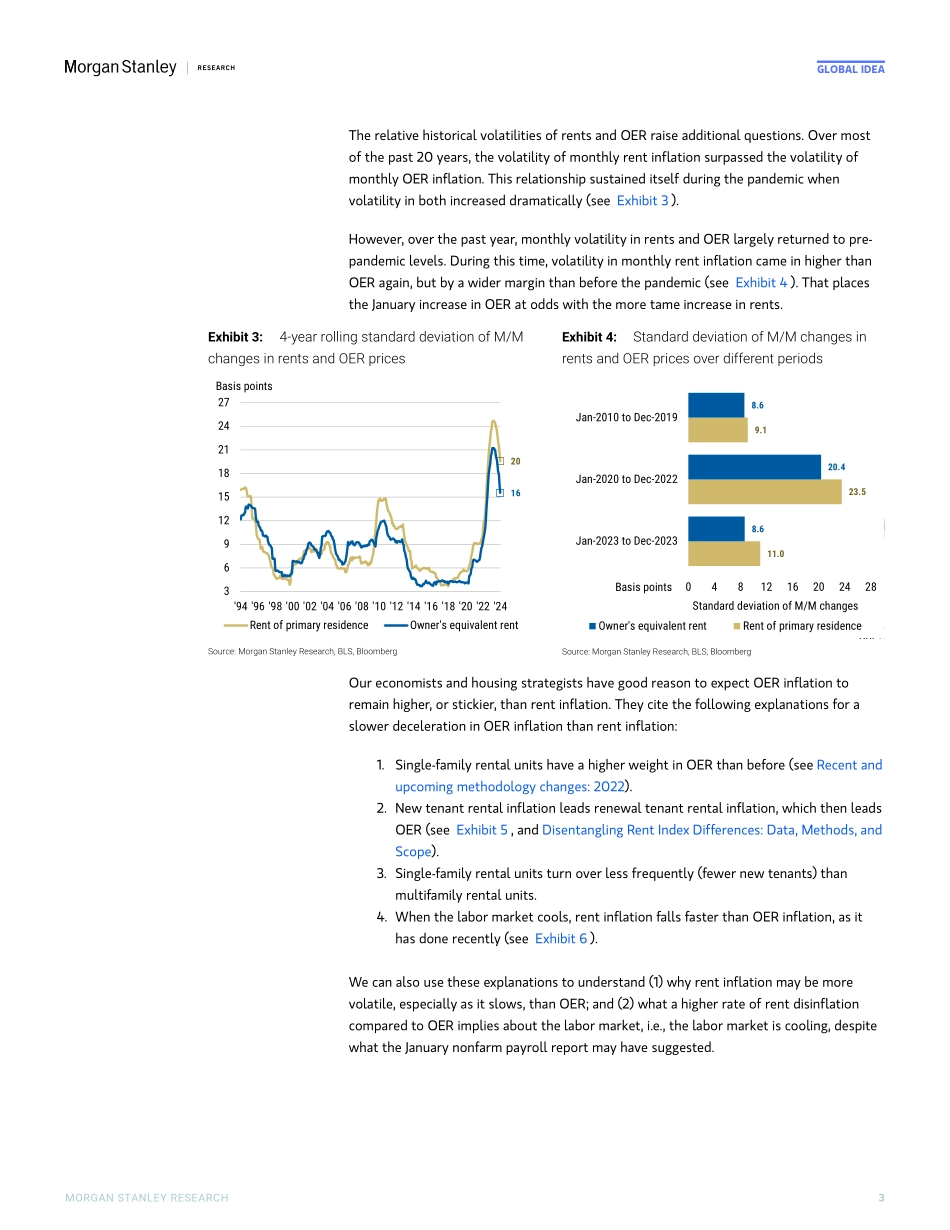

M Global IdeaGlobal Macro StrategistStop! In the Name of DoveMorgan Stanley & Co. LLCMatthew HornbachStrategist Matthew.Hornbach@morganstanley.com +1 212 761-1837 Guneet Dhingra, CFAStrategist Guneet.Dhingra@morganstanley.com +1 212 761-1445 Andrew M WatrousStrategist Andrew.Watrous@morganstanley.com +1 212 761-5287 Efrain A Tejeda, CFAStrategist Efrain.Tejeda@morganstanley.com +1 212 761-3529 Francesco GrechiStrategist Francesco.Grechi@morganstanley.com +1 212 761-1009 Zoe K StraussStrategist Zoe.Strauss@morganstanley.com +1 212 761-0407 Allen F LiuStrategist Allen.Liu@morganstanley.com +1 212 761-6049 Morgan Stanley & Co. International plc+James K LordStrategist James.Lord@morganstanley.com +44 20 7677-3254 David S. Adams, CFAStrategist David.S.Adams@morganstanley.com +44 20 7425-3518 Eric S OynoyanStrategist Eric.Oynoyan@morganstanley.com +44 20 7425-1945 Lorenzo TestaStrategist Lorenzo.Testa@morganstanley.com +44 20 7677-0337 Fabio Bassanin, CFAStrategist Fabio.Bassanin@morganstanley.com +44 20 7425-1869 Marie-Anais C FrancoisStrategist Marie-Anais.Francois@morganstanley.com +44 20 7425-1877 Dominic J KrummenacherStrategist Dominic.Krummenacher@morganstanley.com +44 20 7425-9781 Morgan Stanley MUFG Securities Co., Ltd.+Koichi SugisakiStrategist Koichi.Sugisaki@morganstanleymufg.com +81 3 6836-8428 A string of confusing US inflation reports argued to retain solvency despite irrationality. Price action hit our stop-out level, and we turn neutral on US duration but maintain a bullish stance in Europe. We also suggest positioning for a lower EUR/USD via options, especially to hedge equity risk. Global Macro StrategyWe discuss recently-released confusing US economic data and why the Fed's reaction to it will ultimately determine how investors should react. We also discuss why we think EUR/USD puts are an attractive and cheap buy to hedge for various outcomes, particularly as an overlay to long-equity portfolios.Interest Rate StrategyWe turn neutral on UST duration on curves. We pay maintain short Jun 24 1y midcurve 97.875/98.250 strangle; we close RX/UB invoice spread steepener box; we maintain receive EUR 5y5y (vs 6m) and maintain EUR 5y5 vs 20y5y steepener. In cash, we close our structural short 10y BTP versus Bund. We maintain receive May'24 MPC and long UKT 1T37 vs. short UKT 1T57, and we also keep our short 15y ASW. We maintain receive 2y OIS, long 20y JGBs on 10s20s30s fly, and sell 30y JGB ASW.Currency & Foreign ExchangeBuy EUR/USD puts to hedge an FX regime change, particularly as an overlay to long-equity portfolios. We remain neutral USD with a bullish skew, and discuss how the magnitude of the USD's reaction to CPI was larger than historical evidence on the USD's response to upside surprises in inflation data suggests. We dig into Swiss inflation and growth data to find the balance of probabilities seem to lie with a first SNB cut in June rather than March, We recommend long...