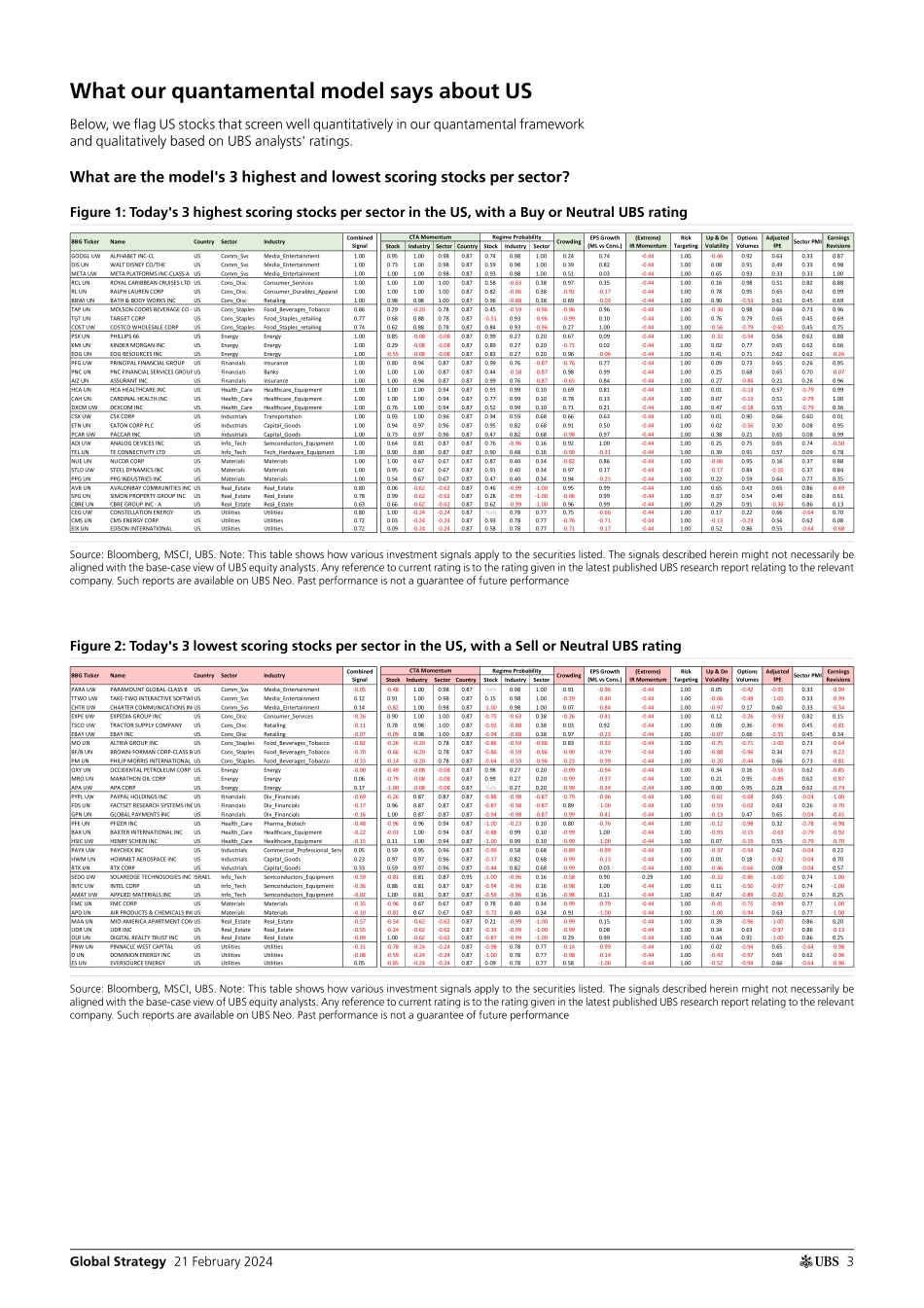

ab21 February 2024Global Research and Evidence LabGlobal StrategyQuantamental Signal Ideas - Top & Bottom Ranked StocksDetails on the methodology/model can be found in our Q-Series report11 Quantamental signals to spot opportunities in global equitiesWe recently introduced our new quantamental framework for single stocks. This model uses 11 high-performing indicators that aim to extract information from price momentum, stocks’ fundamentals and investors’ sentiment/positioning... In this note, we flag stocks across five regions (US, EU, China, Japan and Australia) that screen well quantitatively in our framework and qualitatively based on UBS analysts’ ratings. An easy-to-read dashboard will help visualize the quantamental scores, while our analysts have shared short blurbs highlighting their fundamental views on the selected stocks.What are the model’s recommendations today?Based on the stock-level scores and an optimisation for portfolio balance, we find that the highest-scoring stocks tend to come from sectors like Transportation, Banks, Auto Components and Energy. The lowest-scoring stock list is dominated by Health Care, Household Personal Products, Tech and Food Beverage & Tobacco stocks. Do note these recommendations can differ from the fundamental views of our equity strategy team.Digging into the details, what key message is each signal cohort suggesting?• Chinese stocks are clearly lagging from a price momentum perspective. The most favoured sectors are Financials & Industrials, the least favoured are Real Estate & Utilities.• Positioning is very supportive in China, more balanced in other regions. Real estate is clearly the sector to overweight based on positioning, alongside with communication services. Energy is consistently ranked among the least favoured sectors.• Earnings expectations and momentum seem to favour Real Estate (ex Japan) & Cons. Discretionary stocks. On the opposite side, Utilities & Materials are the least favoured. • With OECD G20 CLI indicating expansion as the most likely regime in 2024 (38% probability, vs. 15% for a downturn), cyclical sectors are favoured in our regime model.• Valuation wise, Financials and Utilities appear cheap in our adjusted 12m fwd PE model, when Tech and Health Care appear expensive. Please keep in mind there seem to be significant relative value plays within sectors and industries, and across regions.• Sector PMI new orders suggest to favour Staples and Financials, over Health Care and Materials. Rankings appear to be quite consistent across regions.What are the industries whose rankings have changed the most?Compared to the previous update, our model is slightly reducing its risk-on stance, albeit from a high level. Food, Beverage & Tobacco, Telecom and Banks have seen their overall scores upgraded, when Health Care, Utilities and Tech have seen their overall scores reduced, despite b...