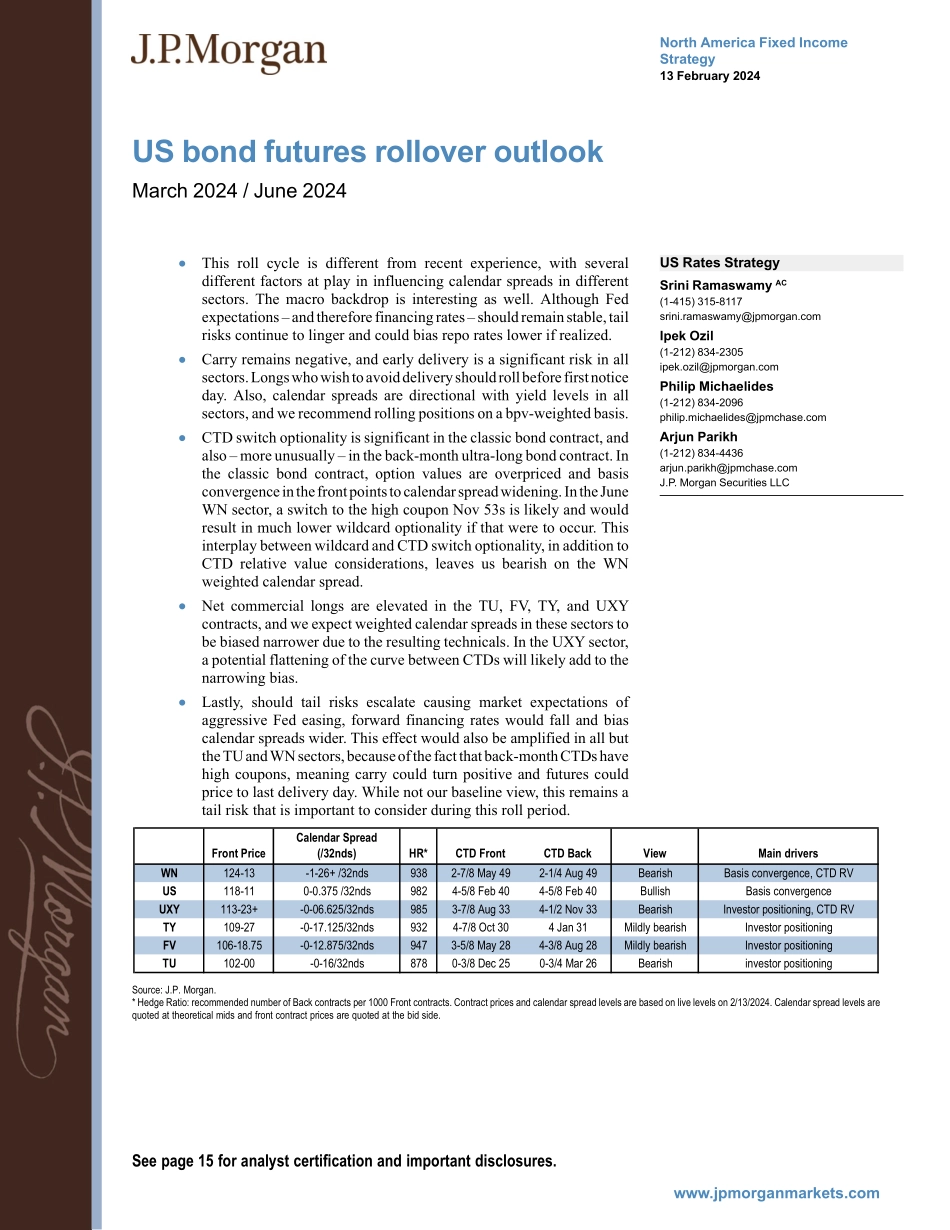

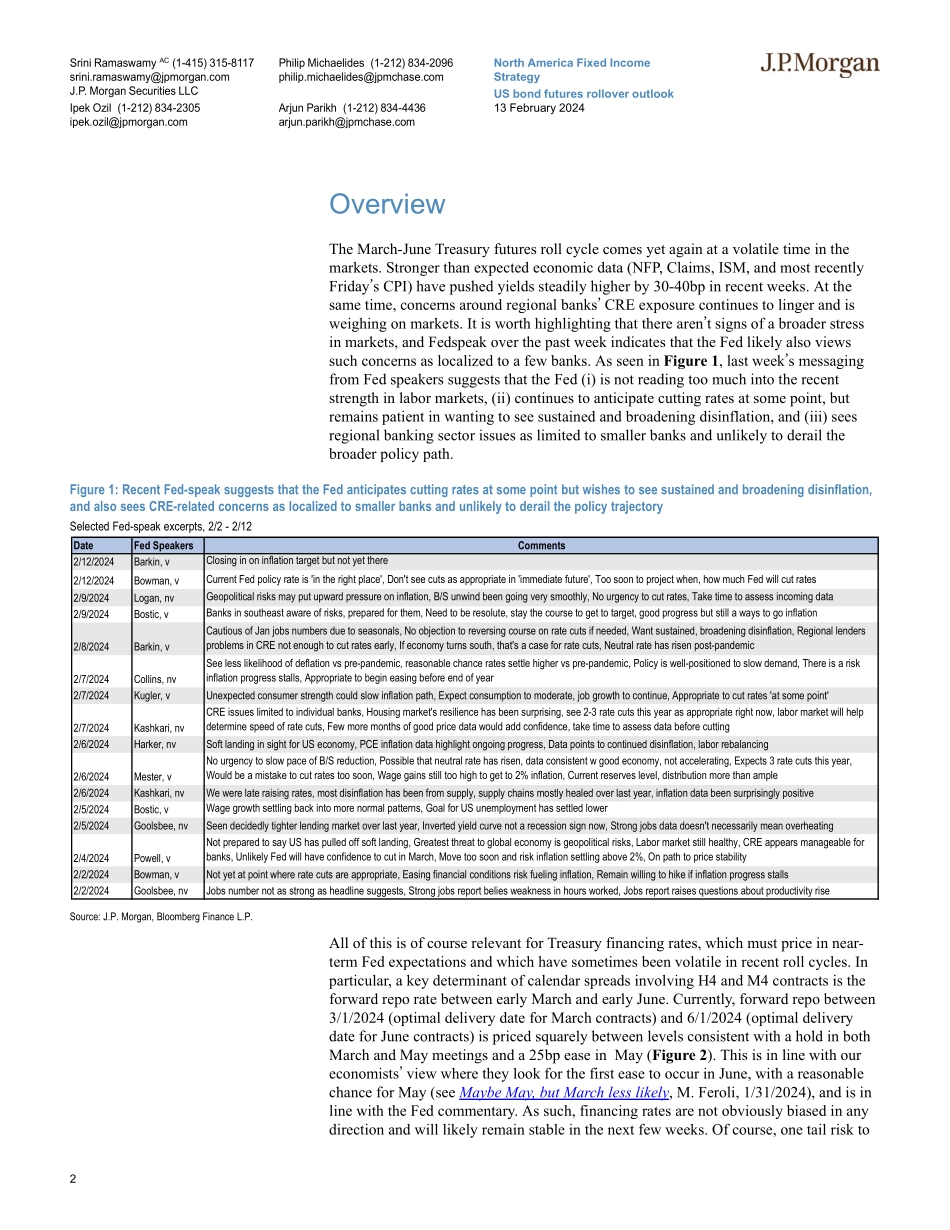

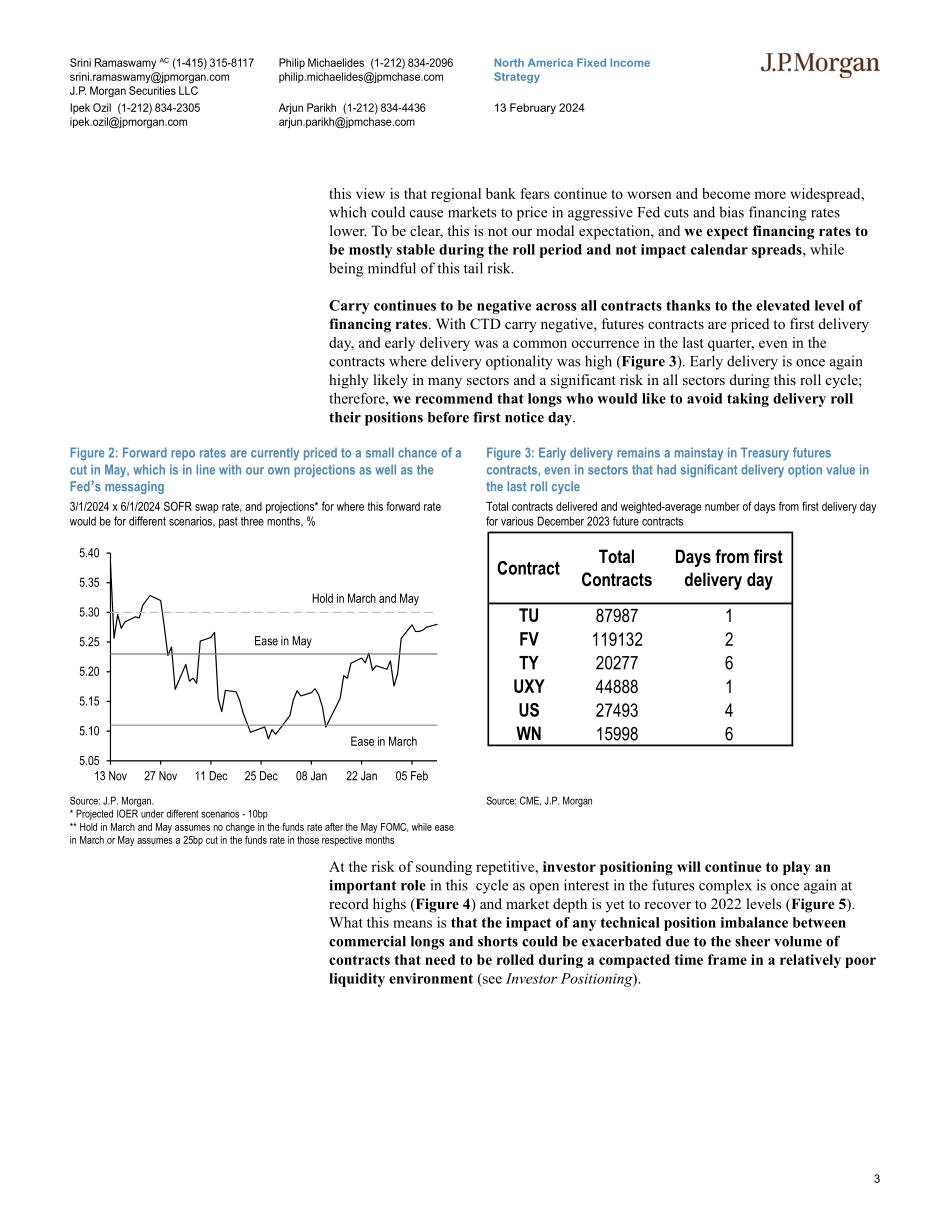

North America Fixed Income Strategy13 February 2024J P M O R G A Nwww.jpmorganmarkets.comUS Rates StrategySrini Ramaswamy AC(1-415) 315-8117srini.ramaswamy@jpmorgan.comIpek Ozil(1-212) 834-2305ipek.ozil@jpmorgan.comPhilip Michaelides(1-212) 834-2096philip.michaelides@jpmchase.comArjun Parikh(1-212) 834-4436arjun.parikh@jpmchase.comJ.P. Morgan Securities LLC•This roll cycle is different from recent experience, with several different factors at play in influencing calendar spreads in different sectors. The macro backdrop is interesting as well. Although Fed expectations – and therefore financing rates – should remain stable, tail risks continue to linger and could bias repo rates lower if realized. •Carry remains negative, and early delivery is a significant risk in all sectors. Longs who wish to avoid delivery should roll before first notice day. Also, calendar spreads are directional with yield levels in all sectors, and we recommend rolling positions on a bpv-weighted basis.