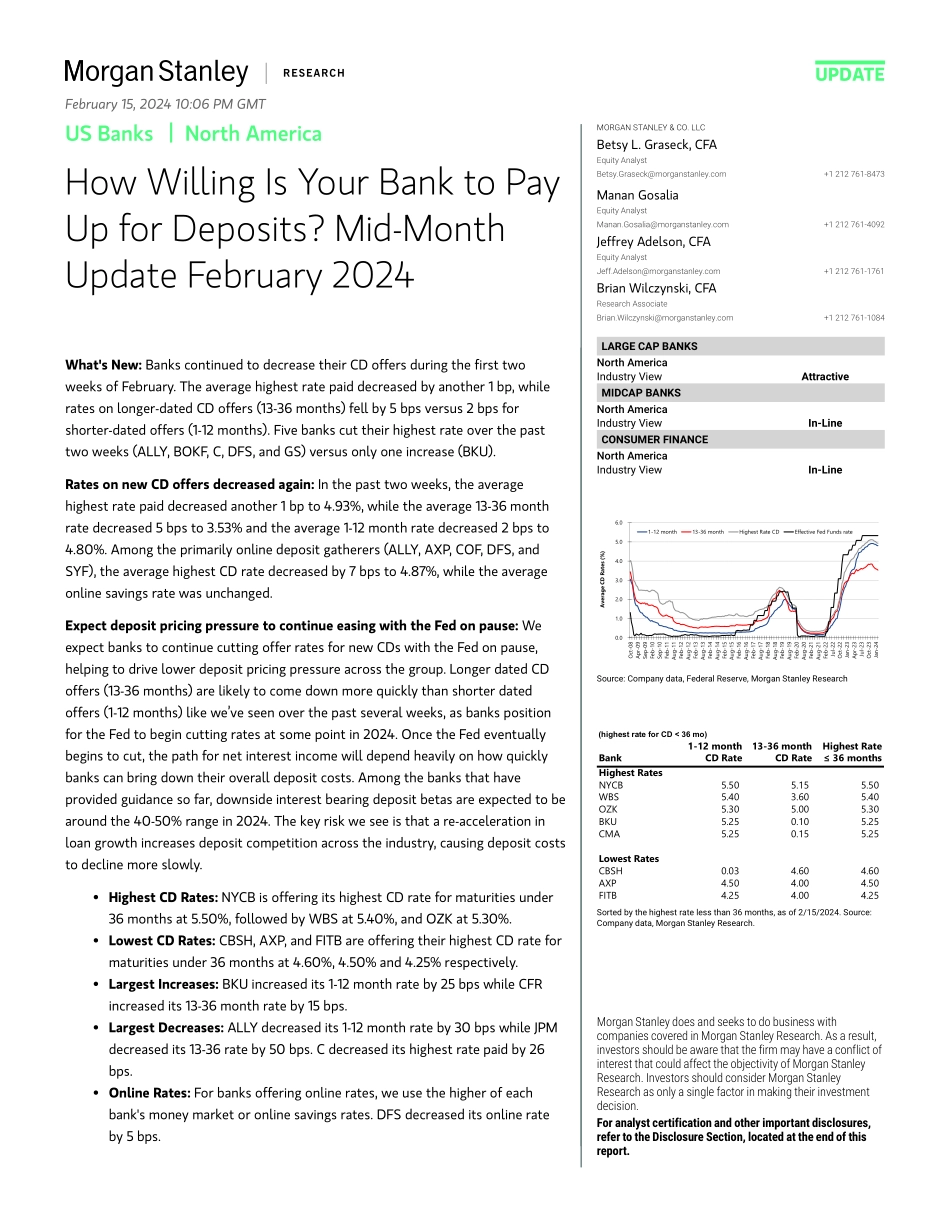

M UpdateUS Banks | North AmericaHow Willing Is Your Bank to Pay Up for Deposits? Mid-Month Update February 2024Morgan Stanley & Co. LLCBetsy L. Graseck, CFAEquity Analyst Betsy.Graseck@morganstanley.com +1 212 761-8473 Manan GosaliaEquity Analyst Manan.Gosalia@morganstanley.com +1 212 761-4092 Jeffrey Adelson, CFAEquity Analyst Jeff.Adelson@morganstanley.com +1 212 761-1761 Brian Wilczynski, CFAResearch Associate Brian.Wilczynski@morganstanley.com +1 212 761-1084 Large Cap BanksNorth AmericaIndustry ViewAttractiveMidcap BanksNorth AmericaIndustry ViewIn-LineConsumer FinanceNorth AmericaIndustry ViewIn-Line0.01.02.03.04.05.06.0Oct-08Apr-09Sep-09Feb-10Sep-10Feb-11Aug-11Feb-12Aug-12Feb-13Aug-13Feb-14Aug-14Feb-15Aug-15Feb-16Aug-16Feb-17Aug-17Feb-18Aug-18Feb-19Aug-19Feb-20Aug-20Feb-21Aug-21Feb-22Jul-22Oct-22Jan-23Apr-23Jul-23Oct-23Jan-24Average CD Rates (%) 1-12 month13-36 monthHighest Rate CDEffective Fed Funds rateSource: Company data, Federal Reserve, Morgan Stanley Research(highest rate for CD < 36 mo)1-12 month13-36 monthHighest RateBankCD RateCD Rate≤ 36 monthsHighest RatesNYCB5.50 5.15 5.50 WBS5.40 3.60 5.40 OZK5.30 5.00 5.30 BKU5.25 0.10 5.25 CMA5.25 0.15 5.25 Lowest RatesCBSH0.03 4.60 4.60 AXP4.50 4.00 4.50 FITB4.25 4.00 4.25 Sorted by the highest rate less than 36 months, as of 2/15/2024. Source: Company data, Morgan Stanley Research.What's New: Banks continued to decrease their CD offers during the first two weeks of February. The average highest rate paid decreased by another 1 bp, while rates on longer-dated CD offers (13-36 months) fell by 5 bps versus 2 bps for shorter-dated offers (1-12 months). Five banks cut their highest rate over the past two weeks (ALLY, BOKF, C, DFS, and GS) versus only one increase (BKU).Rates on new CD offers decreased again: In the past two weeks, the average highest rate paid decreased another 1 bp to 4.93%, while the average 13-36 month rate decreased 5 bps to 3.53% and the average 1-12 month rate decreased 2 bps to 4.80%. Among the primarily online deposit gatherers (ALLY, AXP, COF, DFS, and SYF), the average highest CD rate decreased by 7 bps to 4.87%, while the average online savings rate was unchanged.Expect deposit pricing pressure to continue easing with the Fed on pause: We expect banks to continue cutting offer rates for new CDs with the Fed on pause, helping to drive lower deposit pricing pressure across the group. Longer dated CD offers (13-36 months) are likely to come down more quickly than shorter dated offers (1-12 months) like we’ve seen over the past several weeks, as banks position for the Fed to begin cutting rates at some point in 2024. Once the Fed eventually begins to cut, the path for net interest income will depend heavily on how quickly banks can bring down their overall deposit costs. Among the banks that have provided guidance so far, downside interest bearing deposit betas are expected to be around the 4...