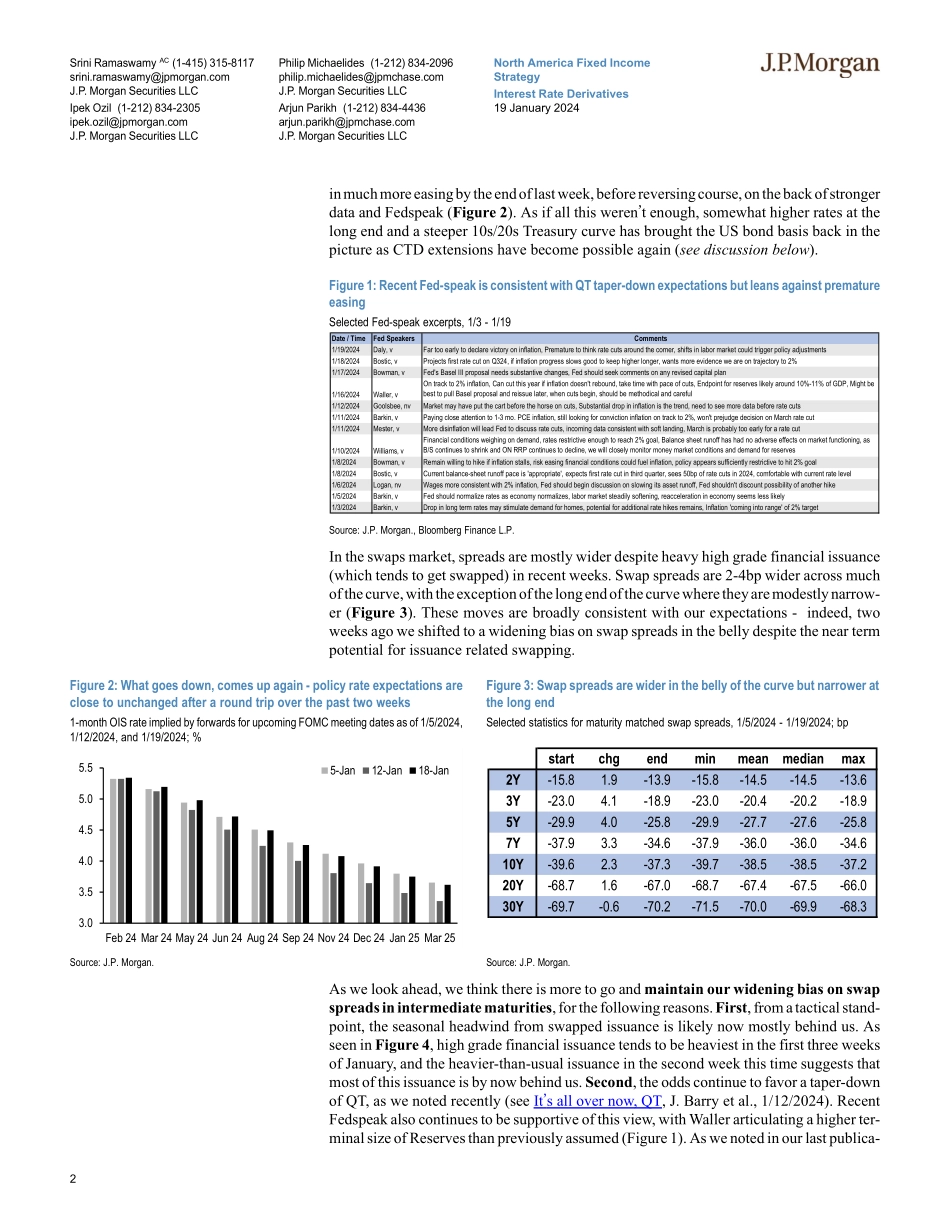

1Srini Ramaswamy AC (1-415) 315-8117srini.ramaswamy@jpmorgan.comJ.P. Morgan Securities LLCIpek Ozil (1-212) 834-2305ipek.ozil@jpmorgan.comJ.P. Morgan Securities LLCPhilip Michaelides (1-212) 834-2096philip.michaelides@jpmchase.comJ.P. Morgan Securities LLCArjun Parikh (1-212) 834-4436arjun.parikh@jpmchase.comJ.P. Morgan Securities LLCNorth America Fixed Income Strategy19 January 2024J P M O R G A N•Maintain swap spread wideners in intermediate maturities. QT taper expectations, a rise in SOFR towards IOR, strong AOCI gains for banks, emerging Fedspeak that appears to lower the odds of near-term Basel III endgame implementation, as well as valuations remain favorable. We recommend asset swapping original issue 10s that are on the verge of falling under the 5Y maturity window … •… pay in 2.625% Feb �29 maturity matched swap spreads. A variation on this theme is to pair such spread wideners with a long volatility position in 2Yx2Y swaption straddles, to hedge against the risk from rising implieds •On the swap yield curve, carry and slide remain the name of the game as the Fed contin-ues to lean against expectations of premature easing and forwards appear likely to “roll up� with the passage of time … •… initiate 1Yx2Y / 3Mx30Y swap curve steepeners paired with 65% risk in Reds / 10Yx5Y flatteners, and/or receive fixed in the belly of a 6M forward 2s/7s/30s swap butterfly (40:69 weighted), to earn attractive carry relative to risk •The bond basis once again in the limelight, thanks to somewhat higher long end yields and a steeper 10s/20s curve. Thus far the USH4 contract has seen no CTD shifts, but numerous near-CTD issues exist and the CTD could indeed shift to the 4.75% Feb �41 in a modest selloff. However, given a net basis that is only slightly wider than the current CTD (the 4.5% Aug �39), the impact on USH4 pricing would likely be modest. That said, more material CTD shifts are certainly a possibility if yields rise by larger amounts or if the curve continues to steepen. Investors concerned about CTD extension can mitigate this risk by buying March USH4 118 puts •Maintain a long volatility bias - recent declines have been undoubtedly painful, but ele-vated policy uncertainty, lower market depth, and a decoupling from fair value all point to higher implieds going forward •Overweight gamma on 2Y tails versus 5Y tails as an attractive core position going into eventual Fed easing, that is additionally supported by relative value considerations •Overweight 2Yx2Y swaption volatility versus 5Yx5Y as a way to benefit from relative value mispricings while also positioning for a rise in the expiry curve towards fair value •Bank earnings revealed strong AOCI gains across banks, handily exceeding our projec-tions and suggesting that we had erred in overestimating the extent to which banks de-risked securities portfolios after ...