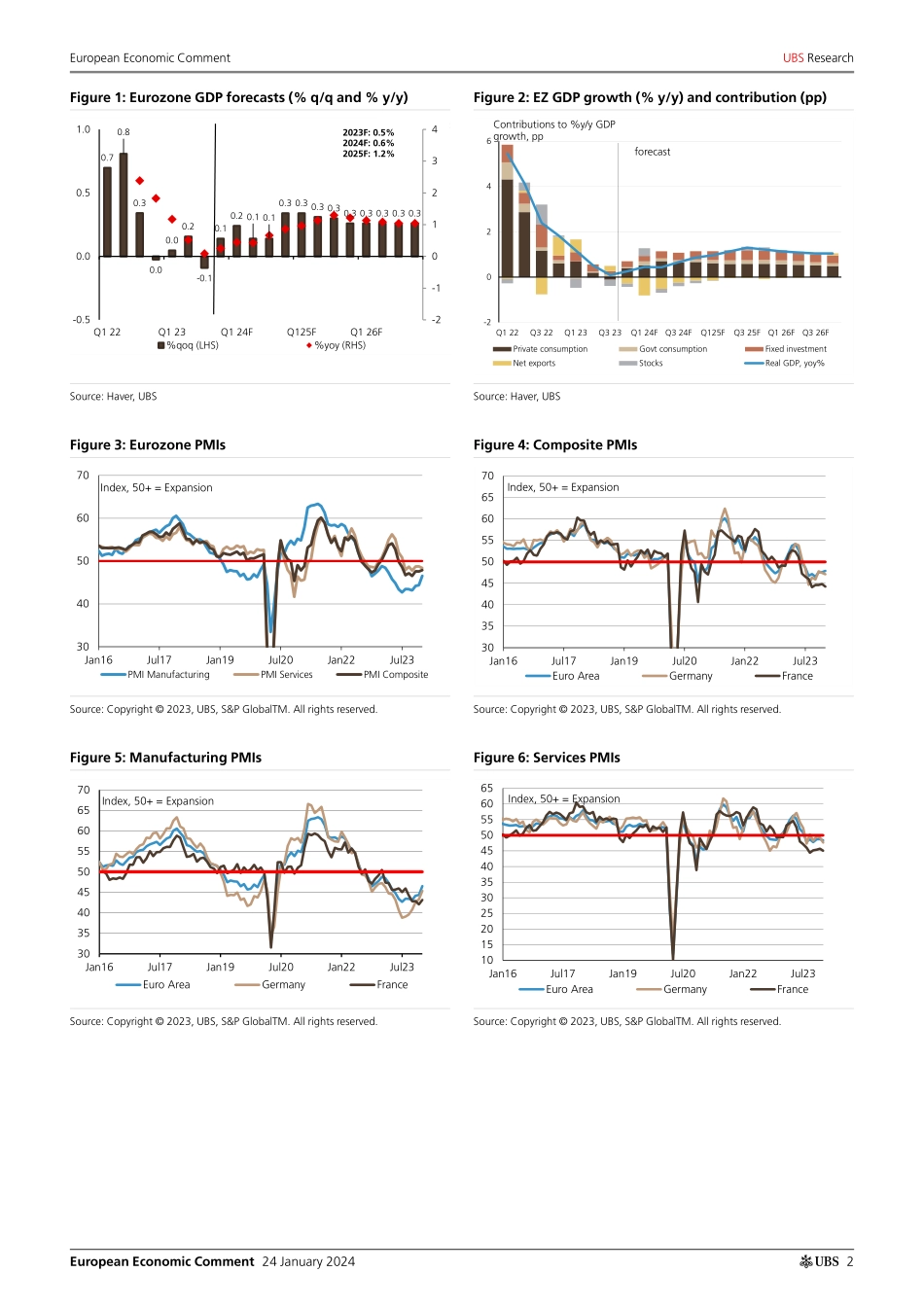

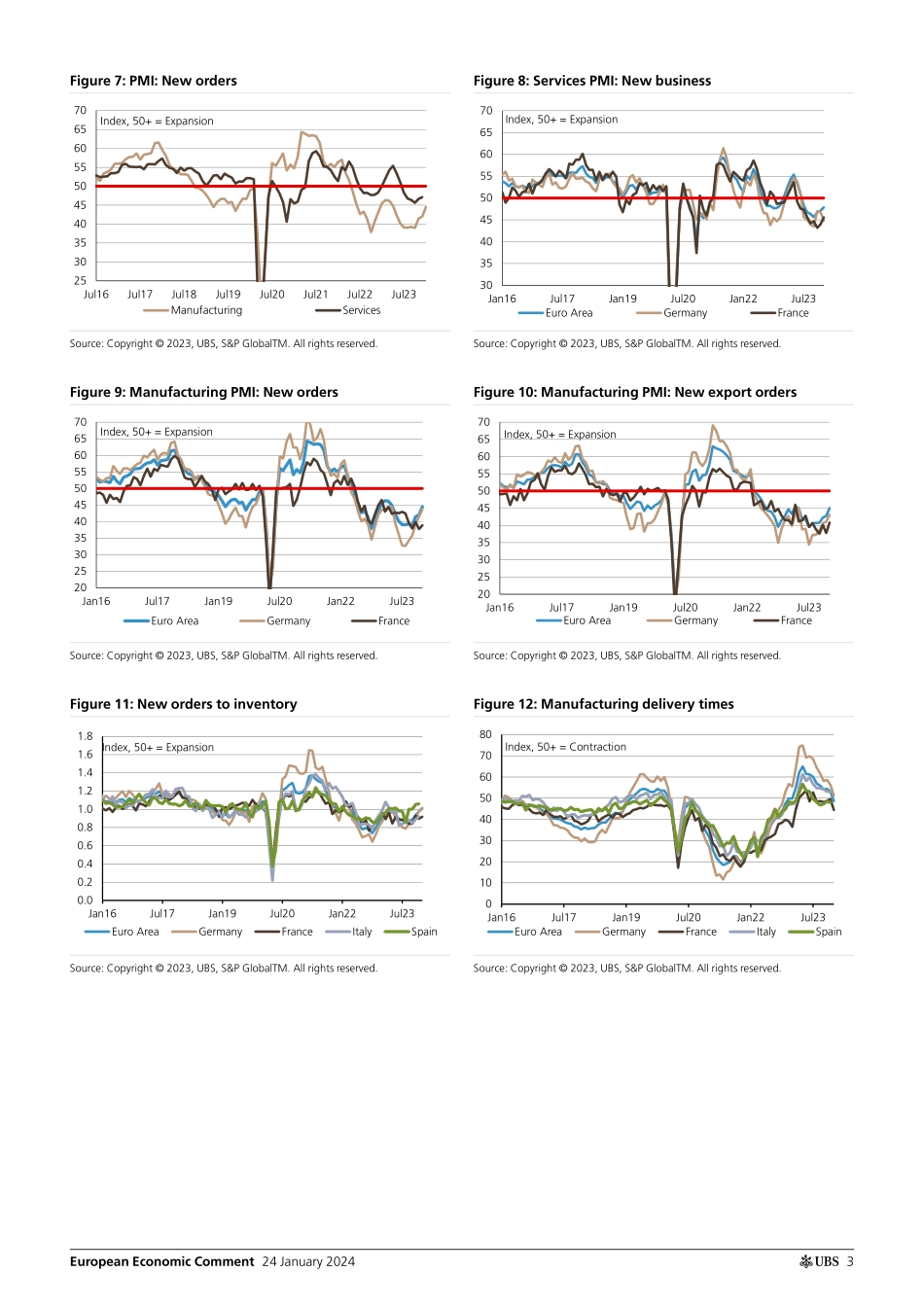

ab24 January 2024Global Research and Evidence LabEuropean Economic CommentEuropean PMIs: Rays of lightEurozone PMI up, despite declines in Germany and France The January PMIs (survey period 11-22 January) paint a somewhat complex and diverse picture: The German and French Composite PMIs declined, but the Eurozone Composite PMI rose by 0.3 points to a six-month high of 47.9, thanks to sentiment in the rest of the Eurozone recovering above the neutral level of 50 for the first time in five months. Specifically, the Eurozone Manufacturing PMI rose 2.2 points a 10-month high of 46.6 while the Services PMI fell 0.4 points to a 3-month low of 48.4. While the overall Eurozone PMI thus signals ongoing contraction at the beginning of 2024, across both services and manufacturing, improvements were visible in manufacturing output, new orders, employment and the 1-year business outlook. We would caution that around 31.5% of the improvement in the Manufacturing PMIs was due to longer supplier delivery times caused by the trade disruptions in the Red Sea. Longer delivery times are usually a sign of stronger economic activity and hence boost the PMI; in the current context, though, a positive interpretation is not justified, of course. Price pressures rose again, with aggregate input prices up 1 point to 57.5 and output prices up 0.4 points to 54.2. Overall, while we draw encouragement