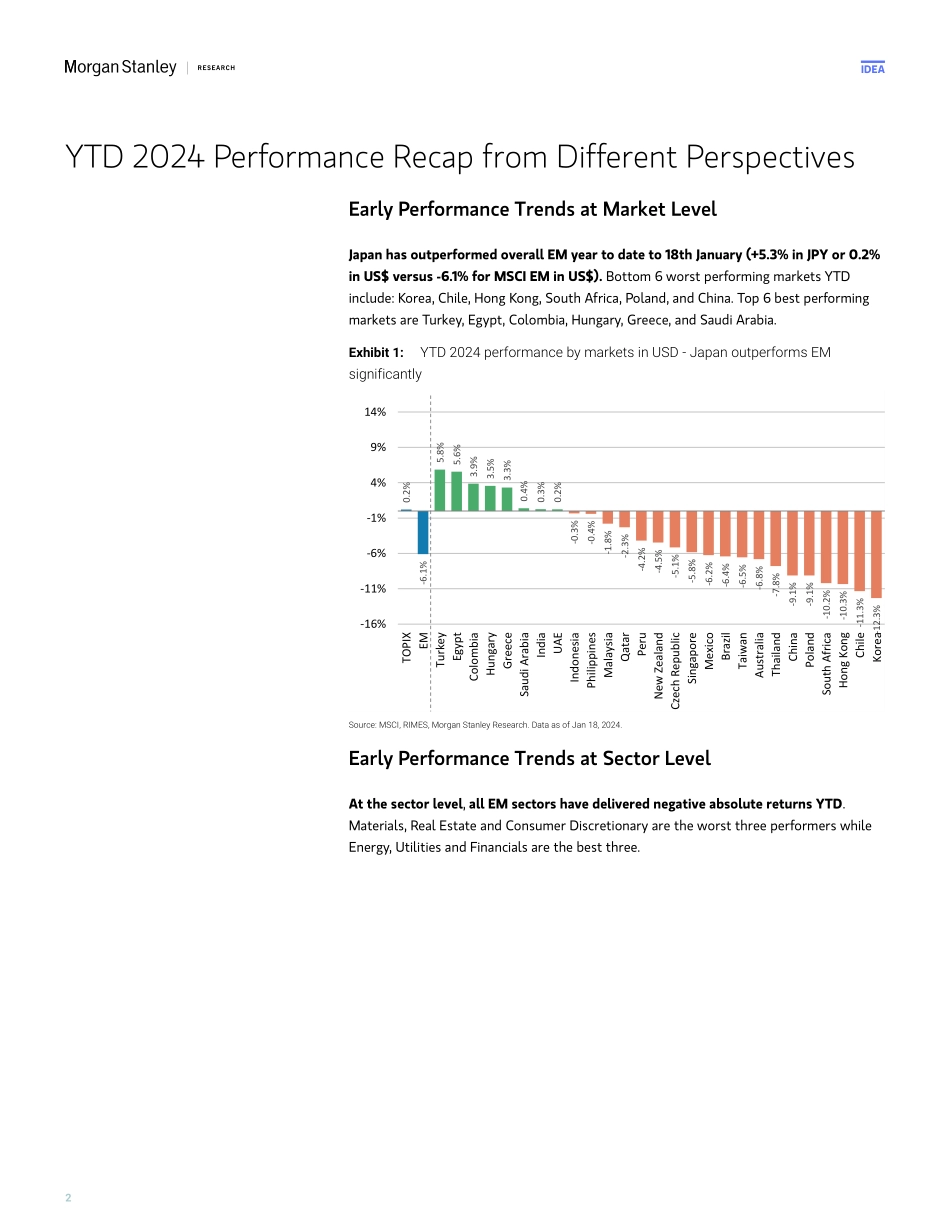

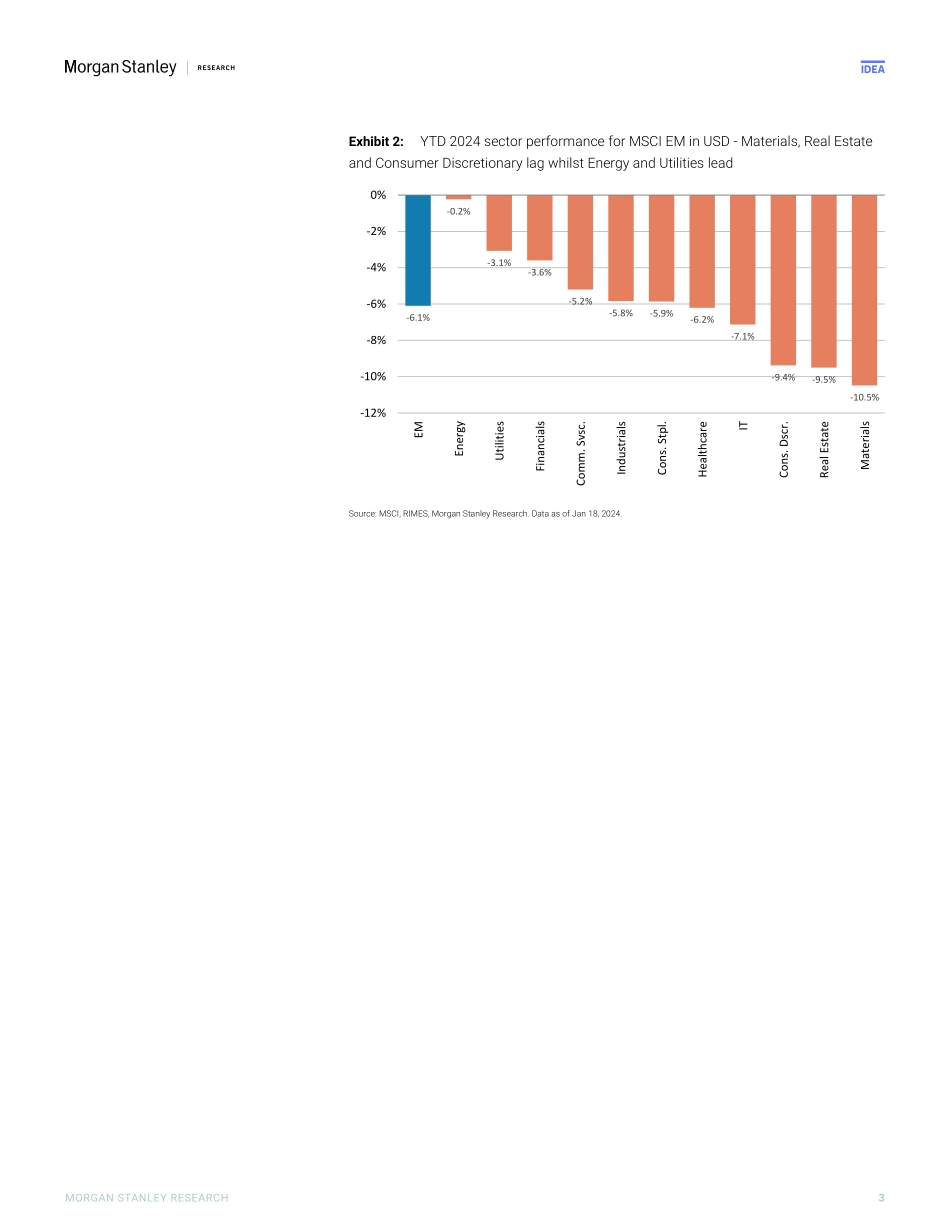

M IdeaAsia EM Equity Strategy | Asia PacificEarly year trends - Japan is outperformingJapan has continued its bull run at the start of 2024, while EM and China are lagging meaningfully. At the stock level in EM, outperformers are clustered in India and Saudi Arabia whilst within the Japan market, Industrials have been outperforming IT early on. Morgan Stanley Asia (Singapore) Pte.+Jonathan F GarnerEquity Strategist Jonathan.Garner@morganstanley.com +65 6834-8172 Morgan Stanley Asia Limited+Jason Ng, CFAQuantitative Strategist Jason.Dl.Ng@morganstanley.com +852 2848-8845 Morgan Stanley Asia (Singapore) Pte.+Daniel K BlakeEquity Strategist Daniel.Blake@morganstanley.com +65 6834-6597 Kristal JiEquity Strategist Kristal.Ji@morganstanley.com +65 6834-6949 Morgan Stanley Asia Limited+Gilbert Wong, CFAQuantitative Strategist Gilbert.Wong@morganstanley.com +852 2848-7102 Morgan Stanley appreciates your support in the 2024 Institutional Investor All-Asia Research Team Survey. Request your ballot here. Japan has made a strong start to 2024 with TOPIX gaining +5.3% YTD (in JPY terms or +0.2% in US$) as of 18th January. Strong nominal GDP growth and positive earnings revisions as well as a structural trend to rising ROE have been driving the outperformance versus RoW - see our recent major note on Japan - Japan Secular Bull Market Arrives: Here is How to Play It. Japan remains a key OW market at the