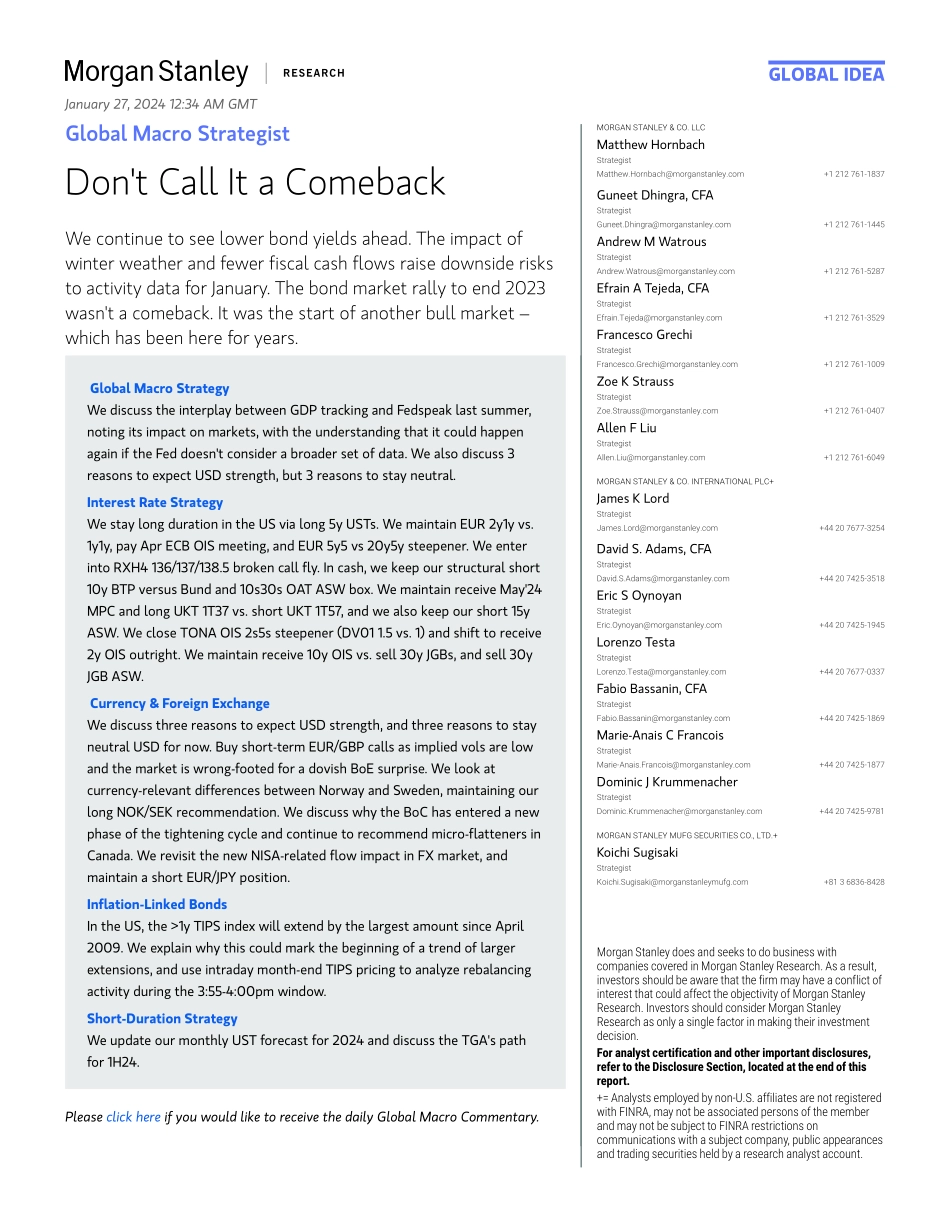

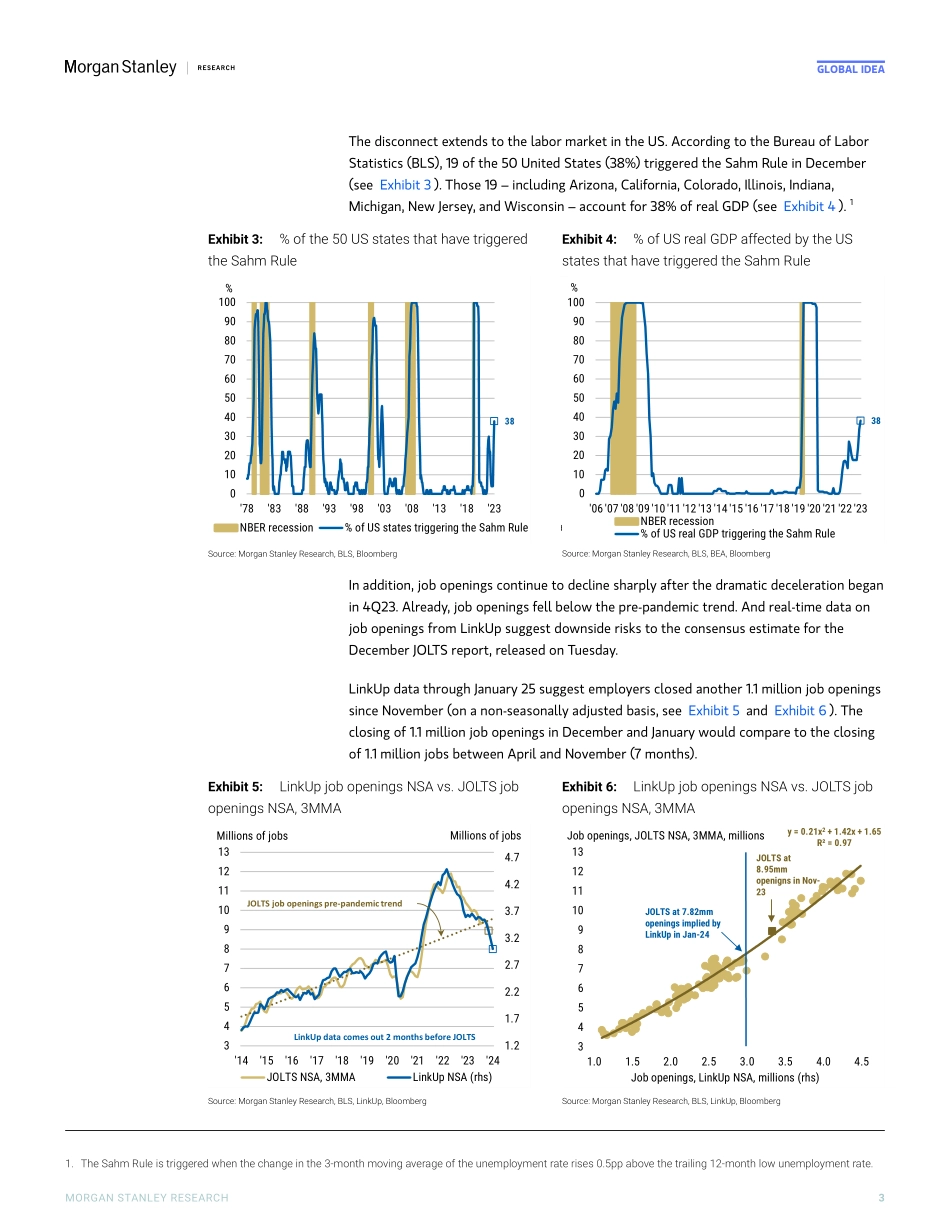

M Global IdeaGlobal Macro StrategistDon't Call It a ComebackMorgan Stanley & Co. LLCMatthew HornbachStrategist Matthew.Hornbach@morganstanley.com +1 212 761-1837 Guneet Dhingra, CFAStrategist Guneet.Dhingra@morganstanley.com +1 212 761-1445 Andrew M WatrousStrategist Andrew.Watrous@morganstanley.com +1 212 761-5287 Efrain A Tejeda, CFAStrategist Efrain.Tejeda@morganstanley.com +1 212 761-3529 Francesco GrechiStrategist Francesco.Grechi@morganstanley.com +1 212 761-1009 Zoe K StraussStrategist Zoe.Strauss@morganstanley.com +1 212 761-0407 Allen F LiuStrategist Allen.Liu@morganstanley.com +1 212 761-6049 Morgan Stanley & Co. International plc+James K LordStrategist James.Lord@morganstanley.com +44 20 7677-3254 David S. Adams, CFAStrategist David.S.Adams@morganstanley.com +44 20 7425-3518 Eric S OynoyanStrategist Eric.Oynoyan@morganstanley.com +44 20 7425-1945 Lorenzo TestaStrategist Lorenzo.Testa@morganstanley.com +44 20 7677-0337 Fabio Bassanin, CFAStrategist Fabio.Bassanin@morganstanley.com +44 20 7425-1869 Marie-Anais C FrancoisStrategist Marie-Anais.Francois@morganstanley.com +44 20 7425-1877 Dominic J KrummenacherStrategist Dominic.Krummenacher@morganstanley.com +44 20 7425-9781 Morgan Stanley MUFG Securities Co., Ltd.