from some of the details of today's PMIs, we cannot gloss over the implication that economic contraction continued in the early part of Q1-24. Eurozone GDP growth was negative in Q3-23, and we have warned that Q4-23 might be negative as well, which would imply technical recession. All combined, we see downside risk to our Eurozone GDP forecast of 0.6% in 2024 (after an expected 0.5% in 2023).Country detail: Weaker services drag down composite in Germany and FranceThe German Composite PMI fell 0.3 points to 47.1 in January, weaker than consensus (47.8) and just above the Q4 average of 47.0. The decline was driven by the 1.7 points decline in the Services PMI (to 47.6, the lowest since August 2023). While the Manufacturing PMI rose 2.1 points to 45.4, around 40% of the improvement was driven by longer supplier delivery times amid the disruptions in the Red Sea. The employment component in the Composite PMI was up 0.5 points to 48.6, but the new orders subcomponent was down 0.5 points to 44.9, driven by further declines in services. The French Composite PMI fell 0.6 points to 44.2 in January, against consensus expectations of an increase (to 45.1). The decline was driven by a fall in the Services PMI (-0.7 points to 45.0; consensus: 46.0) more than offsetting the increase in the Manufacturing PMI (+1.1 points to 43.2; consensus: 42.5). However, around 70% of the improvement was driven by longer suppliers delivery times. The January Composite PMI ...