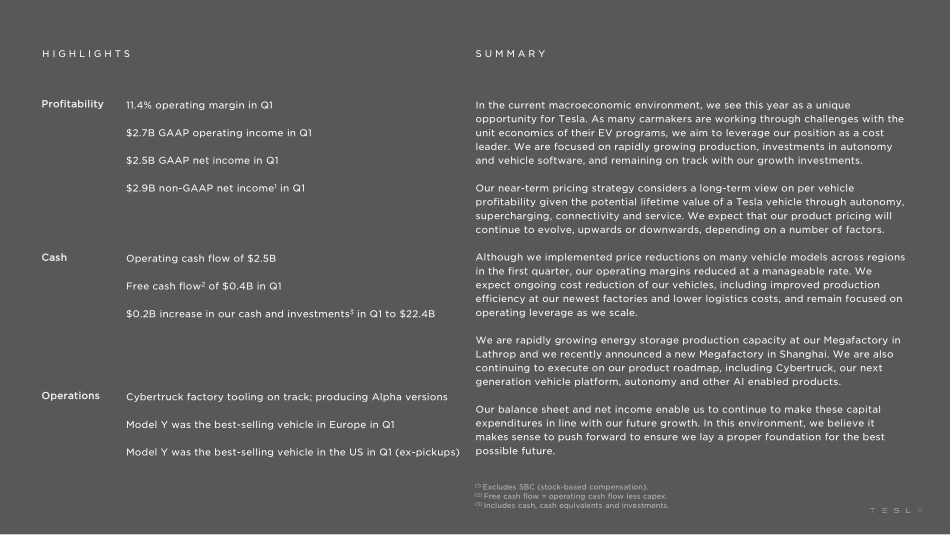

Q1 2023 Update1Highlights 03Financial Summary04Operational Summary06Vehicle Capacity 07Core Technology08Other Highlights09Outlook10Photos & Charts 11Key Metrics19Financial Statements22Additional Information28S U M M A R YH I G H L I G H T S (1) Excludes SBC (stock-based compensation).(2) Free cash flow = operating cash flow less capex.(3) Includes cash, cash equivalents and investments.Profitability11.4% operating margin in Q1$2.7B GAAP operating income in Q1$2.5B GAAP net income in Q1$2.9B non-GAAP net income1 in Q1In the current macroeconomic environment, we see this year as a unique opportunity for Tesla. As many carmakers are working through challenges with the unit economics of their EV programs, we aim to leverage our position as a cost leader. We are focused on rapidly growing production, investments in autonomy and vehicle software, and remaining on track with our growth investments.Our near-term pricing strategy considers a long-term view on per vehicle profitability given the potential lifetime value of a Tesla vehicle through autonomy, supercharging, connectivity and service. We expect that our product pricing will continue to evolve, upwards or downwards, depending on a number of factors.Although we implemented price reductions on many vehicle models across regions in the first quarter, our operating margins reduced at a manageable rate. We expect ongoing cost reduction of our vehicles, including improved production efficiency at our newest factories and lower logistics costs, and remain focused on operating leverage as we scale.We are rapidly growing energy storage production capacity at our Megafactory in Lathrop and we recently announced a new Megafactory in Shanghai. We are also continuing to execute on our product roadmap, including Cybertruck, our next generation vehicle platform, autonomy and other AI enabled products. Our balance sheet and net income enable us to continue to make these capital expenditures in line with our future growth. In this environment, we believe it makes sense to push forward to ensure we lay a proper foundation for the best possible future.CashOperating cash flow of $2.5BFree cash flow2 of $0.4B in Q1$0.2B increase in our cash and investments3 in Q1 to $22.4BOperationsCybertruck factory tooling on track; producing Alpha versionsModel Y was the best-selling vehicle in Europe in Q1Model Y was the best-selling vehicle in the US in Q1 (ex-pickups)F I N A N C I A LS U M M A R Y(Unaudited)($ in millions, except percentages and per share data)Q1-2022Q2-2022Q3-2022Q4-2022Q1-2023YoYTotal automotive revenues16,861 14,602 18,69221,307 19,96318%Energy generation and storage revenue616 866 1,1171,310 1,529148%Services and other revenue1,279 1,466 1,6451,701 1,83744%Total revenues18,75616,93421,45424,31823,32924%Total gross profit5,4604,2345,3825,7774,511-17%Total GAAP gross margin29.1%25.0%25.1%23.8%19.3%-977 bpOperating expenses1,857 1,...