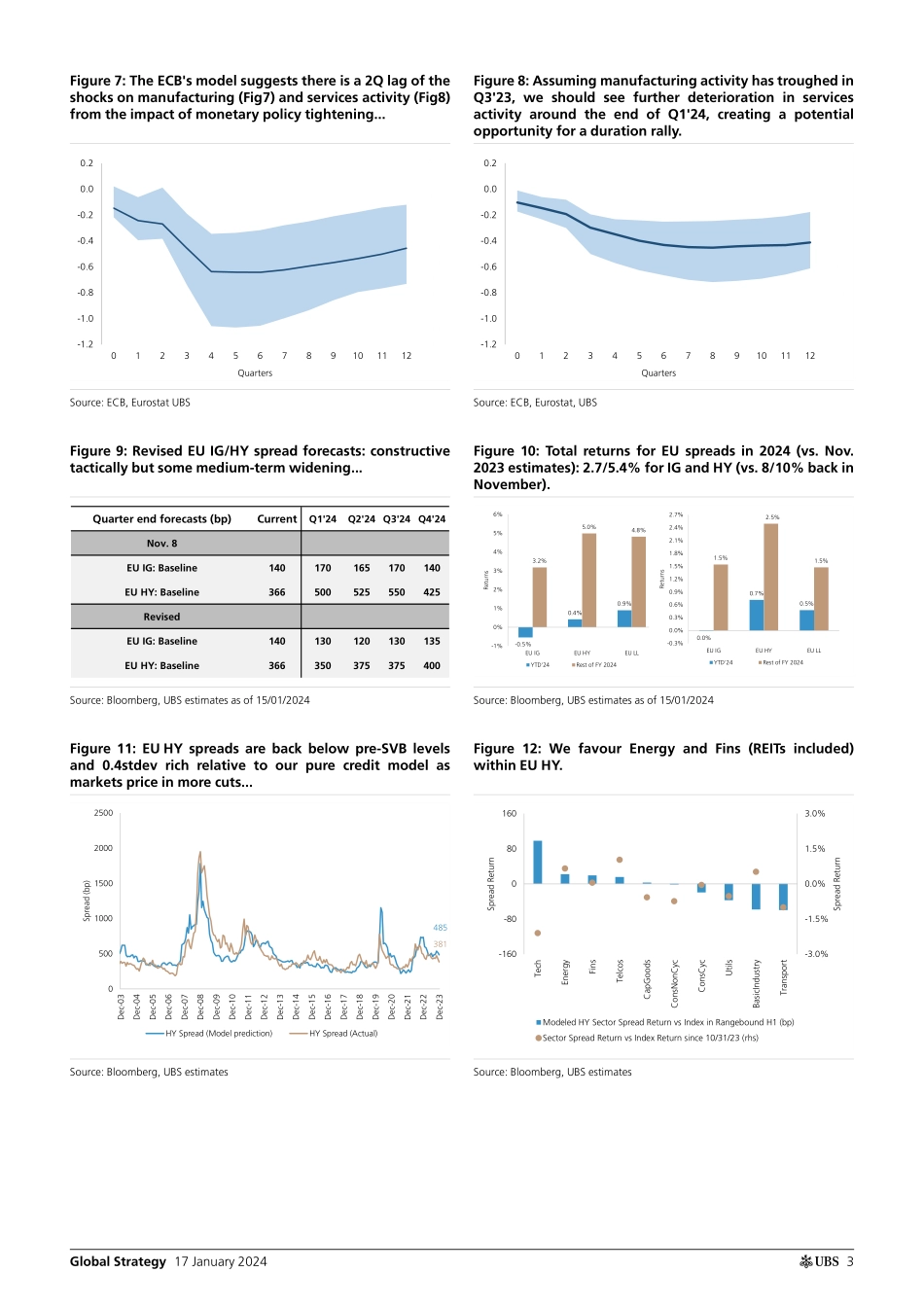

ab17 January 2024Global Research and Evidence LabGlobal StrategyH1'24 European Credit Outlook: What to expect after the rates rallyThe biggest surprise in 2023 was that the economy emerged unscathed from one of the most rapid hiking cycles in history. As the disinflation trend continued, investors quickly accepted the idea of early and aggressive cuts in 2024, triggering a significant rally in the rates market. In this note, we mark to market our EU Credit Outlook post-rally and highlight the key themes to start 2024 as well as revised forecasts:1. Strong technical tailwind in December: we expect this backdrop to persist tactically.In December, EU IG/HY delivered one of their best monthly performances of the past few years, at 2.73%/2.91% respectively, on the back of a very strong technical backdrop. When we look at credit flows, we can see the same pattern we witnessed at the end of 2022: In IG, ETFs flows emphasized the tightening, while MFs flows remain mixed as recently built cash balances were patiently waiting to be deployed in the heavy primary supply of January (€56.9bn YTD). In HY, the liquidity backdrop coupled with a lack of issuance (€3.8bn YTD) pushed spreads even tighter as MFs keep buying on secondary.2. As the disinflation trend seems to be well anchored, will we experience another duration rally? Given the sharp rates rally, the duration of the asset class has been a particularly strong tailwind for TR and spreads are now at median levels in Europe at 140/366bp (first quartile levels in the US). As a significant amount of rate cuts have already been priced in for 2024, we need to see a material growth deterioration to price in additional cuts. According to the recent ECB Economic Bulletin, and assuming manufacturing activity has troughed in Q3'23, we should see further deterioration in services activity around the end of Q1'24, creating a potential opportunity for a duration rally.3. Tactically constructive but medium-term widening to be expected.Despite tighter financial conditions, the economy remained resilient, in part due to accumulated consumer savings and fiscal stimulus from governments. We think the easing in financial conditions coupled with strong technicals will support the asset class in H1'24. In H2, we expect the weaker growth backdrop to slowly become a headwind for the asset class. We revise our 2024 forecasts (IG/HY at 120/375bp June-24 - cf. Figure 9) and now expect much lower performance given the recent material gains: IG/HY TR at 2.7/5.4%, ER at 1.5/3.2% (vs. 8/10% and 3/5% in November, respectively).4. Dispersion to create value opportunities within EU HY.Despite our new forecast for EU HY default rate sitting lower than in November, at 2.5%, we still believe it is not a time to buy the entire market: as of today, EU HY spreads trade 0.4stdev rich relative to our credit mod...