global equity level with a TOPIX base-case target price of 2600 (+4% upside) and a rising likelihood of our bull case of 2800 (+12% upside) coming into play as fund re-allocations to Japan have been high year to date driving multiple expansion. For Japan at the sector level, all 17 Topix-17 sectors have posted positive returns YTD in local currency terms. The top 3 sectors include: Automobiles & Transportation Equipment, Commercial & Wholesale Trade and Energy Resources. The bottom three performing sectors are Raw Materials & Chemicals, Electric Appliances & Precision Instruments and Steel & Nonferrous Metals.MSCI EM, on the other hand, has remained weak at the index level with YTD performance of -6.1%, following subdued absolute and relative performance in 2023. Within EM markets, the top three performers are Turkey, Egypt, Colombia; in contrast, Korea, Chile, Hong Kong were the bottom three performing markets. Within EM sectors, all sectors have delivered negative absolute returns YTD. Materials, Real Estate and Consumer Discretionary are the worst three performers while Energy, Utilities and Financials are the best three.We reiterate our style call on o/w Quality and neutral between Value and Growth in EM. Our empirical study suggests marginal performance difference between Value/Growth and outperformance in Quality under a soft landing scenario. We also summarize the latest YTD 2024 factor performance. Please refer to our latest Biweekly Perspectives: Fed Pivot Pl...