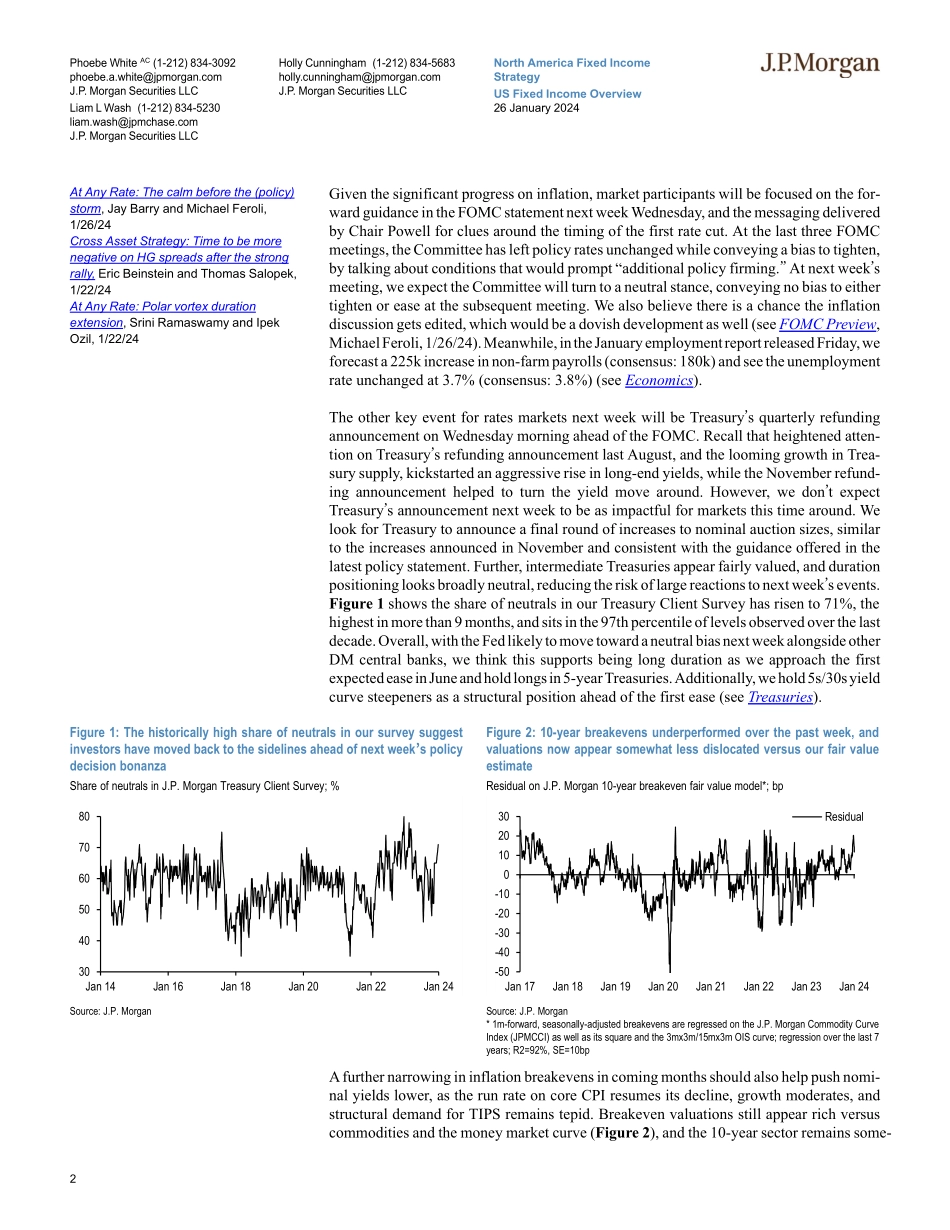

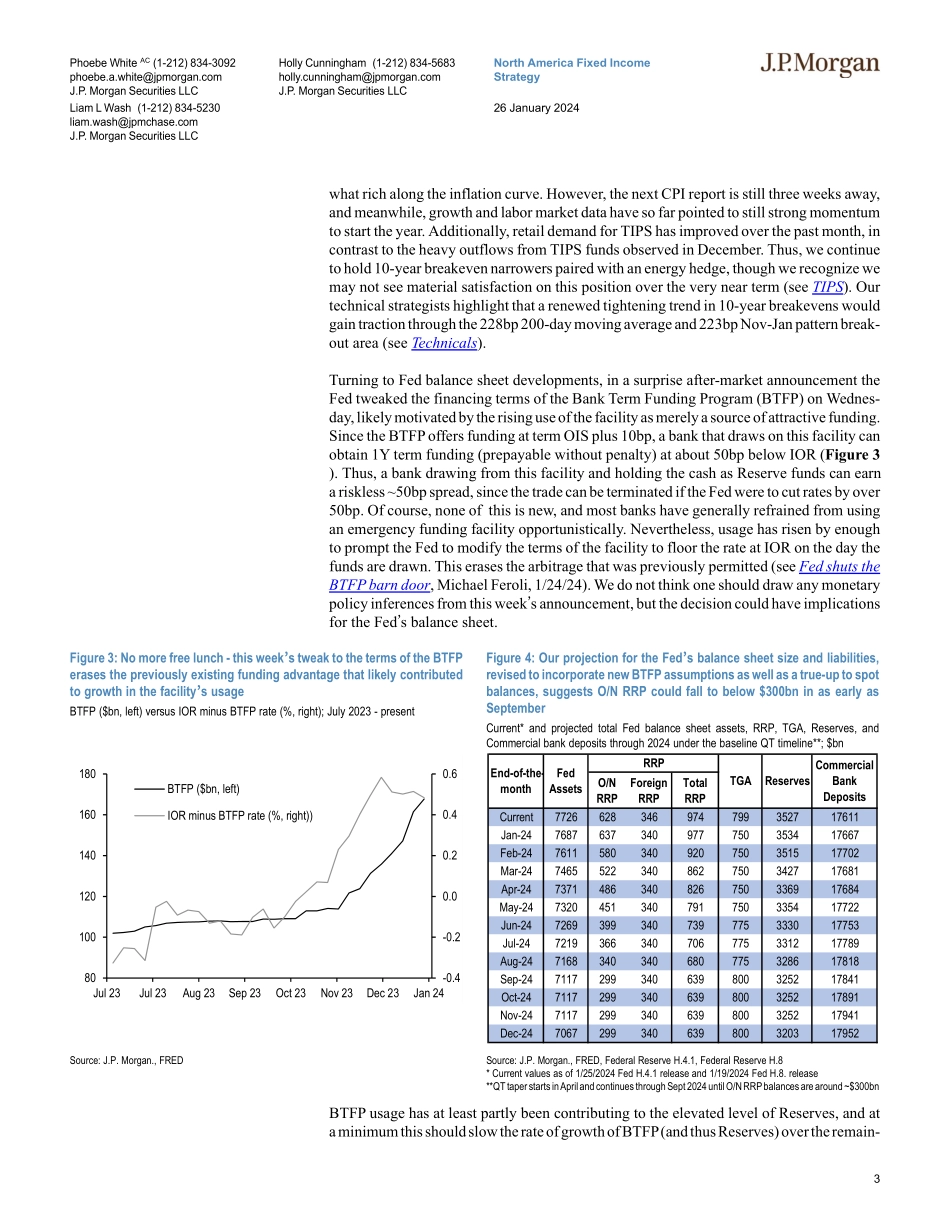

1Phoebe White AC (1-212) 834-3092phoebe.a.white@jpmorgan.comJ.P. Morgan Securities LLCLiam L Wash (1-212) 834-5230liam.wash@jpmchase.comJ.P. Morgan Securities LLCHolly Cunningham (1-212) 834-5683holly.cunningham@jpmorgan.comJ.P. Morgan Securities LLCNorth America Fixed Income Strategy26 January 2024J P M O R G A N•The Treasury curve steepened and spreads ground tighter as DM central banks inched closer to rate cuts and economic data was favorable•We will receive key monetary and fiscal announcements next week. We expect the Fed to leave policy rates unchanged at the upcoming FOMC meeting while adjusting for-ward guidance from a hawkish to neutral bias. We look for Treasury to announce a final round of increases to nominal auction sizes in its quarterly refunding announcement•The Fed tweaked the BTFP to erase the riskless arbitrage offered to banks, which should limit further growth in the facility. We see limited implications for money markets. We see risks to an earlier end to QT, which should be supportive for swap spreads•Economics: We look for non-farm payrolls to have increased 225k and the unemploy-ment rate to have held steady at 3.7% in January•Treasuries: We continue to hold longs in 5-year Treasuries and 5s/30s steepeners as yields should fall and the curve should steepen as we approach the first ease. We look for Treasury to announce a final round of increases to