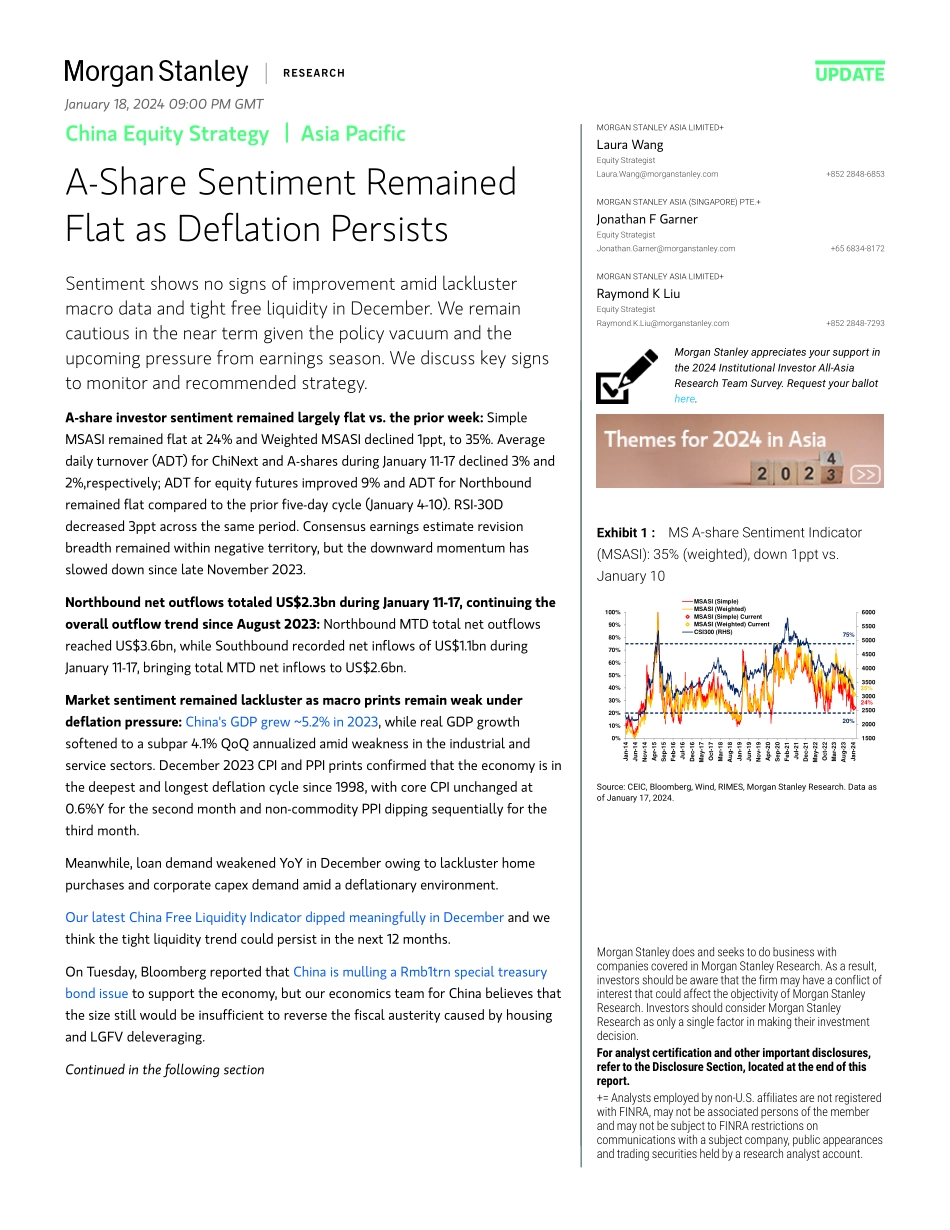

M UpdateChina Equity Strategy | Asia PacificA-Share Sentiment Remained Flat as Deflation PersistsMorgan Stanley Asia Limited+Laura WangEquity Strategist Laura.Wang@morganstanley.com +852 2848-6853 Morgan Stanley Asia (Singapore) Pte.+Jonathan F GarnerEquity Strategist Jonathan.Garner@morganstanley.com +65 6834-8172 Morgan Stanley Asia Limited+Raymond K LiuEquity Strategist Raymond.K.Liu@morganstanley.com +852 2848-7293 Morgan Stanley appreciates your support in the 2024 Institutional Investor All-Asia Research Team Survey. Request your ballot here. Exhibit 1 : MS A-share Sentiment Indicator (MSASI): 35% (weighted), down 1ppt vs. January 1015002000250030003500400045005000550060000%10%20%30%40%50%60%70%80%90%100%Jan-14Jun-14Nov-14Apr-15Sep-15Feb-16Jul-16Dec-16May-17Oct-17Mar-18Aug-18Jan-19Jun-19Nov-19Apr-20Sep-20Feb-21Jul-21Dec-21May-22Oct-22Mar-23Aug-23Jan-24MSASI (Simple)MSASI (Weighted)MSASI (Simple) CurrentMSASI (Weighted) CurrentCSI300 (RHS)75%20%=35%24% Source: CEIC, Bloomberg, Wind, RIMES, Morgan Stanley Research. Data as of January 17, 2024.Sentiment shows no signs of improvement amid lackluster macro data and tight free liquidity in December. We remain cautious in the near term given the policy vacuum and the upcoming pressure from earnings season. We discuss key signs to monitor and recommended strategy. A-share investor sentiment remained largely flat vs. the prior week: Simple MSASI remained flat at 24% and Weighted MSASI declined 1ppt, to 35%. Average daily turnover (ADT) for ChiNext and A-shares during January 11-17 declined 3% and 2%,respectively; ADT for equity futures improved 9% and ADT for Northbound remained flat compared to the prior five-day cycle (January 4-10). RSI-30D decreased 3ppt across the same period. Consensus earnings estimate revision breadth remained within negative territory, but the downward momentum has slowed down since late November 2023. Northbound net outflows totaled US$2.3bn during January 11-17, continuing the overall outflow trend since August 2023: Northbound MTD total net outflows reached US$3.6bn, while Southbound recorded net inflows of US$1.1bn during January 11-17, bringing total MTD net inflows to US$2.6bn.Market sentiment remained lackluster as macro prints remain weak under deflation pressure: China's GDP grew ~5.2% in 2023, while real GDP growth softened to a subpar 4.1% QoQ annualized amid weakness in the industrial and service sectors. December 2023 CPI and PPI prints confirmed that the economy is in the deepest and longest deflation cycle since 1998, with core CPI unchanged at 0.6%Y for the second month and non-commodity PPI dipping sequentially for the third month. Meanwhile, loan demand weakened YoY in December owing to lackluster home purchases and corporate capex demand amid a deflationary environment. Our latest China Free Liquidity Indicator dipped meaningfully in December and we think the tight liquidity trend could persist in the next...