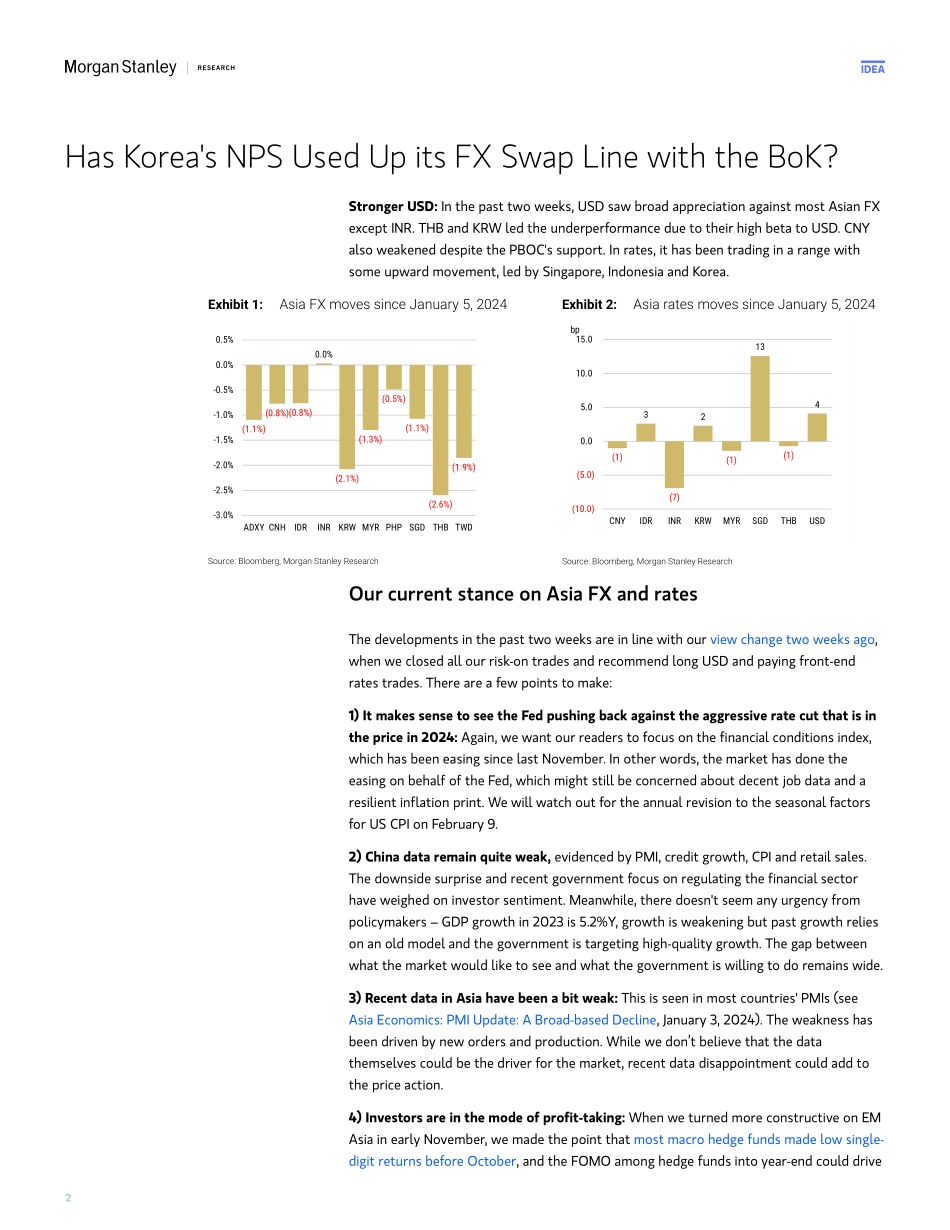

M IdeaEM Strategy | Asia PacificAsia Macro Strategy: Has Korea's NPS Used Up its FX Swap Line with the BoK?Morgan Stanley Asia Limited+Min DaiStrategist Min.Dai@morganstanley.com +852 2239-7983 Gek Teng KhooStrategist Gek.Teng.Khoo@morganstanley.com +852 3963-0303 Recent developments continue to support being cautious on FX and paying front-end rates selectively in the near term in Asia. We increase long USD exposure by adding long USD/PHP. Recent data out of China and Asia… The developments in the past two weeks are in line with our view change two weeks ago, when we closed all our risk-on trades and recommended long USD and paying front-end rates trades selectively. China data remain quite weak, and policy easing is reactive. Recent data in Asia have also been on the weaker side, which could add to the price action....support staying cautious on Asia FX and rates selectively: Additionally, most macro hedge funds generated 3-5% in the last two months of 2023 and could have the incentive to take profit should last year-end's trend (lower USD and UST yields) reverse. Therefore, we stick to our current stance, which is to be cautious on Asia FX and rates via selectively long USD and paying rates exposure. We increase long USD exposure by adding long USD/PHP.This week, we do a deep dive into Korea's NPS FX-hedging activities and discuss SGD FX and rates in the context of the upcoming MAS meeting on January 29.In FX, we recommend:• Short TWD/INR (hold) • Short CNH/INR (hold)• Long USD/PHP 3m NDF (new)• Long USD/THB (hold)In rates, we suggest:• Receive 1-year CNY NDIRS (hold)• Long onshore CNY-hedged 1-year CGB (hold)• Pay 1-year INR NDOIS (hold)• Receive 2-year KRW NDIRS versus 2-year USD IRS without beta adjustment (hold)Morgan Stanley does and seeks to do business with companies covered in Morgan Stanley Research. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of Morgan Stanley Research. Investors should consider Morgan Stanley Research as only a single factor in making their investment decision.For analyst certification and other important disclosures, refer to the Disclosure Section, located at the end of this report.+= Analysts employed by non-U.S. affiliates are not registered with FINRA, may not be associated persons of the member and may not be subject to FINRA restrictions on communications with a subject company, public appearances and trading securities held by a research analyst account. January 22, 2024 11:00 PM GMTM Idea2Has Korea's NPS Used Up its FX Swap Line with the BoK?Stronger USD: In the past two weeks, USD saw broad appreciation against most Asian FX except INR. THB and KRW led the underperformance due to their high beta to USD. CNY also weakened despite the PBOC's support. In rates, it has been trading in a range with ...