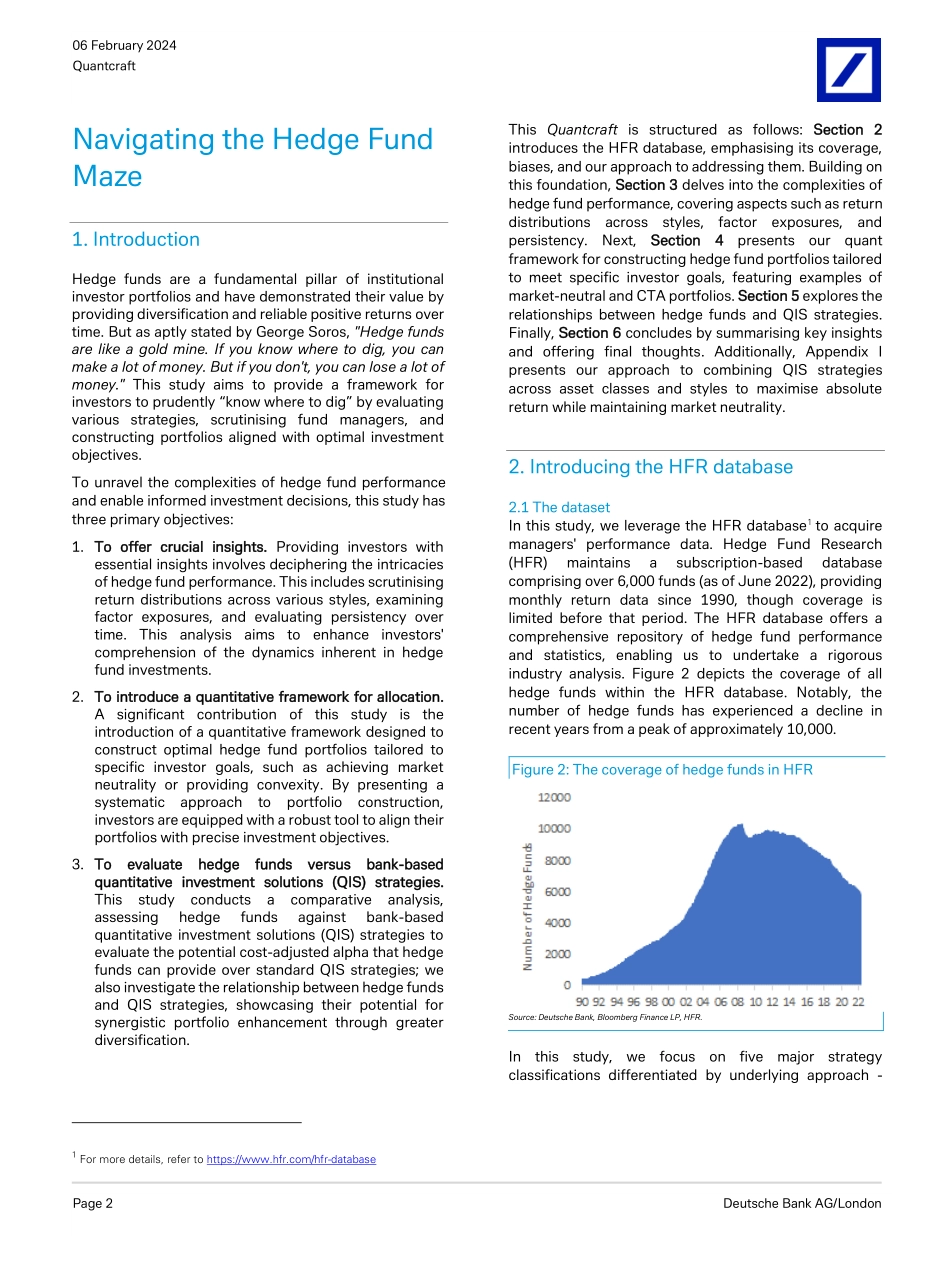

________________________________________________________________________________________________________________ Deutsche Bank AG/London IMPORTANT RESEARCH DISCLOSURES AND ANALYST CERTIFICATIONS LOCATED IN APPENDIX 1. Note to U.S. investors: US regulators have not approved most foreign listed stock index futures and options for US investors. Eligible investors may be able to get exposure through over-the-counter products. Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. MCI (P) 041/10/2023. Deutsche Bank Research Global Quantitative Strategy Quantcraft Date 06 February 2024 Navigating the Hedge Fund Maze Vivek Anand vivek-v.anand@db.com +44(20)754-52789 Research Team Vivek Anand Clayton Gillespie Caio Natividade Gianpaolo Tomasi Ganchi Zhang This is the forty-ninth edition of our Quantcraft series. This periodical outlines new trading and analytical models across different asset classes. Today’s report navigates the complex landscape of hedge fund investing, unravelling insights into strategies, performance trends, and innovative portfolio construction methodologies. We examine the Hedge Fund Research (HFR) database, discussing the intricacies of analysing hedge fund performance, risk measurement, manager selection and risk profiling. We introduce a quantitative approach to construct portfolios tailored to specific investor goals—whether achieving market neutrality or mitigating drawdowns. Additionally, we investigate the relationship between hedge funds and bank-based QIS strategies, showcasing their potential for synergistic portfolio enhancement through diversification. In summary, this study provides a refined perspective to guide investors through the intricacies of this rewarding but complex alternative asset class. Figure 1: Navigating the Hedge Fund Maze Source: Deutsche Bank. Distributed on: 06/02/2024 09:29:09 GMT7T2se3r0Ot6kwoPa 06 February 2024 Quantcraft Page 2 Deutsche Bank AG/London Navigating the Hedge Fund Maze 1. Introduction Hedge funds are a fundamental pillar of institutional investor portfolios and have demonstrated their value by providing diversification and reliable positive returns over time. But as aptly stated by George Soros, "Hedge funds are like a gold mine. If you know where to dig, you can make a lot of money. But if you don't, you can lose a lot of money." This study aims to provide a framework for investors to prudently “know where to dig” by evaluating various strategies, scrutinising fund managers, and constructing portfolios aligned with optimal investment objectives. To unravel the complexities of hedge fund performance and enable informed investment decisions, this study h...