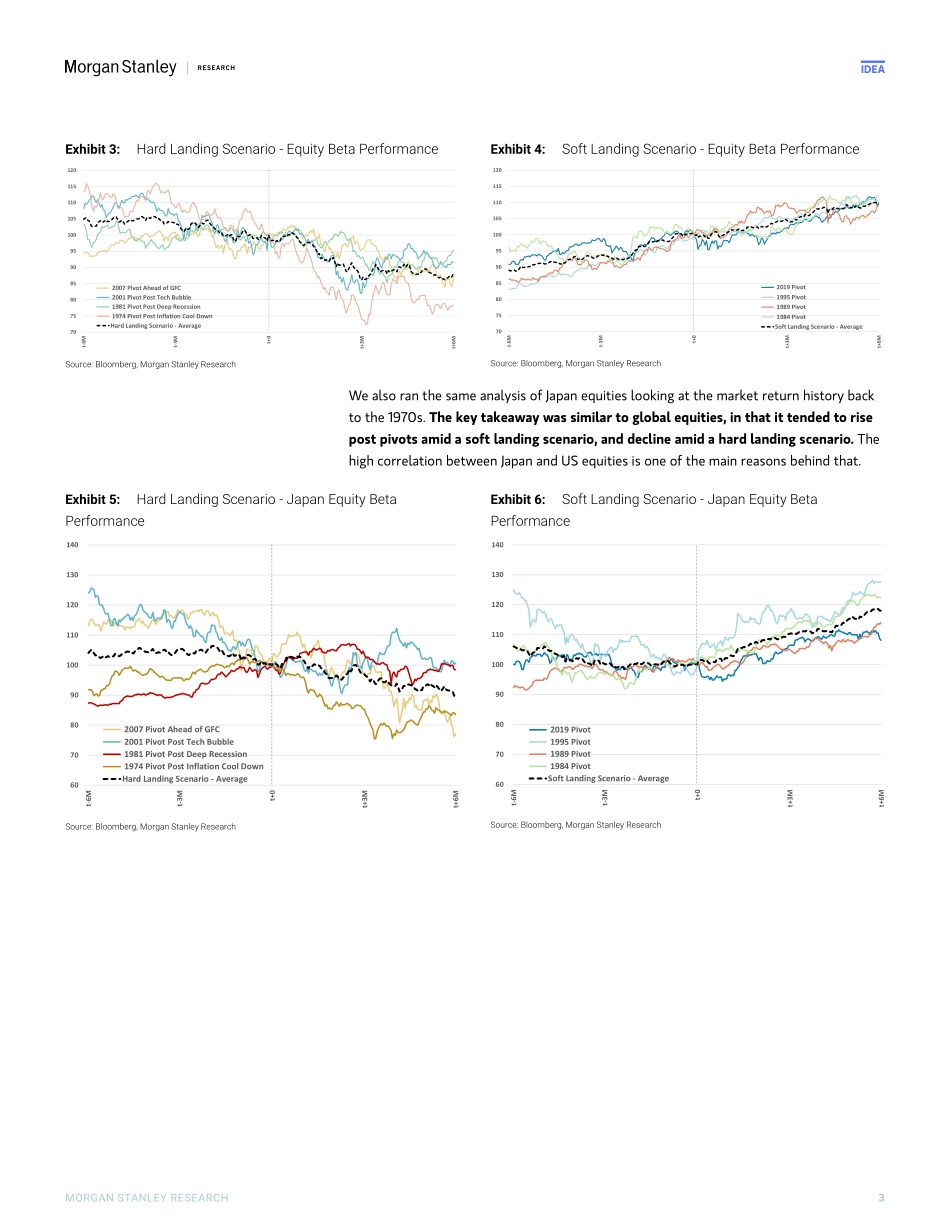

M IdeaAsia Quantitative Strategy | Asia PacificBiweekly Perspectives: Fed Pivot Playbook For Asia/EM Equities In 2024The market is pricing in a front-loaded and steep Fed pivot in 2024, but its timing and pace are unclear amid sticky service inflation. Here we study market performance around the eight Fed pivots since the 1970s to help investors navigate trading patterns. M Morgan Stanley Asia Limited+Gilbert Wong, CFAQuantitative Strategist Gilbert.Wong@morganstanley.com +852 2848-7102 Jason Ng, CFAQuantitative Strategist Jason.Dl.Ng@morganstanley.com +852 2848-8845 Morgan Stanley Asia (Singapore) Pte.+Jonathan F GarnerEquity Strategist Jonathan.Garner@morganstanley.com +65 6834-8172 Daniel K BlakeEquity Strategist Daniel.Blake@morganstanley.com +65 6834-6597 Morgan Stanley Asia Limited+Crystal NgEquity Strategist Crystal.Ng@morganstanley.com +852 2239-1468 Morgan Stanley appreciates your support in the 2024 Institutional Investor All-Asia Research Team Survey. Request your ballot here. Exhibit 1 : Market Performance Around Historical Fed Pivots -6M-3M-1M+1M+3M+6M-6M-3M-1M+1M+3M+6MGlobal Equity Beta-4.6%-3.7%0.3%-2.1%-13.9%-11.8%12.3%6.7%1.6%0.3%4.5%10.4%APxJ/EM Equity Beta-7.5%-4.4%6.8%13.9%-2.1%-4.1%11.6%9.9%-0.3%-6.0%-2.9%2.2%Japan Beta-3.9%-5.1%-1.5%1.6%-3.1%-10.1%-5.7%-0.2%-1.2%2.3%10.3%18.0%Value vs. Growth15.6%5.8%4.1%4.6%19.8%15.4%0.6%0.9%1.2%-2.4%0.7%-2.8%Quality3.8%3.9%0.7%-1.0%1.6%0.5%4.1%2.0%0.5%0.9%2.3%3.8%Momentum-6.3%-0.1%4.6%0.5%7.7%5.3%4.2%3.9%2.3%2.5%1.5%2.3%Small Cap-0.5%-2.0%-0.1%3.5%0.9%-4.0%-10.7%-6.1%-2.0%-2.2%-6.0%-9.1%UST 10Y Yield-48bps-67bps-24bps4bps-30bps-38bps-78bps-91bps-26bps-31bps-28bps-54bpsDXY-1.0%-3.8%-3.2%-0.6%1.1%-0.7%1.8%2.4%1.6%-0.8%0.9%-0.7%USDJPY2.1%-1.2%1.8%1.2%4.0%-2.2%-1.5%2.4%2.1%1.1%7.0%8.3%Hard Landing ScenarioSoft Landing ScenarioMarketStyleRates & FX Source: Bloomberg, Morgan Stanley Research; notes: the table covers the simple average of market performance in the 8 Fed Pivots since 1970s, namely July 1974, June 1981, October 1984, June 1989, July 1995, January 2001, September 2007, July 2019. Details could be found in section - Fed Pivots Playbook - A Study Back to the 1970s .Our Fed Pivot Playbook: We identify eight Fed pivot scenarios since the 1970s and conduct a detailed study of market and style performance vs. the corresponding macro environment. We found that: (i) UST 10Y yield showed a consistent downward trend prior to previous Fed pivots, with an average decline of 80bps; (ii) If the Fed initiates a pivot when the policy rate is >5%, rotation from Value to Growth is likely to occur at a later stage, (iii) Historically, Quality and Large Cap stocks performed the best with high consistency before and after Fed pivots. Latest Market Dynamics & Our Thoughts: There appears to be a disconnect between equity and fixed income markets now - with rates and FX traders expecting six Fed rate cuts in 2024, with outstanding short positions in the US dollar the largest since 2020. These ...