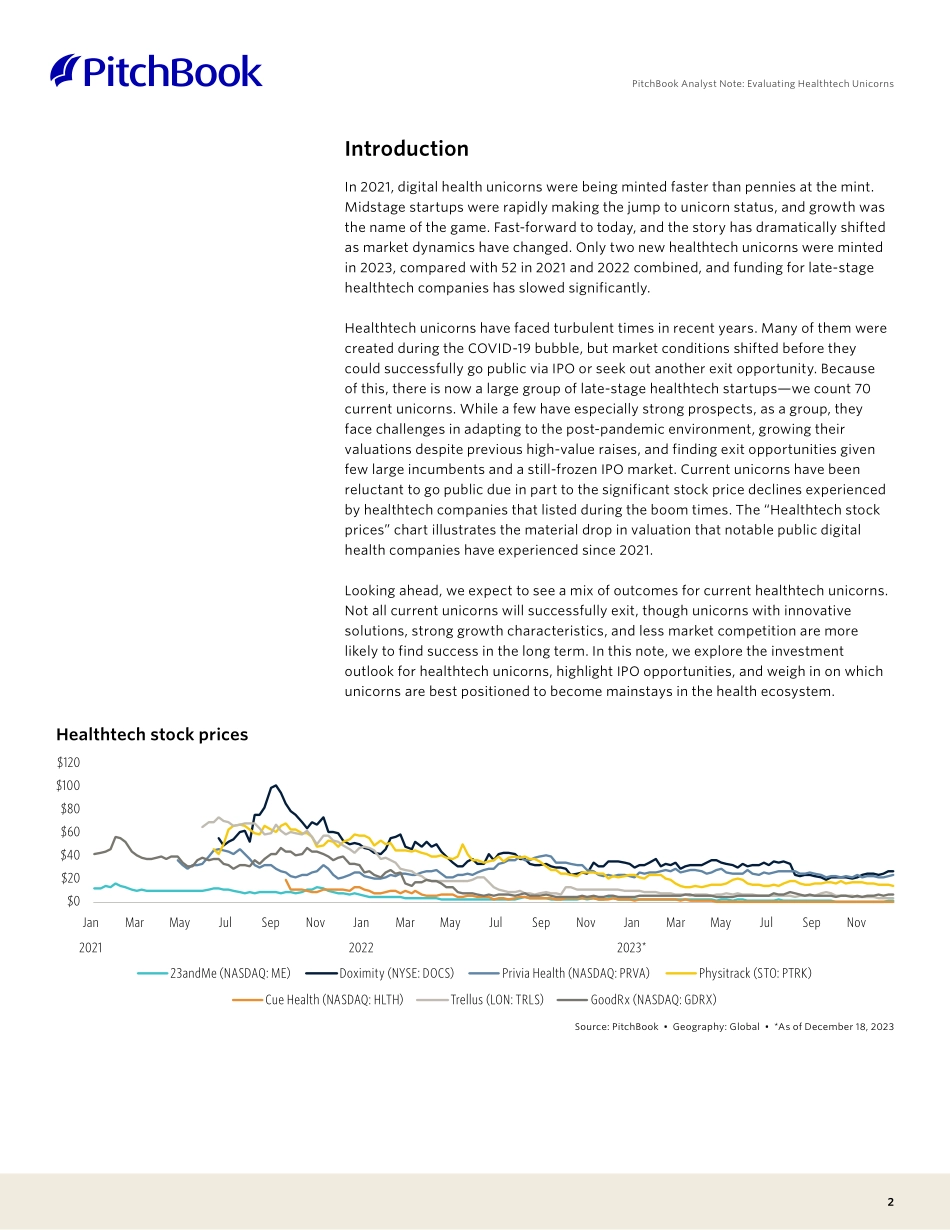

1PitchBook Data, Inc.John Gabbert Founder, CEONizar Tarhuni Vice President, Institutional Research and EditorialPaul Condra Head of Emerging Technology ResearchInstitutional Research GroupAnalysisContentsKey takeaways1Introduction2Stalled funding, outdated valuations3Shifting market expectations4Healthtech unicorn M&A outlook52024 IPO watch6Evaluating healthtech unicorn prospects6Appendix 13pbinstitutionalresearch@pitchbook.comPublished on January 18, 2024PublishingDesigned by Megan WoodardAaron DeGagne, CFA Senior Analyst, Healthcareaaron.degagne@pitchbook.comEMERGING TECH RESEARCHEvaluating Healthtech UnicornsDeal trends, exit opportunities, and what the future holdsPitchBook is a Morningstar company providing the most comprehensive, most accurate, and hard-to-find data for professionals doing business in the private markets.Key takeaways• Late-stage funding for healthtech unicorns has significantly slowed, trailing broader healthcare funding. Current unicorns raised $12.1 billion of VC funding in 2021, $4.8 billion in 2022, and just $1.2 billion in 2023.• Investors’ demands of healthtech unicorns have changed. Expectations of profitability and margins have risen, putting a premium on business models geared toward enterprise as compared to DTC solutions requiring high marketing expenses.• The market environment will continue to be tough for late-stage digital health startups as the sector faces market headwinds and a small number of acquirers. Lower interest rates will not be a quick fix to drive significant deal flow in the near term.• In our base case, several healthtech unicorns go public in 2024, and we predict that at least three will successfully IPO. In digital health broadly, our top IPO candidates for 2024 are Noom, Ro, Spring Health, Hinge Health, Headspace, and Quantum Health.• Musculoskeletal solutions, digital therapeutics, and behavioral health are categories that are anticipated to see a higher rate of consolidation over the coming years as scaled solutions are more likely to be successful in these markets. 2PitchBook Analyst Note: Evaluating Healthtech UnicornsIntroductionIn 2021, digital health unicorns were being minted faster than pennies at the mint. Midstage startups were rapidly making the jump to unicorn status, and growth was the name of the game. Fast-forward to today, and the story has dramatically shifted as market dynamics have changed. Only two new healthtech unicorns were minted in 2023, compared with 52 in 2021 and 2022 combined, and funding for late-stage healthtech companies has slowed significantly. Healthtech unicorns have faced turbulent times in recent years. Many of them were created during the COVID-19 bubble, but market conditions shifted before they could successfully go public via IPO or seek out another exit opportunity. Because of this, there is now a large group of late-stage healthtech startups—we count 70 current unicorns. Whi...