nominal auction sizes: Treasury remains underfinanced and the T-bill share of debt should remain above 20%. Hold ener-gy-hedged 10-year TIPS breakeven narrowers•Interest Rate Derivatives: Swap spreads in the belly remain narrow relative to fair value, although the gap has shrunk steadily since year end. We continue to see value in swap spread wideners in the 5Y sector. At the front end, with spreads wide to fair value, with the 2s/5s curve likely biased flatter and with RRP balances expected to decline further, we now look for narrower swap spreads. We recommend positioning for this via 2s/5s weighted spread curve steepeners, given the widening risk posed by spreads in the belly•Securitized Products: Remain neutral on the mortgage basis; spreads are still on the tighter end of the fair range, but may have more support from banks than we had antici-pated. We have seen strong performance across CMBS, RMBS, and ABS sectors but generally turn cautious at these tight spread levels•Corporates: HG bond spreads reached their post-GFC tights as demand continues to outstrip supply, and we look for the 10s30s spread curve to widen. HY mutual funds are becoming increasingly conservatively positioned•Near-term catalysts: FOMC meeting (1/30-1/31), Jan employment (2/2), Jan CPI (2/13), Jan retail sales (2/15)Following a relatively sleepy week in US fixed income markets, the Treasury yield curve twisted steeper and spreads across high-grade and high yield corporates continued t...