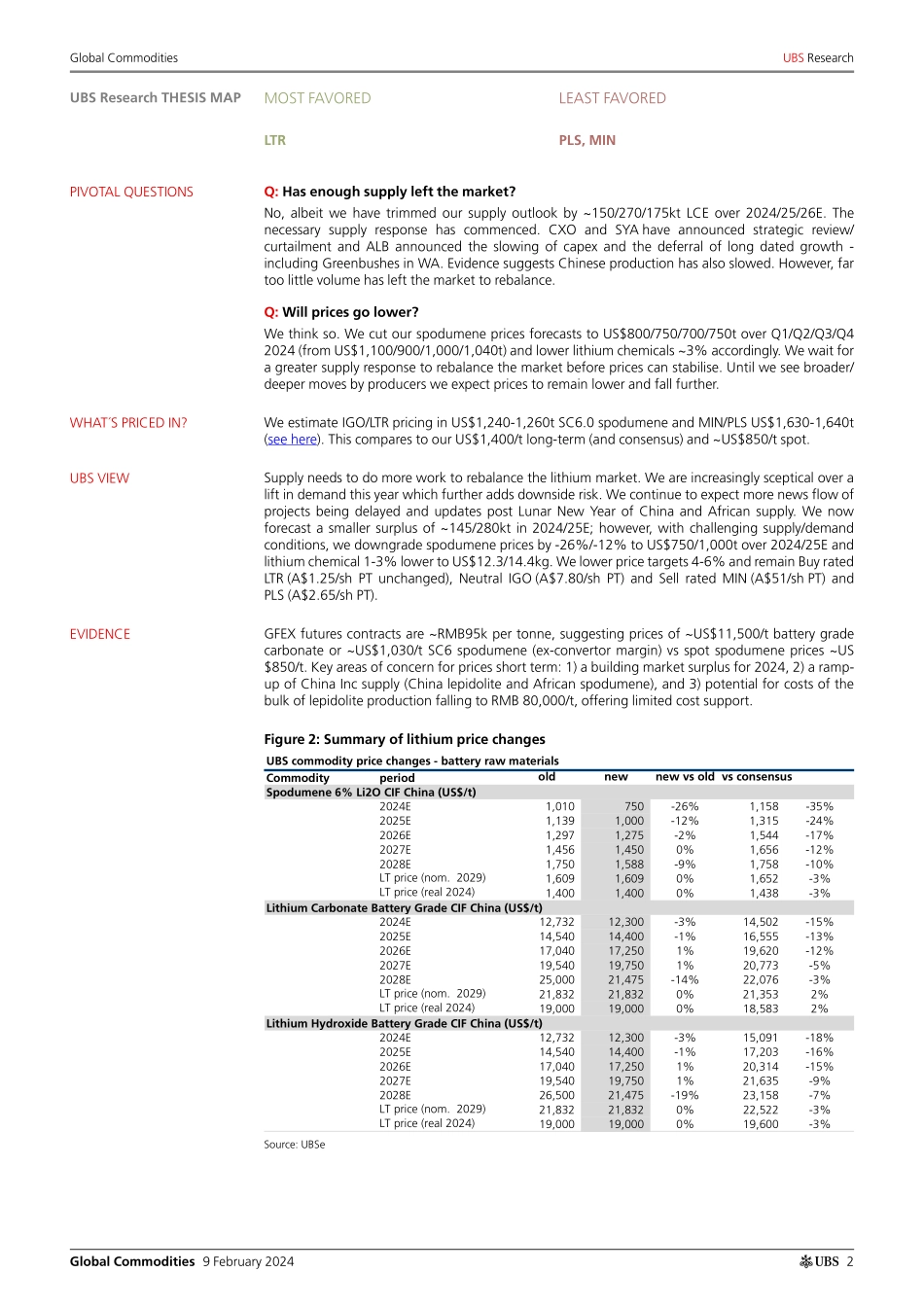

ab9 February 2024Global Research and Evidence LabGlobal CommoditiesLithium: More supply needs to come outSupply growth ~30% vs demand growth ~25% over 2024/25E Late last year we had forecast lithium demand growing 25% per annum for 2024/25 vs supply at 41%/36%. This imbalance drove large multi-year surpluses requiring a supply response to rebalance the market. Since then we have only seen very modest supply curtailment, opex/capex cuts and lower unit costs (partly due to increased volumes). We have further reviewed and reduced our supply outlook, in particular tempering growth and risk weightings, reducing supply ~150/270kt LCE in 2024/25E. However, we continue to see a (smaller) market surplus of ~145/280kt LCE in 2024/25E. We downgrade prices (again) in sympathy with spot and challenging supply/demand conditions ahead, lowering spodumene -26%/-12% to US$750/1,000t over 2024/25E and lithium chemical 1-3% lower to US$12.3/14.4kg. We estimate IGO/LTR pricing in ~US$1,240-1,260t SC6.0 spodumene and MIN/PLS ~US$1,630-1,640t. We have reduced price targets up to 6% and remain Buy rated LTR (A$1.25/sh PT), Neutral IGO (A$7.80/sh PT) and Sell rated MIN (A$51/sh PT) and PLS (A$2.65/sh PT). Cut supply ~150/270kt over 2024/25E but it's not enough The supply response to rebalance the market has commenced. CXO and SYA have announced strategic reviews, ALB the slowing of capex and the deferral of long dated growth and Chinese production has also slowed (UBS China lithium database). We have incorporated these plus further updates into our modelling whilst tempering risk weightings of projects which takes out ~150/270/175kt LCE over 2024/25/26E (see here). However, this still leaves a ~150/280/285kt LCE surplus. Chinese supply costs have fallen to around/just below current spot chemical prices, while African spodumene/petalite projects are seen marginal but pulling costs out. Meanwhile, brine assets are showing their worth as the lowest cost source of chemical supply supported by falls in price-linked royalties. Brine producers are not anticipated to help rebalance the market.Supply has more work to do We need a bigger supply response to rebalance the market before prices can stabilise. Lower commodity prices will support cheaper EVs and ESS batteries, but we struggle to see this offering sufficient market relief. Rather, we look to supply (eg: industry) to do the heavy lifting to rebalance the market with broader and deeper curtailment/optimising by producers. We watch news flow ahead of projects being delayed, reflected by our higher project risk weightings, ahead of this we see lithium prices staying lower and falling further. Remain cautious - lower lithium prices and price targets (up to 6%) We cut our spodumene prices to US$800/750/700/750t over Q1/Q2/Q3/Q4 2024 (from US$1,100/900/1,000/1,040t) and lower lithium chemicals ~3% accordingly (see here). We...