+Koichi SugisakiStrategist Koichi.Sugisaki@morganstanleymufg.com +81 3 6836-8428 We continue to see lower bond yields ahead. The impact of winter weather and fewer fiscal cash flows raise downside risks to activity data for January. The bond market rally to end 2023 wasn't a comeback. It was the start of another bull market – which has been here for years. Global Macro StrategyWe discuss the interplay between GDP tracking and Fedspeak last summer, noting its impact on markets, with the understanding that it could happen again if the Fed doesn't consider a broader set of data. We also discuss 3 reasons to expect USD strength, but 3 reasons to stay neutral.Interest Rate StrategyWe stay long duration in the US via long 5y USTs. We maintain EUR 2y1y vs. 1y1y, pay Apr ECB OIS meeting, and EUR 5y5 vs 20y5y steepener. We enter into RXH4 136/137/138.5 broken call fly. In cash, we keep our structural short 10y BTP versus Bund and 10s30s OAT ASW box. We maintain receive May'24 MPC and long UKT 1T37 vs. short UKT 1T57, and we also keep our short 15y ASW. We close TONA OIS 2s5s steepener (DV01 1.5 vs. 1) and shift to receive 2y OIS outright. We maintain receive 10y OIS vs. sell 30y JGBs, and sell 30y JGB ASW.Currency & Foreign ExchangeWe discuss three reasons to expect USD strength, and three reasons to stay neutral USD for now. Buy short-term EUR/GBP calls as implied vols are low and the market is wrong-footed for a dovish BoE surprise. We look at currency-relevant differences between Norway and Sweden, maintaining our long NOK/SEK recommendation. We discuss why the BoC has entered a new phase of the tightening cycle and continue to recommend micro-flatteners in Cana...