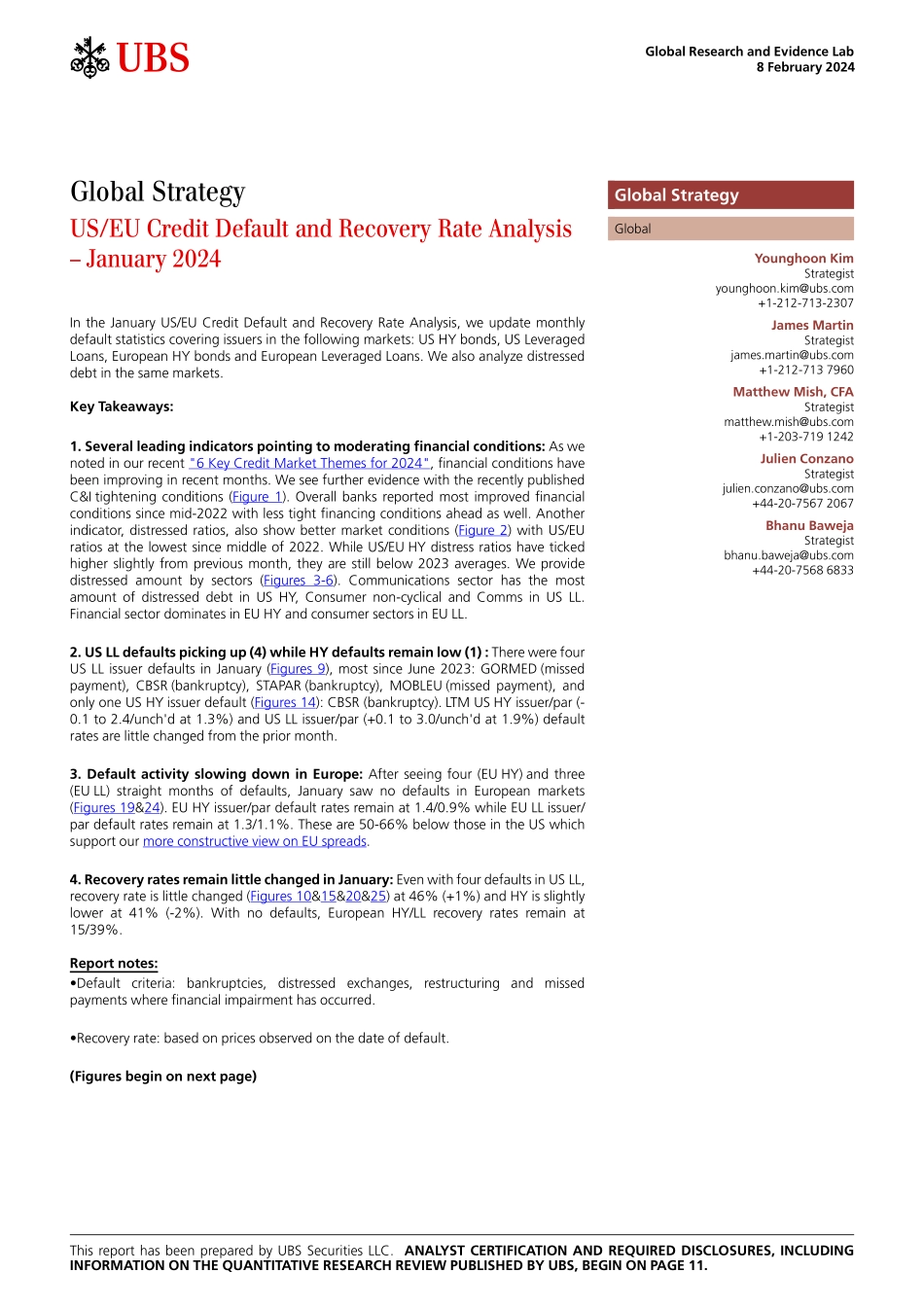

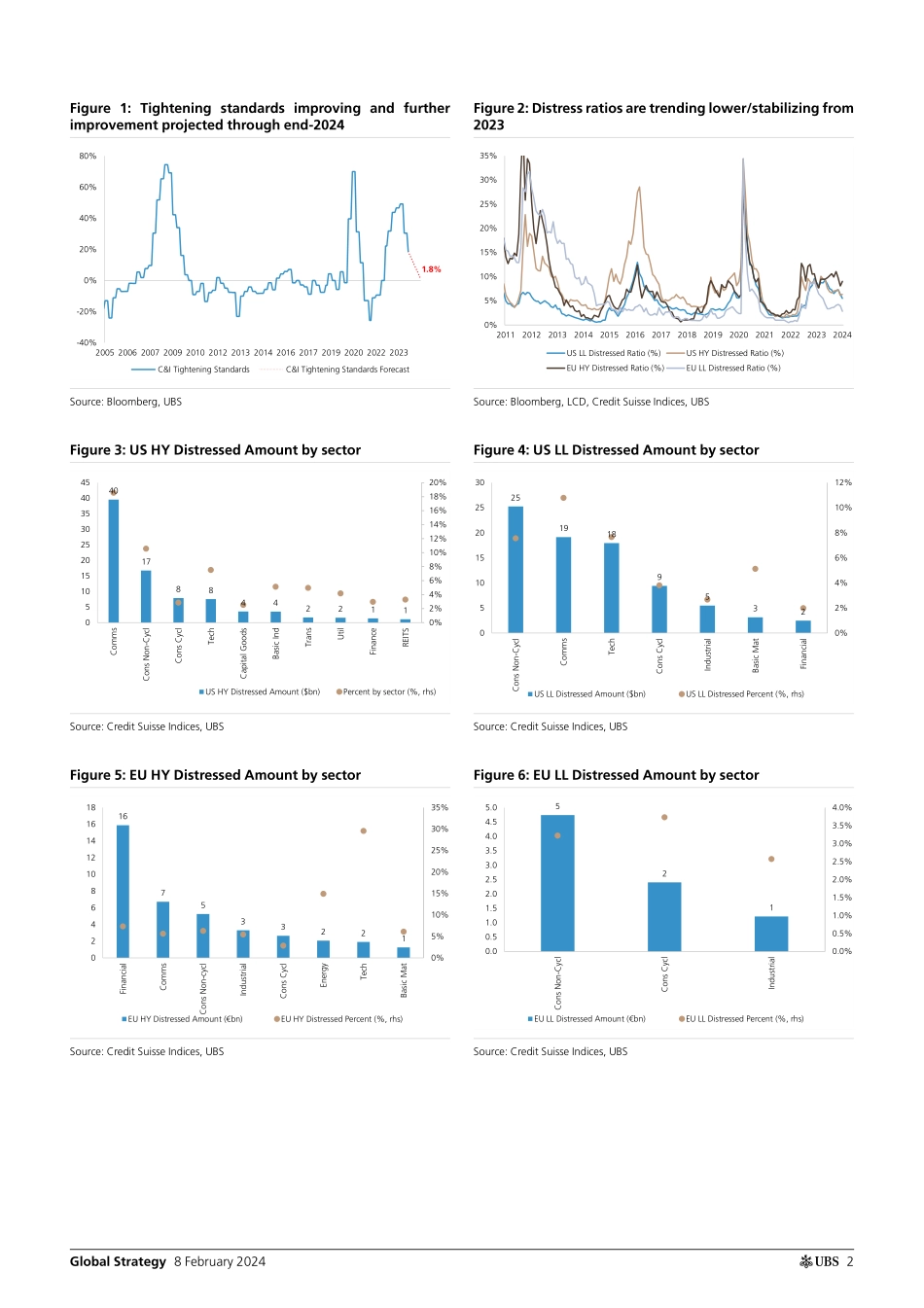

ab8 February 2024Global Research and Evidence LabGlobal StrategyUS/EU Credit Default and Recovery Rate Analysis – January 2024In the January US/EU Credit Default and Recovery Rate Analysis, we update monthly default statistics covering issuers in the following markets: US HY bonds, US Leveraged Loans, European HY bonds and European Leveraged Loans. We also analyze distressed debt in the same markets.Key Takeaways:1. Several leading indicators pointing to moderating financial conditions: As we noted in our recent "6 Key Credit Market Themes for 2024", financial conditions have been improving in recent months. We see further evidence with the recently published C&I tightening conditions (Figure 1). Overall banks reported most improved financial conditions since mid-2022 with less tight financing conditions ahead as well. Another indicator, distressed ratios, also show better market conditions (Figure 2) with US/EU ratios at the lowest since middle of 2022. While US/EU HY distress ratios have ticked higher slightly from previous month, they are still below 2023 averages. We provide distressed amount by sectors (Figures 3-6). Communications sector has the most amount of distressed debt in US HY, Consumer non-cyclical and Comms in US LL. Financial sector dominates in EU HY and consumer sectors in EU LL. 2. US LL defaults picking up (4) while HY defaults remain low (1) : There were four US LL