•CTD switch optionality is significant in the classic bond contract, and also – more unusually – in the back-month ultra-long bond contract. In the classic bond contract, option values are overpriced and basis convergence in the front points to calendar spread widening. In the June WN sector, a switch to the high coupon Nov 53s is likely and would result in much lower wildcard optionality if that were to occur. This interplay between wildcard and CTD switch optionality, in addition to CTD relative value considerations, leaves us bearish on the WN weighted calendar spread.•Net commercial longs are elevated in the TU, FV, TY, and UXY contracts, and we expect weighted calendar spreads in these sectors to be biased narrower due to the resulting technicals. In the UXY sector, a potential flattening of the curve between CTDs will likely add to the narrowing bias.•Lastly, should tail risks escalate causing market expectations of aggressive Fed easing, forward financing rates would fall and bias calendar spreads wider. This effect would also be amplified in all but the TU and WN sectors, because of the fact that back-month CTDs have high coupons, meaning carry could turn positive and futures could price to last delivery day. While not our baseline view, this remains a tail risk that is important to consider during this roll period.Front PriceCalendar Spread (/32nds)HR*CTD FrontCTD BackViewMain driversWN124-13-1-26+ /32nds9382-7/8 May 492-1/4 Aug 49BearishBasis convergence, CTD RVUS118-110-0.375 /32nds9824-5/8 Feb 404-5/8 Feb 40BullishBasis convergenceUXY113-23+-0-06.625/32nds9853-7/8 Aug 334-1/2 Nov 33BearishInvestor positioning, CTD RVTY109-27-0-17.125/32nds9324-7/8 Oct 304 Jan 31Mildly bearishInvestor positioningFV106-18.75-0-12.875/32nds9473-5/8 May 284-3/8 Aug 28Mildly bearishInvestor positioningTU102-00-0-16/32nds8780-3/8 Dec 250-3/4 Mar 26Bearishinvestor positioningSource: J.P. Morgan. * Hedge Ratio: recomm...