issuer defaults in January (Figures 9), most since June 2023: GORMED (missed payment), CBSR (bankruptcy), STAPAR (bankruptcy), MOBLEU (missed payment), and only one US HY issuer default (Figures 14): CBSR (bankruptcy). LTM US HY issuer/par (-0.1 to 2.4/unch'd at 1.3%) and US LL issuer/par (+0.1 to 3.0/unch'd at 1.9%) default rates are little changed from the prior month.3. Default activity slowing down in Europe: After seeing four (EU HY) and three (EU LL) straight months of defaults, January saw no defaults in European markets (Figures 19&24). EU HY issuer/par default rates remain at 1.4/0.9% while EU LL issuer/par default rates remain at 1.3/1.1%. These are 50-66% below those in the US which support our more constructive view on EU spreads.4. Recovery rates remain little changed in January: Even with four defaults in US LL, recovery rate is little changed (Figures 10&15&20&25) at 46% (+1%) and HY is slightly lower at 41% (-2%). With no defaults, European HY/LL recovery rates remain at 15/39%.Report notes:•Default criteria: bankruptcies, distressed exchanges, restructuring and missed payments where financial impairment has occurred.•Recovery rate: based on prices observed on the date of default.(Figures begin on next page)This report has been prepared by UBS Securities LLC. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES, including information on the Quantitative Research Review published by UBS, begin on page 11. Global StrategyGlobalYounghoon KimStrategist...